Wuhu Token Sciences' (SZSE:300088) stock is up by a considerable 55% over the past three months. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Specifically, we decided to study Wuhu Token Sciences' ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Wuhu Token Sciences is:

3.0% = CN¥264m ÷ CN¥8.9b (Based on the trailing twelve months to September 2024).

The 'return' refers to a company's earnings over the last year. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.03 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don't share these attributes.

A Side By Side comparison of Wuhu Token Sciences' Earnings Growth And 3.0% ROE

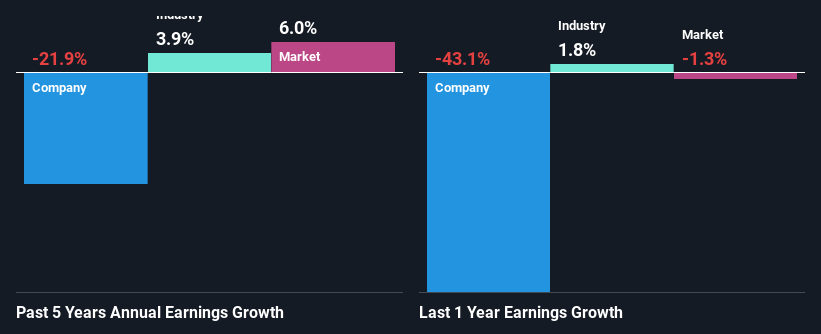

As you can see, Wuhu Token Sciences' ROE looks pretty weak. Not just that, even compared to the industry average of 6.3%, the company's ROE is entirely unremarkable. For this reason, Wuhu Token Sciences' five year net income decline of 22% is not surprising given its lower ROE. However, there could also be other factors causing the earnings to decline. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

However, when we compared Wuhu Token Sciences' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 3.9% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Wuhu Token Sciences is trading on a high P/E or a low P/E, relative to its industry.

Is Wuhu Token Sciences Efficiently Re-investing Its Profits?

In spite of a normal three-year median payout ratio of 40% (that is, a retention ratio of 60%), the fact that Wuhu Token Sciences' earnings have shrunk is quite puzzling. So there could be some other explanations in that regard. For instance, the company's business may be deteriorating.

Moreover, Wuhu Token Sciences has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

On the whole, we feel that the performance shown by Wuhu Token Sciences can be open to many interpretations. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.