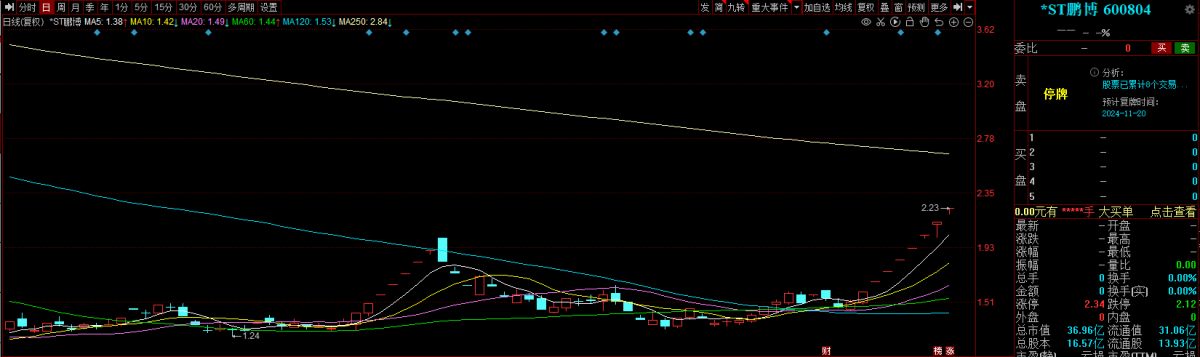

① The disclosure of the company's 2023 annual results forecast was inaccurate. The establishment of wholly-owned subsidiary companies, investment participation companies, and sales of subsidiaries did not fulfill the obligation to disclose information in a timely manner. ② *ST Pengbo shares rose and fell for 8 consecutive trading days before the suspension. Currently, they are still in the suspension verification period. The stock price is 2.23 yuan/share.

Financial Services Association, November 18: *ST Peng Bo, which was suspended for inspection last week due to eight consecutive stock price checks, has now been filed by the Securities Regulatory Commission.

Today, *ST Pengbo announced that the company received the “Notice of Case Filing” issued by the China Securities Regulatory Commission on November 18, 2024. Due to suspected illegal disclosure of information, the China Securities Regulatory Commission decided to file a case against the company on November 17.

Furthermore, the company received a notice from Yang Xueping, the actual controller. Yang Xueping received the “Notice of Case Filing” issued by the China Securities Regulatory Commission on November 18. Due to suspected illegal disclosure of information, the China Securities Regulatory Commission decided to file a case against it on November 17.

Furthermore, the company received a notice from Yang Xueping, the actual controller. Yang Xueping received the “Notice of Case Filing” issued by the China Securities Regulatory Commission on November 18. Due to suspected illegal disclosure of information, the China Securities Regulatory Commission decided to file a case against it on November 17.

On the same day, *ST Pengbo also issued an announcement stating that on November 18, 2024, the company received the administrative supervision measures decision “Decision on Issuing Warning Letter Measures against Dr. Peng Telecom Media Group Co., Ltd. and related personnel” issued by the Qingdao Regulatory Bureau of the China Securities Regulatory Commission. According to the announcement, the company had the following irregularities:

(1) The disclosure of the 2023 annual results forecast is inaccurate

On January 31, 2024, the company disclosed the pre-profit announcement for the 2023 annual results. It is estimated that net profit attributable to shareholders of listed companies in 2023 is about 31.25 million yuan, and net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss is about -34.95 million yuan. On April 27, 2024, the company disclosed the performance forecast correction announcement. The estimated net profit is about -93.25 million yuan, and the estimated net profit after deduction is about -129.19 million yuan. On April 30, 2024, the company disclosed its 2023 annual report, 2023 net profit - -93.2455 million yuan, net profit after deduction - -129.1906 million yuan. The disclosure of the company's performance forecast information is inaccurate, which violates the provisions of Article 3 (1) of the “Administrative Measures on Information Disclosure of Listed Companies” (Securities Regulatory Commission Order No. 182). The then-chairman Yang Xueping, then-general manager Lu Weituan, financial director Xu Zhangang, and then-director Wu Wentao are mainly responsible for the company's irregularities.

(2) Establishing wholly-owned subsidiary companies or investment participating companies, and failure to fulfill information disclosure obligations

On June 21, 2023, Dr. Peng Investment Holdings Hong Kong Co., Ltd., a wholly-owned subsidiary of the company, invested 50 million US dollars to establish a wholly-owned subsidiary, Qingdao Yuepeng Communication Technology Co., Ltd. (hereinafter referred to as Qingdao Yuepeng), with a paid-in registered capital of 26 million US dollars. On June 25, 2023, Qingdao Yuepeng invested in Qingdao Yuehai Communication Technology Co., Ltd. and invested 490 million yuan. On July 5, 2023, Qingdao Yuepeng invested RMB 188.2524 million in Qingdao Yuehai. The company did not disclose until April 30, 2024. Failure to disclose relevant information in a timely manner violates the provisions of Article 3 (1) of the “Administrative Measures on Information Disclosure of Listed Companies” (Securities Regulatory Commission Order No. 182). The company's then-chairman Yang Xueping, then-general manager Lu Weituan, and then-director Wu Wentao are mainly responsible for the company's irregularities.

(3) Failure to comply with disclosure obligations regarding the sale of subsidiaries

On April 15, 2024, the company disclosed the “Notice on Response to the Letter of Supervisory Work on Matters Relating to Letters, Complaints and Reports”, stating that on January 18, 2024, the company held the 30th meeting of the board of directors and unanimously agreed to review and pass the “Proposal on Transfer of 100% Shares and Related Transactions in Wholly-owned Subsidiaries”. Failure to disclose relevant information in a timely manner violates the provisions of Article 3 (1) of the “Administrative Measures on Information Disclosure of Listed Companies” (Securities Regulatory Commission Order No. 182). The company's then-chairman Yang Xueping, then-general manager Lu Weituan, and then-director Wu Wentao are mainly responsible for the company's irregularities.

According to Sections 51 and 52 of the “Administrative Measures on Information Disclosure of Listed Companies” (CSRC Order No. 182), the Qingdao Securities Regulatory Bureau decided to issue warning letters against the company and its then-chairman Yang Xueping, then-general manager Lu Weituan, financial director Xu Zhangang, and then-director Wu Wentao.

It is worth mentioning that *ST Bloomberg's shares are still under suspension inspection. Before trading was suspended, the stock price rose and stopped for 8 consecutive trading days. Up to now, the company's stock price is 2.23 yuan/share.

Last Thursday evening, *ST Pengbo announced that the company's stock had risen and stopped for a total of 8 trading days from November 5, 2024 to November 14, 2024, with a stock price increase of 48.67%. Following the application, trading of the company's shares was suspended from the opening of the market on November 15, 2024, and resumed after the disclosure of the inspection announcement. The suspension period is expected to be no more than 3 trading days.

此外,公司接到实际控制人杨学平通知,杨学平11月18日收到中国证监会下发的《立案告知书》,因涉嫌信息披露违法违规,中国证监会决定11月17日对其立案。

此外,公司接到实际控制人杨学平通知,杨学平11月18日收到中国证监会下发的《立案告知书》,因涉嫌信息披露违法违规,中国证监会决定11月17日对其立案。