Analysts have a range of choices when valuing cannabis companies. Viridian commonly uses Discounted Cash Flow Analysis, Public Company Comparables, and M&A Precedent Transactions to value both small private concerns as well as larger public companies.

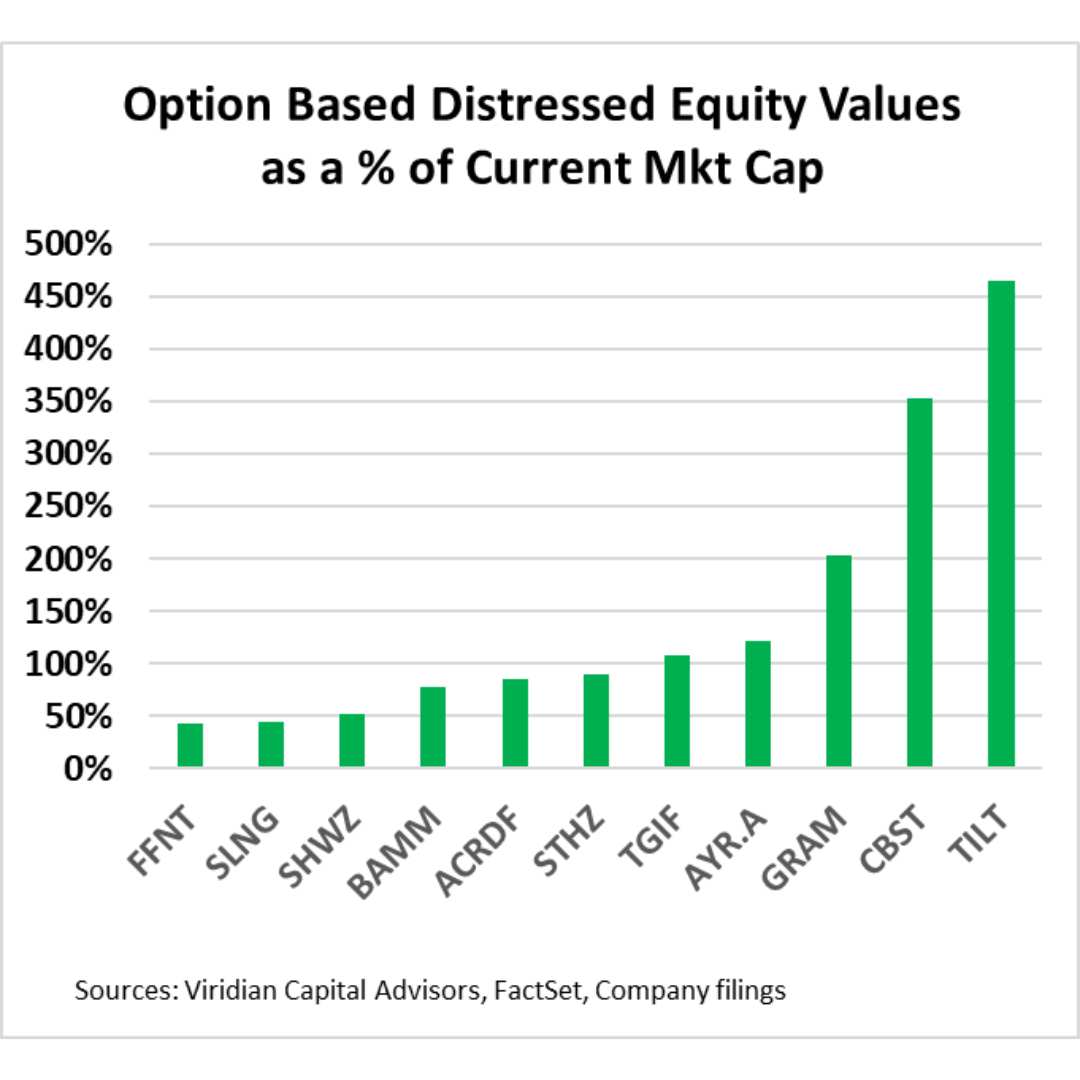

But, consider the task of valuing a company where the current asset value is close to or even below the value of the debt. The companies in the chart all have total liabilities to market cap in excess of 9x, a good measure of distress. In addition, our initial assigned asset value for all of them, except Cannabist (OTC: CBSTF), is lower than the...

Login or create a forever free account to read this news

Sign up/Log in