SYoung Group (SZSE:300740) Takes On Some Risk With Its Use Of Debt

SYoung Group (SZSE:300740) Takes On Some Risk With Its Use Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that SYoung Group Co., Ltd. (SZSE:300740) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

当大卫·伊本说'波动性不是我们关心的风险。我们关心的是避免永久性的资本损失'时,他表达得很好。因此,明智的资金知道,债务(通常与破产有关)是评估公司风险程度时非常重要的因素。我们注意到水羊股份有限公司(SZSE:300740)在资产负债表上确实有债务。但股东们应该担心该公司使用债务吗?

What Risk Does Debt Bring?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

当企业无法轻松用自由现金流或以有吸引力的价格筹集资金来履行那些义务时,债务和其他负债会对企业产生风险。资本主义的一部分是“创造性破坏”的过程,在这个过程中,失败的企业无情地被银行家清算。虽然这不太常见,但我们经常看到负债累累的公司因为借贷者强迫它们以困境价格筹集资本而永久性稀释股东。然而,通过取代稀释,债务可以成为需要资金以高回报率投资增长的企业的极其有用的工具。在考虑企业使用多少债务时,第一件要做的事情是查看它的现金和债务。

What Is SYoung Group's Net Debt?

SYoung Group的净债务是多少?

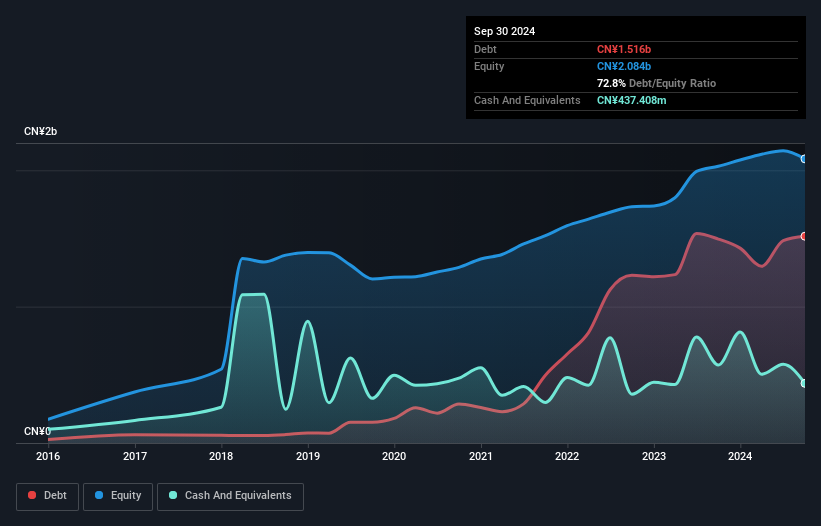

As you can see below, SYoung Group had CN¥1.52b of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of CN¥437.4m, its net debt is less, at about CN¥1.08b.

正如以下所示,截至2024年9月,水羊股份的债务为15.2亿元人民币,与前一年持平。您可以点击图表查看更详细的信息。然而,由于其现金储备为43740万元人民币,因此其净债务较少,约为10.8亿元人民币。

How Strong Is SYoung Group's Balance Sheet?

SYoung集团的资产负债表有多强?

According to the last reported balance sheet, SYoung Group had liabilities of CN¥820.5m due within 12 months, and liabilities of CN¥1.18b due beyond 12 months. Offsetting these obligations, it had cash of CN¥437.4m as well as receivables valued at CN¥505.8m due within 12 months. So it has liabilities totalling CN¥1.06b more than its cash and near-term receivables, combined.

根据最近公布的资产负债表,SYoung集团有人民币82050万的到期负债,以及人民币11.8亿的超过12个月到期负债。 抵消这些义务,它有43740万的现金以及50580万的应收账款在12个月内到期。 因此,它的负债总计为10.6亿,超过了其现金和短期应收账款的合计。

While this might seem like a lot, it is not so bad since SYoung Group has a market capitalization of CN¥4.98b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

虽然这可能看起来很多,但由于SYoung集团的市值为49.8亿,因此如果有需要,它可能通过增加资本来加强其资产负债表。 但是,仍然值得密切关注其偿还债务的能力。

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

我们使用两个主要的比率来告诉我们相对于收益的债务水平。第一个是净债务除以利息、税、折旧和摊销前利润(EBITDA),而第二个是其利润前利息和税(EBIT)覆盖其利息费用的次数(或其利息覆盖率,简称)。因此,我们考虑与折旧和摊销费用相关的盈利以及没有相关费用的盈利相对于债务水平。

SYoung Group has net debt to EBITDA of 2.8 suggesting it uses a fair bit of leverage to boost returns. On the plus side, its EBIT was 8.7 times its interest expense, and its net debt to EBITDA, was quite high, at 2.8. If SYoung Group can keep growing EBIT at last year's rate of 10% over the last year, then it will find its debt load easier to manage. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine SYoung Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

SYoung集团的净债务与EBITDA比为2.8,表明它使用了相当大的杠杆来提高回报。 从积极的一面来看,其EBIT是其利息支出的8.7倍,其净债务与EBITDA相当高,为2.8。 如果SYoung集团能够以去年10%的速度继续增长EBIT,那么它将发现更容易管理其债务负载。 毫无疑问,我们从资产负债表中最了解债务情况。 但相比任何其他因素,未来的收益将决定SYoung集团能否维持健康的资产负债表前行。 因此,如果您想了解专业人士的看法,您可能会发现这份关于分析师利润预测的免费报告很有趣。

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, SYoung Group saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

最后,虽然税务人员可能喜欢会计利润,但贷款人只接受冰冷的现金。 因此,我们始终核对这些EBIT中有多少被转化为自由现金流。 在过去三年中,SYoung集团的自由现金流大幅为负。 尽管这可能是为了增长开支,但这确实使得债务变得更加冒险。

Our View

我们的观点

SYoung Group's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. But on the bright side, its ability to to cover its interest expense with its EBIT isn't too shabby at all. We think that SYoung Group's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for SYoung Group (1 is significant!) that you should be aware of before investing here.

水羊股份将EBIt转换为自由现金流的情况在这个分析中确实不太好,尽管我们考虑的其他因素使其光芒四射。但值得一提的是,水羊股份用其EBIt覆盖利息支出的能力并不差。我们认为水羊股份的债务情况确实使其有点风险,考虑到前述数据点的共同作用。这不一定是件坏事,因为杠杆可以提高股本回报率,但这是需要注意的事项。毫无疑问,我们从资产负债表中了解债务情况最多。但最终,每家公司都可能包含超出资产负债表之外的风险。例如,我们已经发现了水羊股份的2个警示标志(其中1个很重要!)你在投资之前应注意到这些。

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

如果在所有这些之后,您更感兴趣的是具有坚实资产负债表的快速增长公司,那么不要拖延,查看我们的净现金增长股票列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

According to the last reported balance sheet, SYoung Group had liabilities of CN¥820.5m due within 12 months, and liabilities of CN¥1.18b due beyond 12 months. Offsetting these obligations, it had cash of CN¥437.4m as well as receivables valued at CN¥505.8m due within 12 months. So it has liabilities totalling CN¥1.06b more than its cash and near-term receivables, combined.

According to the last reported balance sheet, SYoung Group had liabilities of CN¥820.5m due within 12 months, and liabilities of CN¥1.18b due beyond 12 months. Offsetting these obligations, it had cash of CN¥437.4m as well as receivables valued at CN¥505.8m due within 12 months. So it has liabilities totalling CN¥1.06b more than its cash and near-term receivables, combined.