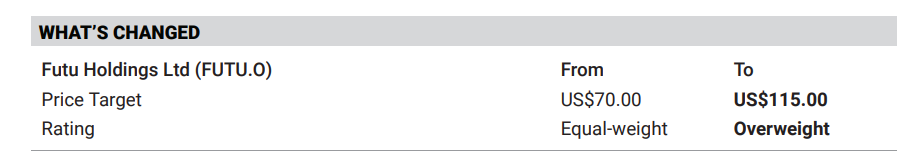

Morgan Stanley has upgraded its rating on Futu Holdings Ltd (FUTU.0) from "Equal-weight" to "Overweight" and increased the price target from $70.00 to $115.00. The firm highlights the company's accelerated profit growth and impressive client asset increases, particularly from the expansion of its overseas franchise.

Morgan Stanley anticipates significant growth in client assets and profits, underpinned by healthy asset inflows and robust trading activity:

Client Asset and Inflow Growth: Client assets are expected to grow by 38% year-over-year in 3Q24. Total inflows are projected to remain strong at around HK$40 billion.

Profit Growth: Aided by a market rally in September, trading velocity is likely to recover, leading to an estimated year-over-year 20% profit growth in 3Q24.

Profit Growth: Aided by a market rally in September, trading velocity is likely to recover, leading to an estimated year-over-year 20% profit growth in 3Q24.Earnings Forecast Increase: Earnings forecasts for 2024, 2025, and 2026 have been revised up by 12%, 19%, and 19% respectively. This adjustment is due to a larger expected contribution from overseas markets, which are projected to account for 25-30% of total inflows in 2024 and potentially up to 60% by 2026.

Long-Term Growth from Overseas Markets: Futu is expected to continue maintaining robust customer acquisition capabilities in the stock markets of Hong Kong, Singapore, Japan, and Malaysia in the third quarter of this year. Japan offers a huge potential market space, and it is projected to contribute 6-7% to client assets and revenue by 2026.

Price Objective Risk:

Upside Risks: Stronger-than-expected performance in overseas markets, higher-than-anticipated asset inflows, and favorable market conditions.

Downside Risks: Overly optimistic consensus earnings expectations, potential regulatory tightening, and significant corrections in the US/HK stock market.