PROCEPT BioRobotics Corporation (NASDAQ:PRCT) shares have continued their recent momentum with a 29% gain in the last month alone. The annual gain comes to 169% following the latest surge, making investors sit up and take notice.

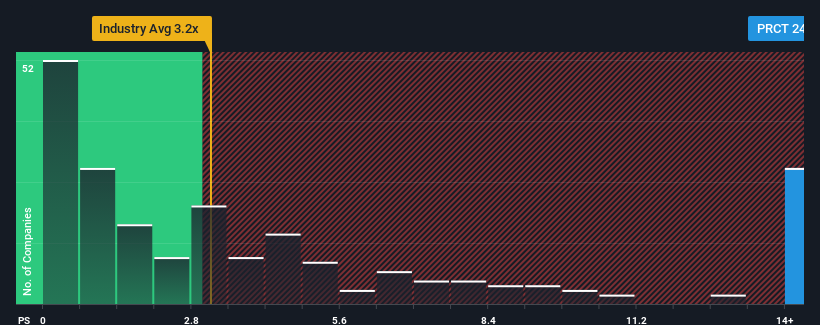

Since its price has surged higher, PROCEPT BioRobotics may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 24.1x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios under 3.2x and even P/S lower than 1.1x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does PROCEPT BioRobotics' P/S Mean For Shareholders?

PROCEPT BioRobotics certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on PROCEPT BioRobotics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as PROCEPT BioRobotics' is when the company's growth is on track to outshine the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as steep as PROCEPT BioRobotics' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 72%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 33% per annum as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 9.1% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why PROCEPT BioRobotics' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On PROCEPT BioRobotics' P/S

PROCEPT BioRobotics' P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of PROCEPT BioRobotics' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with PROCEPT BioRobotics.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.