Silence Therapeutics plc (NASDAQ:SLN) shares have had a horrible month, losing 31% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 40%, which is great even in a bull market.

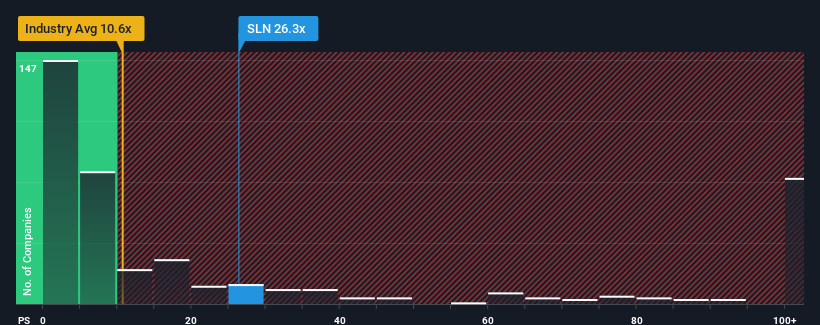

Even after such a large drop in price, Silence Therapeutics may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 26.3x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 10.6x and even P/S lower than 3x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Silence Therapeutics' Recent Performance Look Like?

Silence Therapeutics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Silence Therapeutics.How Is Silence Therapeutics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Silence Therapeutics' is when the company's growth is on track to outshine the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as steep as Silence Therapeutics' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 37%. Even so, admirably revenue has lifted 76% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 18% per annum during the coming three years according to the five analysts following the company. With the industry predicted to deliver 120% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Silence Therapeutics is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

A significant share price dive has done very little to deflate Silence Therapeutics' very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Silence Therapeutics trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about these 3 warning signs we've spotted with Silence Therapeutics (including 1 which is a bit concerning).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.