$NVIDIA (NVDA.US)$ is set to announce its Q3 2024 earnings on November 20 after market close. Investors will look at the company’s full-year forecast alongside positive sentiments surrounding the next-generation Blackwell chips.

What guidance does the options market provide?

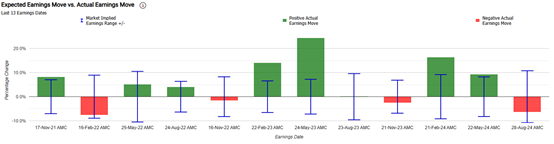

The options market overestimated Nvidia stocks earnings move 62% of the time in the last 13 quarters. The predicted move after earnings announcement was ±8.0% on average vs an average of the actual earnings moves of 8.0% (in absolute terms).

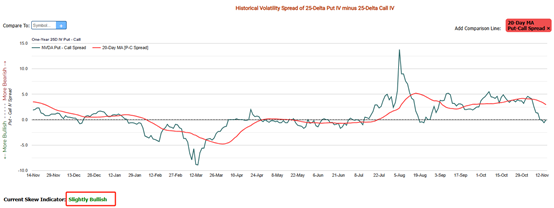

From the perspective of implied volatility skew, market sentiment is slightly bullish on Nvidia.Over the last 12 quarters earnings day, there has been a 67% probability of achieving positive returns, with the maximum gain reaching 24.4%.

From the perspective of implied volatility skew, market sentiment is slightly bullish on Nvidia.Over the last 12 quarters earnings day, there has been a 67% probability of achieving positive returns, with the maximum gain reaching 24.4%.

Option strategies

Investors can utilize various strategies to navigate the potential volatility surrounding Nvidia's earnings report. Here are some potential option strategies for investors to consider:

Long calls or long puts

Investors who are optimistic about Nvidia's performance post-earnings might opt to purchase call options at a specific strike price. This gives them the right to buy shares at that price if they rise above it by the expiration date. Conversely, for those with a negative outlook, buying put options can be advantageous, as these allow them to profit from a potential decline in the stock price.

This strategy offers the possibility of substantial gains if Nvidia's stock soars, with the potential for high leverage and limited downside risk. However, if the stock doesn't surpass the break-even point by the expiration date, the initial investment in the option premium is at risk.

2. Selling Covered calls

For shareholders who own Nvidia stock and anticipate a stable or moderately rising market, selling covered calls can be a way to generate additional income. By selling call options with a higher strike price, they can earn a premium, which acts as a buffer against minor stock price declines and can enhance returns in a flat or slightly bullish market.

This approach has its benefits, such as providing a cushion against small stock price drops and increasing returns in a stagnant or mildly positive market. However, it caps the potential upside if Nvidia's stock rallies significantly, as profits are limited to the strike price of the sold call options. Additionally, if Nvidia's stock falls sharply, the strategy exposes the investor to potential losses on the stock position.

3. Cash-secured puts

Investors who are interested in acquiring Nvidia shares at a lower price can implement a cash-secured put strategy. By selling put options and keeping cash on hand equivalent to the strike price, they are prepared to purchase shares if the option is exercised.

This strategy allows investors to earn premium income while being ready to buy shares at a discounted price if the stock falls below the strike price. If successful, the premium income adds to the overall yield, and shares can be acquired at an effective discount. However, there are risks involved, such as the obligation to buy shares at the strike price even if the stock declines significantly, leading to potential paper losses, and the upside is limited to the premium received.

4. Protective puts

Investors who already own Nvidia shares and are long-term bullish but wish to mitigate downside risk in case of disappointing earnings can use protective puts. By purchasing put options on their existing shares, they create a safety net against sharp declines.

This strategy is suitable for those who want to maintain their long-term bullish stance while protecting against short-term volatility. It caps losses at the put option's strike price and provides peace of mind during potentially volatile earnings periods. However, the cost of the put option premium reduces overall returns if Nvidia doesn't decline as anticipated.

5. Collars

For investors who own Nvidia shares and want to protect against potential downside while capping their upside, a collar strategy can be employed. This involves holding the shares, selling a call option, and buying a put option.

This strategy is often favored by conservative investors who wish to maintain their equity exposure without taking on excessive risk. It has a low-cost structure since the premium from selling the call can offset the cost of the put, providing protection against significant losses while allowing for modest gains. However, it also limits the potential upside if Nvidia's stock price increases substantially.

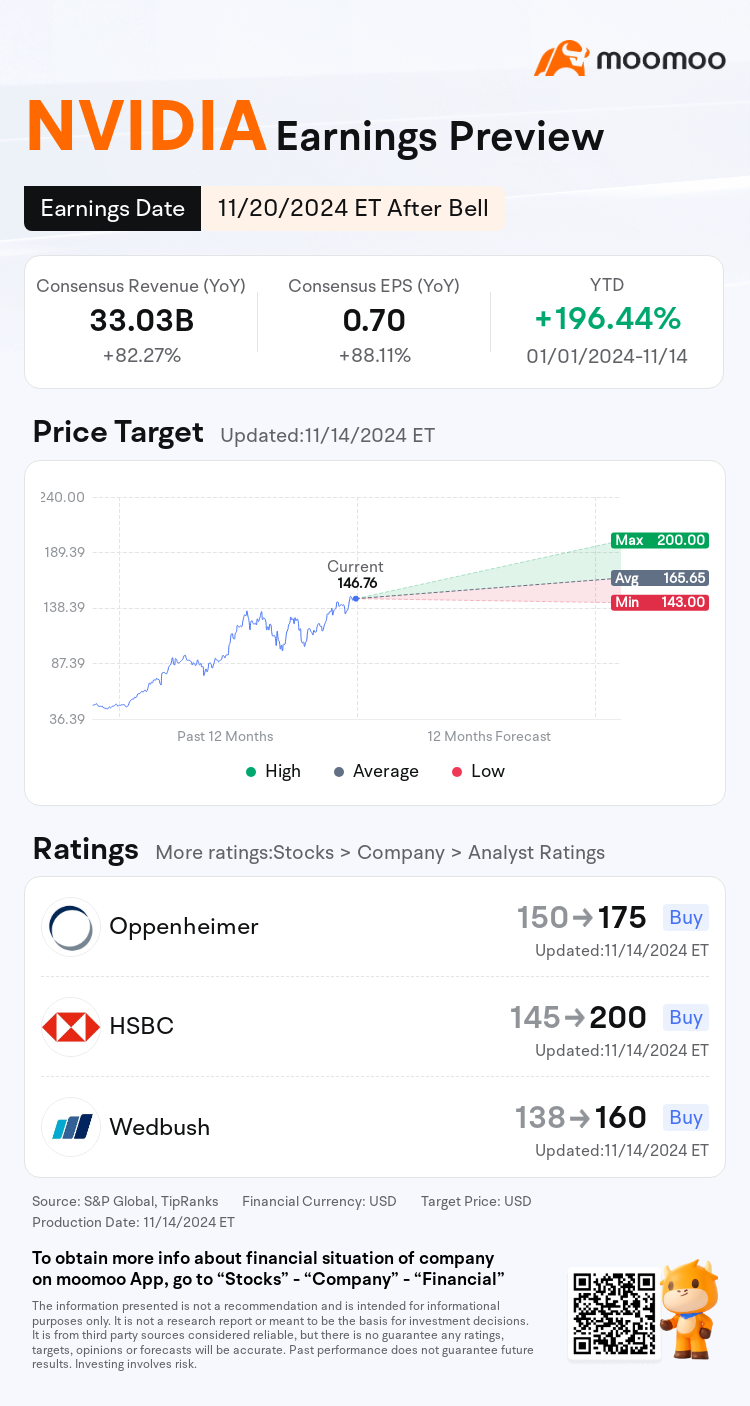

Consensus Estimates

● The analyst consensus has Nvidia reporting revenue of $33.03 billion, up 82% year-over-year. The world's most valuable company’s stock has nearly tripled in 2024 driven by demand for the company’s family of AI chips—including its next generation Blackwell graphics processing units.

● Earnings are expected to be $0.70 per share in the third quarter, up 88.11% from the year-ago quarter.

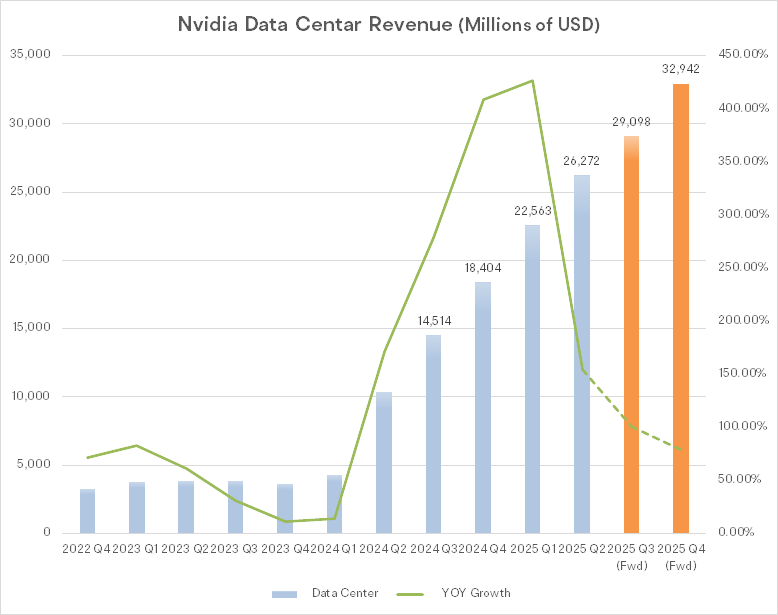

Nvidia’s data center business is still the only segment that matters

Nvidia's performance has been dominated by its Data Center segment, which accounts for nearly 90% of total revenue (as of Q2 2025). This segment has been showing remarkable growth, which is expected to continue for the next few years.

According to Bloomberg consensus forecasts, Nvidia’s Data Center Q3 revenue is expected to reach $29.098 billion, representing a year-over-year increase of 100.48%.“We see Nvidia remaining the leader in the AI training and inference chips for data center applications,” analysts at Mizuho wrote, estimating that the company holds a dominant market share of nearly 95% in the space.

Based on Nvidia’s strong forecast for fiscal 2025, Morningstar analysts predict that Data Center revenue will rise by 133% to $111 billion in fiscal 2025. They also forecast a 23% compound annual growth rate for the three years thereafter, as strong growth in capital expenditures in data centers at leading enterprise and cloud computing customers.

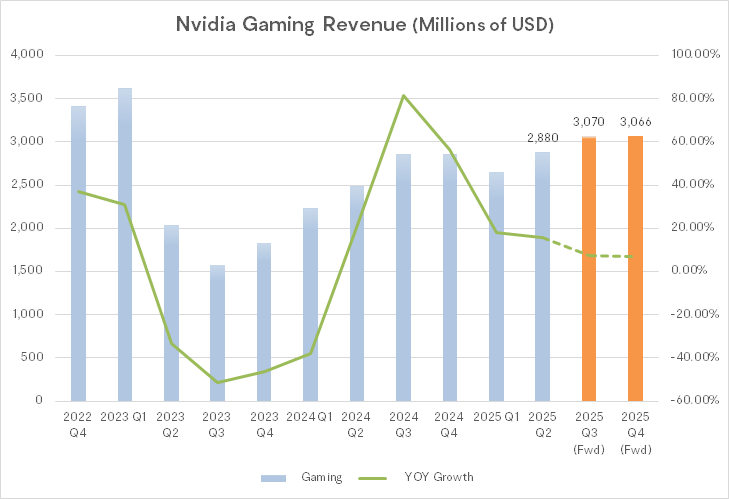

Nvidia's other segments have shown modest but stable growth

The Gaming segment reported 16% year-over-year (YoY) growth in Q2 2025, while the Professional Visualization segment grew by 20%. Both segments are expected to maintain similar growth rates in Q3, though they remain overshadowed by the dominant Data Center segment's performance.

According to Bloomberg consensus forecasts, the Gaming segment is expected to achieve revenue of $3.07 billion in Q3, up 7.5% from the year-ago quarter.

How's the $50 billion buyback progressing?

Nvidia announced in August that its board of directors approved $50 billion of buybacks.

On the surface, Nvidia increasing its share buyback program could be viewed as a bullish sign for investors. Generally speaking, companies buy back stock when management believes shares are undervalued. Based on the past two years, Nvidia stock trades below its average price-to-earnings (P/E) and price-to-free cash flow (P/FCF) multiples.

Since the company's new Blackwell GPU is shaping up to be a massively successful product launch, there's reason to believe Nvidia stock is poised to break out. Such a move would come with valuation expansion and, therefore, a more pricey stock.

For these reasons, investors are closely watching to see if the company repurchased any stock during the fiscal third quarter at more reasonable valuations, prior to any Blackwell-driven tailwinds.

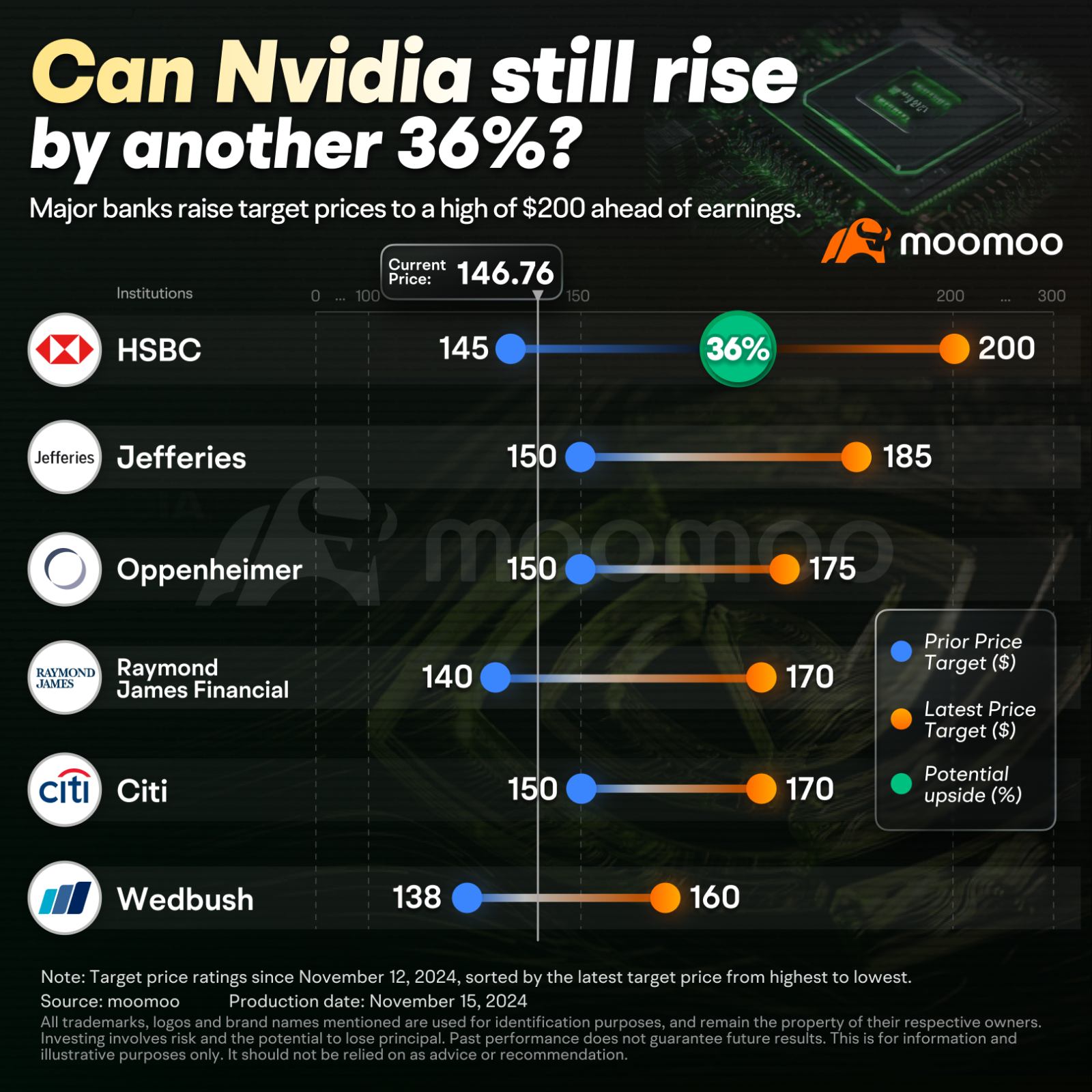

Analysts are bullish on Nvidia stock ahead of earnings next week

Analysts are growing increasingly confident in the artificial intelligence chip behemoth's prospects. At least five research firms raised their price targets on Nvidia ahead of earnings.

Susquehanna Financial Group analyst Christopher Rolland reiterated his positive rating on Nvidia stock and raised his price target to 180 from 160.

Rolland said his industry checks indicated sustained demand for Nvidia's current-generation Hopper series products, H100 and H200, ahead of the Blackwell series launch.

Robust capital equipment spending plans by hyperscale cloud service providers such as $亚马逊(AMZN.US)$ and $Meta Platforms(META.US)$ are driving AI data center processor demand, Rolland said.

"We expect another strong quarter driven by healthy Hopper demand and early Blackwell ramps," Raymond James analyst Srini Pajjuri said in a client note. "Supply remains a wild card, which could limit near-term upside."

Pajjuri kept his strong buy rating on Nvidia stock and increased his price target to 170 from 140.

Additionally, Morgan Stanley’s Joseph Moore raised his target from $150 to $160, citing the impact of the upcoming Blackwell chips, which CEO Jensen Huang noted are experiencing intense demand.

However, Moore warned that the company might be impacted by supply chain constraints,“we are back to fully supply constrained on new products, which could limit upside on current quarter and outlook,” said Moore.

Beyond NVIDIA earnings report: Upcoming U.S. stock market highlights in the rest of 2024?

Black Friday: Opportunity for U.S. consumer stocks?

The Thanksgiving to Christmas period is a traditional shopping peak, with the Friday following Thanksgiving, known as "Black Friday," often triggering a significant retail uptick. This annual event is crucial for retail companies, as it may boost their business performance and stock prices due to the substantial consumer spending it generates. However, investor confidence could be at risk if retail sales on Black Friday do not meet market expectations and this may lead to a drop in stock prices.

As the holiday season draws near, U.S. consumer stocks could be in the spotlight. According to the National Retail Federation, holiday spending reached a record of over $964 billion in 2023, which was up 3.8% from 2022. This growth trend is expected to continue, with Morgan Stanley forecasting that holiday spending will rise from last year's record high. Additionally, retail sales data for October revealed a stronger-than-anticipated 0.4% month-over-month increase, with September's figure revised to a substantial 0.8%. This trend could signal a robust foundation for the upcoming holiday shopping season.

Stocks to watch: $Walmart (WMT.US)$, $Amazon (AMZN.US)$, and $Target (TGT.US)$.

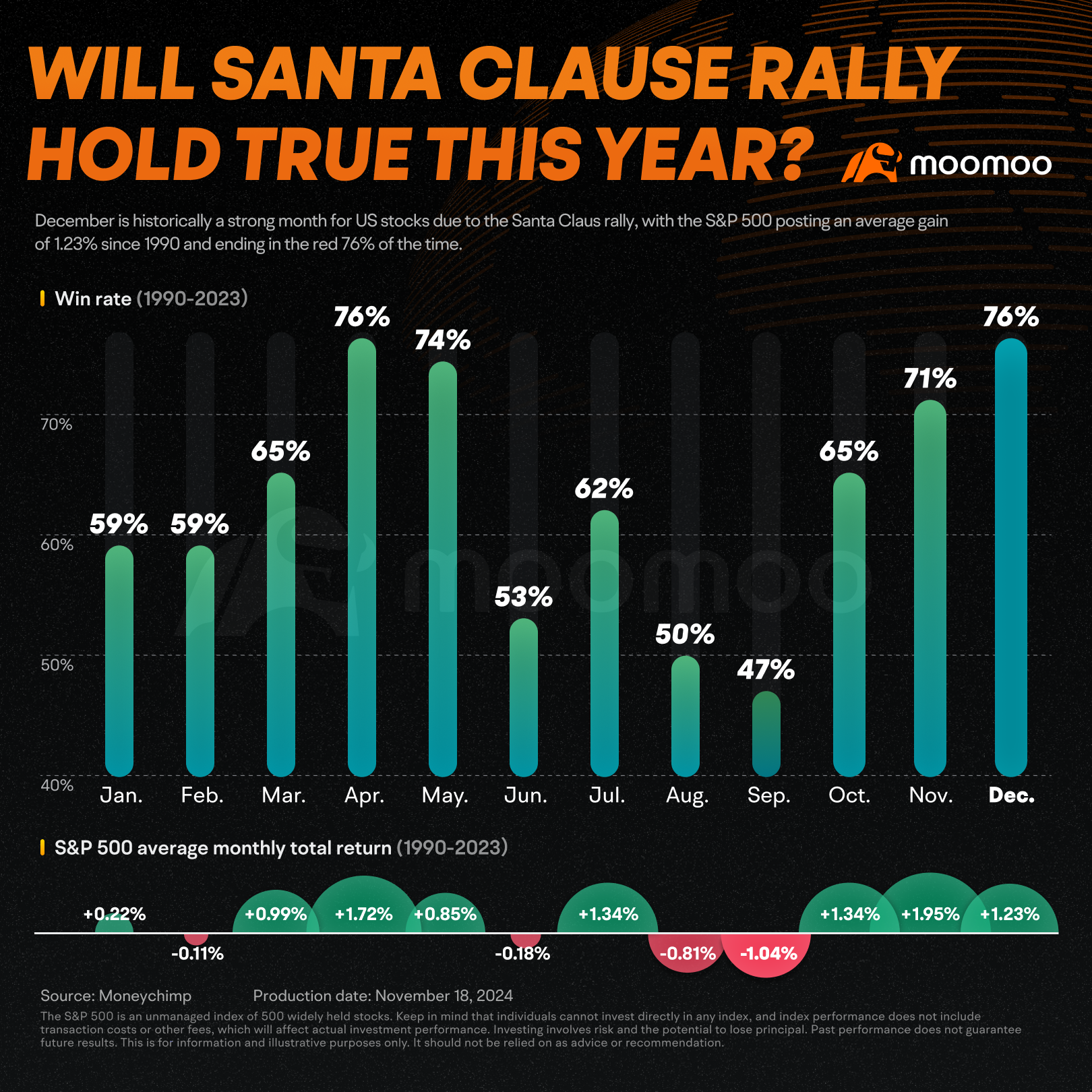

Santa Claus Rally

Wall Street typically refers to the market performance during the last five trading days of the year and the first two trading days of January as the "Santa Claus rally." During this period, the stock market often exhibits unusually strong performance. Since 1990, the S&P 500 has achieved a win rate of 71% in November, with an average monthly gain of 1.95%. In December, the win rate is even higher at 76%, with an average monthly gain of 1.23%.

According to statistics from the Almanac Trader, the U.S. stock market experienced a "Santa Claus rally" in each of the past seven years. From 2016 to 2022, the S&P 500 index rose by 0.4%, 1.1%, 1.3%, 0.3%, 1.0%, 1.4%, and 0.8% during the Santa Claus rally period. However, the S&P 500 index declined 0.88% in the past year. Therefore, despite historical data showing the Santa Claus Rally has occurred often in the past, its recurrence is unpredictable for investors, as it is influenced by a multitude of factors that can vary from year to year.

Source: IBD, Investopedia, Market Chameleon, Business Insider