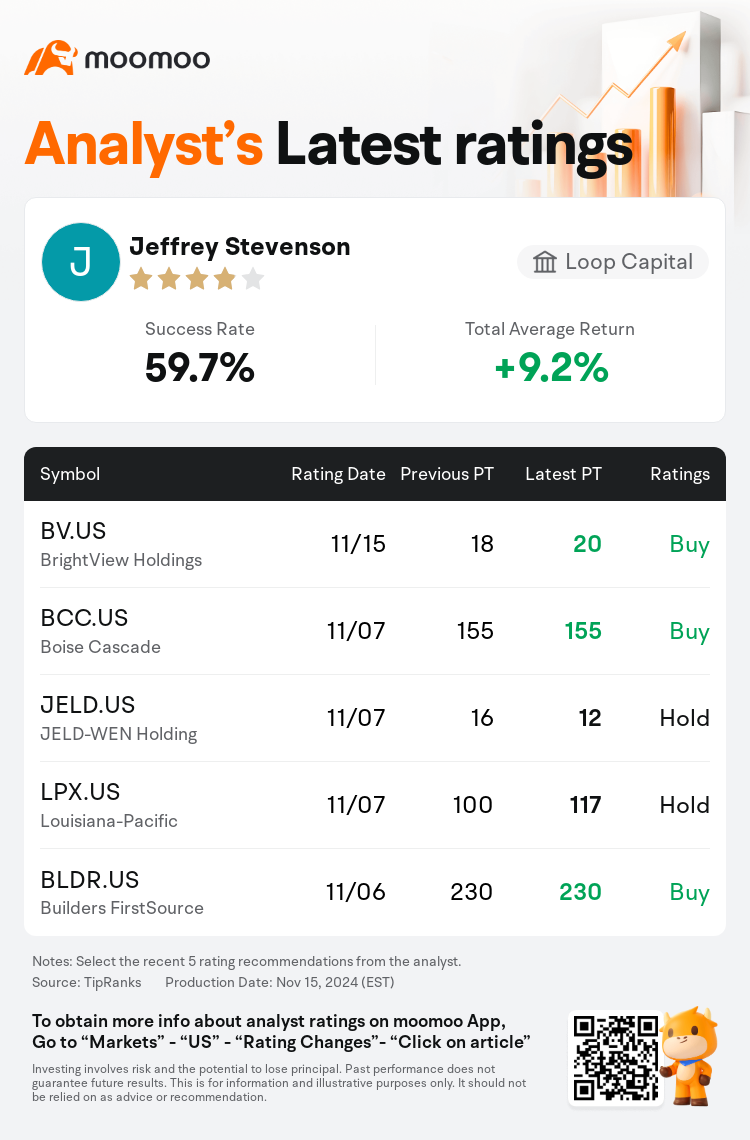

Loop Capital analyst Jeffrey Stevenson maintains $BrightView Holdings (BV.US)$ with a buy rating, and adjusts the target price from $18 to $20.

According to TipRanks data, the analyst has a success rate of 59.7% and a total average return of 9.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $BrightView Holdings (BV.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $BrightView Holdings (BV.US)$'s main analysts recently are as follows:

BrightView exhibited a mixed financial performance in its fourth-quarter results, with a slight increase in revenue overshadowed by earnings that failed to meet expectations and projections for FY25 that are underwhelming compared to market predictions. The company's landscape maintenance segment is undergoing a downturn in revenue, influenced by the winding down of its BES aggregator subcontractor business and the sell-off of USL. Analysts point out that to revitalize its core landscape maintenance revenue growth, the company will need to invest in workforce expansion and customer service enhancements. These investments are likely to affect EBITDA margins adversely, which are currently below the pre-pandemic benchmark. Given these circumstances, there is skepticism regarding BrightView's ability to achieve significant revenue growth and maintain desirable EBITDA margins at the same time.

The company's alignment with its strategic transformation, termed 'One BrightView', is acknowledged as contributing to its Q4 outcomes and the preliminary guidance for FY25. Despite the stock experiencing a decline post-earnings, which was attributed to heightened anticipations, there's an optimistic projection for the return to positive revenue growth in landscaping by FY25, alongside an ongoing expansion in segment margin.

The firm expressed that their outlook remains unchanged as BrightView completed fiscal year 2024 with a quarter that met expectations, contained no significant surprises, and encapsulated a year filled with constructive changes.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

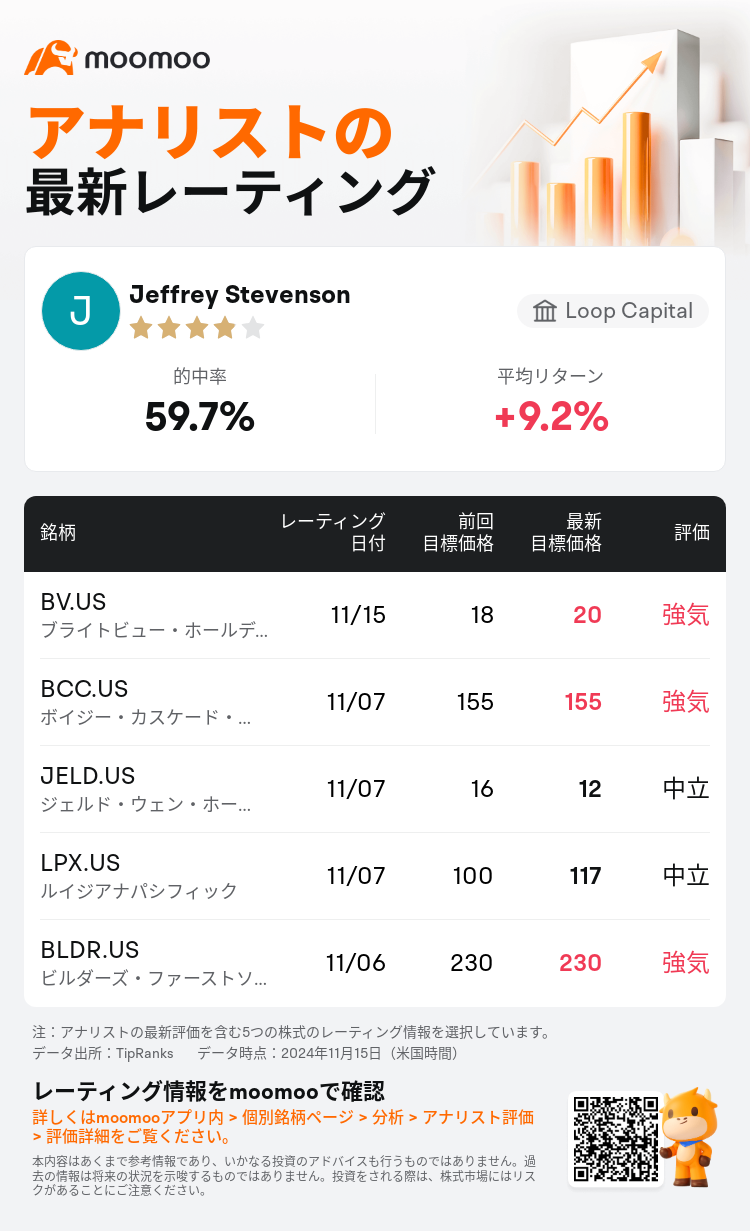

Loop CapitalのアナリストJeffrey Stevensonは$ブライトビュー・ホールディングス (BV.US)$のレーティングを強気に据え置き、目標株価を18ドルから20ドルに引き上げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は59.7%、平均リターンは9.2%である。

また、$ブライトビュー・ホールディングス (BV.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ブライトビュー・ホールディングス (BV.US)$の最近の主なアナリストの観点は以下の通りである:

BrightViewは、第4四半期の結果において、売上高がわずかに増加したものの、利益が期待に応えられず、FY25の予測が市場の予測と比べて控えめであるため、混合した財務成績を示しました。同社の景観維持部門は、BES集約請負業者ビジネスの縮小とUSLの売却の影響を受け、売上高が減少しています。アナリストは、同社がコアの景観維持の売上高成長を活性化させるためには、労働力の拡充と顧客サービスの向上に投資する必要があると指摘しています。これらの投資は、現在パンデミック前の基準を下回っているEBITDAマージンに悪影響を及ぼす可能性があります。これらの状況を考えると、BrightViewが大幅な売上高成長を達成し、望ましいEBITDAマージンを同時に維持できるかについては懐疑的です。

同社の戦略的変革である『One BrightView』との整合性は、第4四半期の結果やFY25の初期ガイダンスに寄与していると認められています。決算発表後に株が下落したものの、それは期待の高まりに起因するものであり、FY25までに景観分野での売上高の正の成長に戻る楽観的な予測と、セグメントマージンのさらなる拡大が見込まれています。

同社は、BrightViewが2024会計年度を期待通りの四半期で終了し、重大なサプライズがなく、建設的な変化に満ちた年を要約したため、見通しは変わらないと表明しました。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$ブライトビュー・ホールディングス (BV.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ブライトビュー・ホールディングス (BV.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of