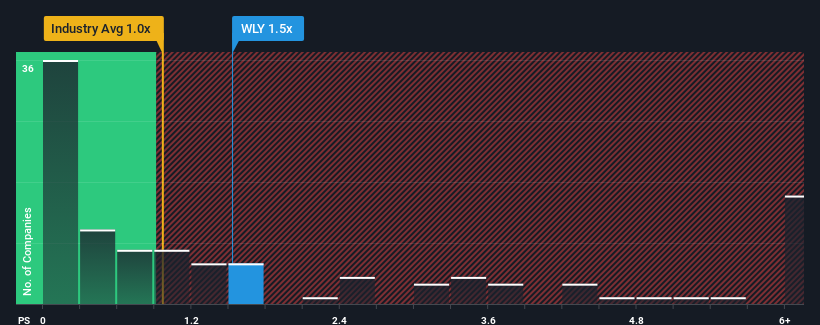

When you see that almost half of the companies in the Media industry in the United States have price-to-sales ratios (or "P/S") below 1x, John Wiley & Sons, Inc. (NYSE:WLY) looks to be giving off some sell signals with its 1.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does John Wiley & Sons' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, John Wiley & Sons' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think John Wiley & Sons' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For John Wiley & Sons?

John Wiley & Sons' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.9%. The last three years don't look nice either as the company has shrunk revenue by 8.6% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.9%. The last three years don't look nice either as the company has shrunk revenue by 8.6% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 8.0% as estimated by the lone analyst watching the company. With the industry predicted to deliver 3.8% growth, that's a disappointing outcome.

With this in mind, we find it intriguing that John Wiley & Sons' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Bottom Line On John Wiley & Sons' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that John Wiley & Sons currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

You always need to take note of risks, for example - John Wiley & Sons has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.