$Life360 Inc (360.AU)$ shares fell 6.33% on Monday, with trading volume expanding to A$37.8 million. Life360 has fallen 11.90% over the past week, with a cumulative gain of 178.97% year-to-date.

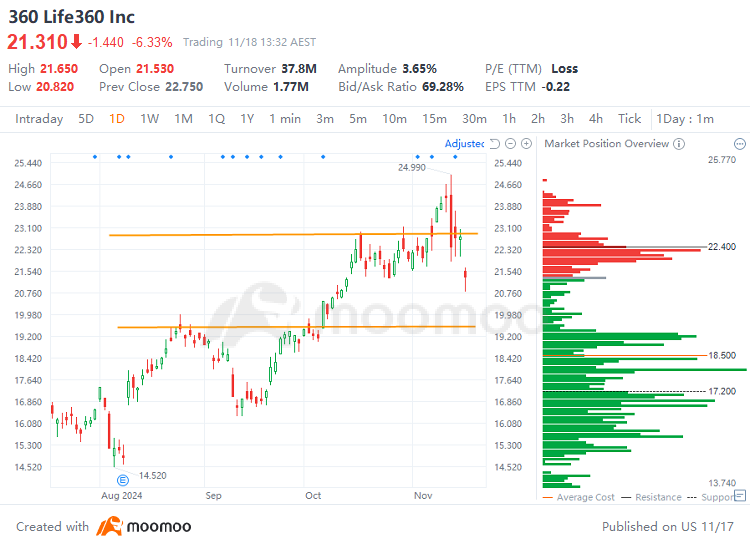

Life360's technical analysis chart:

Technical Analysis:

Support: A$19.53

Resistance: A$22.89

Resistance: A$22.89Price range A$19.53 to A$22.89: The trading range indicates a heavy concentration of selling orders, with the stock price on an downward trend. There's a high concentration of trapped positions within the trading range, which implies strong resistance to any upward movement. The stock started to decline near A$22.89 due to selling pressure and repeatedly touched the A$19.53 level, where it seems to find some support. Going forward, it's crucial to watch whether the support at A$19.53 holds and if it can lead to a potential rebound.

Market News :

Life360 announced Co-founder and Chief Executive Officer, Chris Hulls, executed a partial disposition of his holdings amounting to 863,903 shares, or 1.2% of total outstanding shares in the company, pursuant to Rule 144 of the Securities Act of 1933, as amended. Following the disposition, Mr. Hulls will continue to beneficially own approximately 3.8% of the total outstanding shares in the company.

Mr. Hulls said:

At the same time I decided to activate my planned diversification, and these transactions will enable me to secure my family’s future as well as creating a foundation to undertake philanthropic projects in my local community. I am donating over a third of my securities immediately to a private foundation and donor advised fund. I will still have close to 75% of my net worth in Life360 equity and have committed to not undertake certain additional sales in the next 12 months - this includes terminating the Rule 10b5- 1 plan that I had set up and was disclosed in our most recent Form 10-Q.

Overall Analysis:

Fundamentally, focus on the company's performance and operational status. Technically, pay attention to whether the support levels hold and if the resistance levels can be effectively breached.

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.

Source: Life360