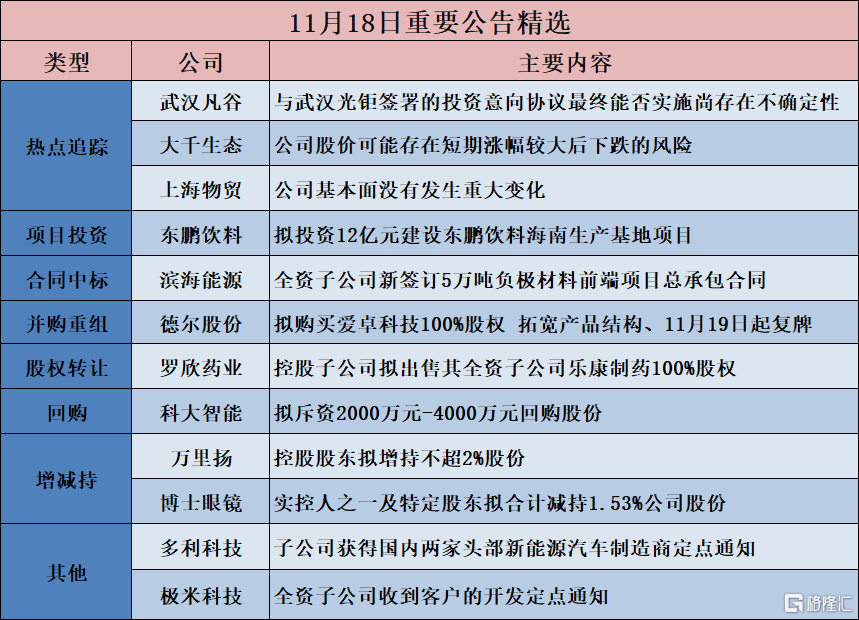

【注目のトピック】

武漢凡谷(002194.SZ):武汉光钜との投資意向契約が最終的に実施できるかには不確実性が残っています

shanghai material trading(600822.SH):会社の基本的な状況に重大な変化はありません。

10連続ストップ高のdaqian ecology & environment group(603955.SH):会社の株価は短期的に大きく上昇した後、下落するリスクがある可能性があります。

【プロジェクト投資】

ningbo peacebird fashion(603877.SH):約60億元を投資して、 ningbo peacebird fashion のファッション研究開発センターを建設することを計画しています。

東鵬飲料(605499.SH):12億円を投資して、東鵬飲料 海南 生産基地プロジェクトを建設する予定です

jiajiayue group(603708.SH):3.5億円を投じて、jiajiayue groupのスマートロジスティクスパークプロジェクトを計画中

zhejiang tiancheng controls(603085.SH):4億元以上を投資してタイに生産拠点を建設する計画

【契約競争入札】

tianjin binhai energy & development (000695.SZ): 全資子会社が5万トンの負極材料フロントエンドプロジェクト総合契約を新規締結

shenzhen bauing construction holding group(002047.SZ):全額子会社shenzhen bauing建設が7.45億元で大橫琴湖心新城プロジェクト14号地区の建設総請負を受注

中広核技(000881.SZ):全額出資子会社の江蘇省金沃が1.83億元の中広核風力発電光伏専用ケーブル調達プロジェクトを受注しました。

chn energy changyuan electric power (000966.SZ):関連会社が荆门のchn energy changyuan electric power荆门会社の化学水処理の柔軟性改造EPCプロジェクトに入札しました

【M&A再構築】

fuxin dare automotive parts(300473.SZ):愛卓科技の100%株式を購入することを検討し、製品構造を拡充し、11月19日から再取引を開始する。

華海誠科(688535.SH):株式は引き続き取引停止中で、停止期間は5営業日を超えない予定です

【株式取得】

gettop accoustic(002655.SZ):共達浙江の10%株式を取得することを計画している。

luoxin pharmaceuticals group stock(002793.SZ):持株子会社がその全額出資子会社である楽康製薬の100%の株式を売却することを提案しています

ght co.,ltd(300711.SZ):6630万元で北京易用の51%株式を取得する計画を立てている。

faw jiefang group(000800.SZ):一汽財務の21.8%株式を売却する計画で、取引価格は49.24億元。

hubei chutian smart communication(600035.SH):2953万元で平安交通の100%株式を取得する計画。

zhuzhou hongda electronics corp.,ltd.(300726.SZ):宏达磁电の2.57%の株式、華毅微波の3%の株式を取得する計画です

【自社株式の取得】

csg smart science & technology(300222.SZ):2000万元-4000万元を投資して自社株を買い戻すことを検討中

【増減保有】

盛泰グループ(605138.SH):控股株主は3500万元から7000万元の株式を保有することを計画しています

華図山鼎(300492.SZ):株主の張鹏は3.00%を超えない株式の保有を減らす計画です

愛博医療(688050.SH):5%以上の株主である白莹は1.5%の会社の株式を減持する計画です

doctorglasses chain(300622.SZ):実質的な所有者および特定の株主が合計1.53%の会社株式を削減する予定です。

nantong jiangshan agrochemical & chemicals (600389.SH):福華テクノロジーは、合計で会社の株式の3%を超えないように保有することを計画しています

ktk group co., ltd.(603680.SH):中国の軌道が保有する株式の3%未満を減持する予定です。

zhejiang wanliyang(002434.SZ):筆頭株主が所有株式の2%未満の追加購入を計画

【その他】