① Since September, a total of 10 listed companies have announced the termination of restructuring matters (attached table), and Dongfang Seiko, a popular robot concept shareholder, is clearly on the list; ② the termination of the restructuring “took the lead” for multiple shares, and Shimao Energy fell to a standstill the next day, while Mogao shares and Lucang Technology closed down; ③ Yingfangwei terminated the restructuring due to the disclosure of insider information by relevant personnel involved in the restructuring.

Finance Association, November 17 (Editor Xuan Lin) According to financial news agency's incomplete statistics, as of press release, 10 A-share listed companies, including Shimao Energy, Ruitai Technology, Kaird, Yingfangwei, Mogao Co., Ltd., Energy-saving Tiehan, Lucang Technology, Zhonglian Heavy Industries, Tianhou Energy, and Dongfang Precision have announced the termination of restructuring matters. See the chart below for details:

▌The termination of the restructuring matter gave many shares the “first step” Shimao Energy, Mogao Co., Ltd. and Lu Chang Technology announced that the relevant personnel involved in Yingfang's micro restructuring terminated the restructuring due to suspicion of leaking insider information and the filing of a case

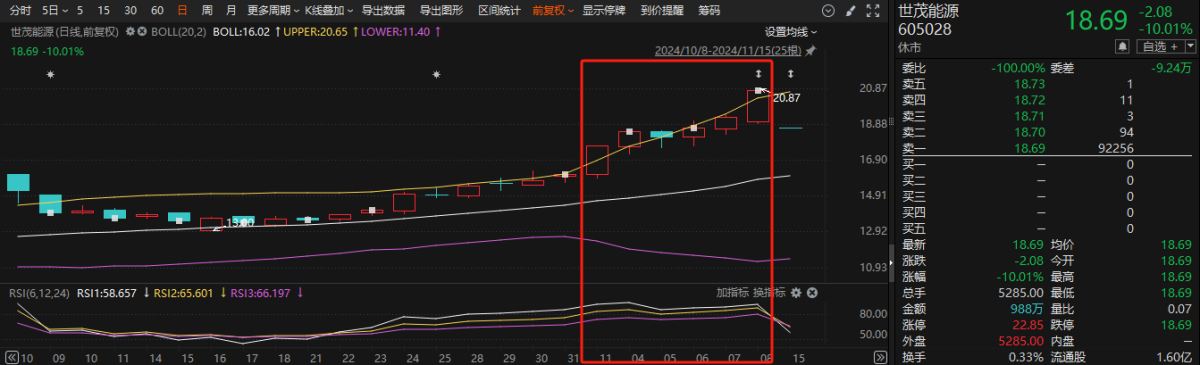

Shimao Energy announced on November 14 that the company originally planned to purchase no less than 58.07% of the equity assets of Nantong Zhanding Material Technology Co., Ltd. held by the Shanghai Dongfuyuan Enterprise Development Center (limited partnership) and the Shanghai Xuyin Zhanding Enterprise Development Center (limited partnership) by issuing shares and paying in cash. However, the parties to the transaction did not finally reach a substantive agreement on the specific plan and transaction conditions, so they decided to terminate the issue of purchasing assets. The day after the announcement, Shimao Energy's resumption of trading came to a standstill.

Shimao Energy announced on November 14 that the company originally planned to purchase no less than 58.07% of the equity assets of Nantong Zhanding Material Technology Co., Ltd. held by the Shanghai Dongfuyuan Enterprise Development Center (limited partnership) and the Shanghai Xuyin Zhanding Enterprise Development Center (limited partnership) by issuing shares and paying in cash. However, the parties to the transaction did not finally reach a substantive agreement on the specific plan and transaction conditions, so they decided to terminate the issue of purchasing assets. The day after the announcement, Shimao Energy's resumption of trading came to a standstill.

According to information, Shimao Energy disclosed the restructuring intention announcement on November 11. It has only been 3 days since the suspension of trading and restructuring until the end of trading. It is worth noting that before the news of the restructuring was released, the company's stock price had already risen markedly. At the beginning of November, Shimao Energy's trading volume broke 100 million yuan several times. Until the suspension of trading, the biggest cumulative increase in stock prices in November was nearly 30%.

Mogao Co., Ltd. announced on October 25 that the company originally intended to purchase 51% of Haotian Technology's shares through a combination of cash payments and capital increases, but since the market environment has changed significantly since the transaction was planned, the parties to the transaction failed to agree on the core issues of the transaction plan, such as payment methods, transaction consideration, and performance commitments. After thorough careful research and friendly negotiations with the counterparty, all parties to the transaction agreed and jointly decided to terminate the transaction. The day after the announcement, Mogao shares dropped to a halt.

Looking at it for a long time, Mogao Co., Ltd. disclosed the restructuring plan announcement on the evening of August 28. The company's stock price recorded 4 boards for 5 days from August 28 to September 3, and the biggest cumulative increase in stock prices reached 92% from August 28 to October 25.

Lu Chang Technology announced on September 13 that it originally intended to issue shares to 27 counterparties including Zoomlion Heavy Industries to purchase 99.5320% of its shares in Hunan Zhonglian Heavy Industries Intelligent Aerial Work Machinery Co., Ltd., and to raise supporting capital by issuing shares to no more than 35 specific targets. In view of major changes in the market environment, in order to protect the interests of listed companies and investors, the company decided to terminate the restructuring and withdraw the relevant application documents from the Shenzhen Stock Exchange. The day after the announcement, Lu Chang Technology closed down.

On the evening of October 29, Carred announced that it originally intended to purchase no less than 29.01% of State Grid Technology's shares using cash payment transaction consideration, becoming the largest shareholder of State Grid Technology. The transaction amount is expected to be no less than 0.387 billion yuan. Meanwhile, the parties to the transaction carefully studied and discussed the current market environment and core terms of the transaction, and decided to terminate this major asset restructuring matter by consensus. Strangely enough, Carred closed the day “early” and fell 5.7% to a close the next day.

Going back to the evening of August 5, Kerrader announced the restructuring plan. The company's stock price rose and stopped on the same day. From August 5 to August 8, it recorded 4 consecutive markets, with the biggest cumulative increase of 96% from August 5 to October 28.

It is worth mentioning that Yingfangwei terminated the restructuring due to the filing of a case involving personnel involved in the restructuring. The company announced on October 25 that it originally intended to purchase 49% of Huaxinke's shares and 49% of WORLD STYLE's shares by issuing shares and paying cash; at the same time, it plans to raise supporting capital from Shunyuan Enterprise Management and others. The relevant personnel of the parties involved in the restructuring were issued a “Notice of Case Filing” by the China Securities Regulatory Commission on suspicion of leaking insider information. After friendly negotiations and careful research and verification between the company and all parties involved in the transaction, it was decided to terminate the restructuring.

世茂能源11月14日公告,公司

世茂能源11月14日公告,公司