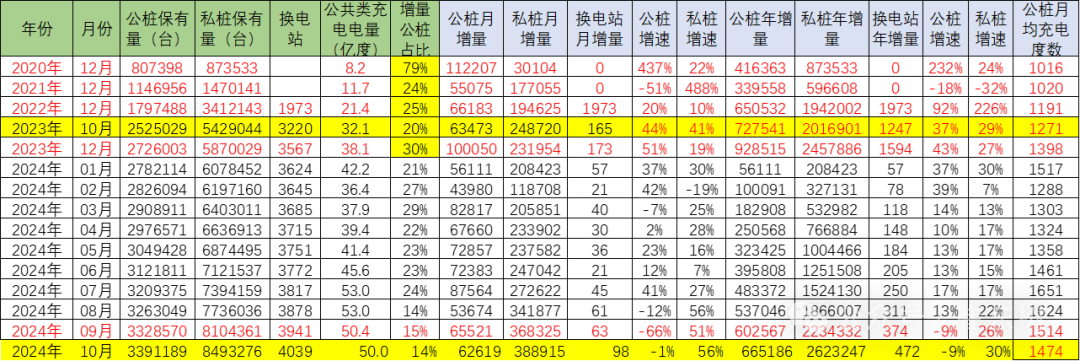

According to the data analysis from the China Charging Alliance organized by the Passenger Vehicle Association, the total number of public charging stations reached 3.39 million in October 2024, an increase of 0.0626 million stations from the previous month, slower than the 1% increase compared to the same period last year.

According to a report obtained by Zhitong Finance APP, Cui Dongshu stated that based on the data analysis from the China Charging Alliance organized by the Passenger Vehicle Association, the total number of public charging stations reached 3.39 million in October 2024, an increase of 0.0626 million stations from the previous month, slower than the 1% increase compared to the same period last year; the annual cumulative increase of public charging stations in 2024 was 0.665 million, a decline of 9% compared to the same period last year. Currently, there are 8.49 million private charging stations, which increased by 0.39 million stations in October, with an increase rate of 56%; the annual cumulative increase of private charging stations in 2024 is 2.62 million, with an increase rate of 30% compared to the same period last year. The average monthly charging of public charging stations is 1474 kWh, which has improved compared to 1271 kWh in October last year.

In recent years, China's charging infrastructure has developed rapidly and has become the world's largest, most widely-serviced, and most comprehensive charging infrastructure system in terms of the variety and types of chargers. Currently, according to the calculation of 1 public charging pile equals 3 private ones, China's ratio of electric vehicle chargers in 2024 market is already 1:1, far exceeding that of other countries in the world.

Currently, there are still problems that need to be addressed to improve the charging infrastructure. These include the issue of inadequate layout, unreasonable structure, outdated charging infrastructure technology, uneven service distribution, and lack of regulation. In some low-tier cities, the rate of electric vehicle purchase regret has increased. However, with the continuous increase in scale and the small adjustment difficulty, the potential for improvement of electric vehicles is huge.

Currently, there are still problems that need to be addressed to improve the charging infrastructure. These include the issue of inadequate layout, unreasonable structure, outdated charging infrastructure technology, uneven service distribution, and lack of regulation. In some low-tier cities, the rate of electric vehicle purchase regret has increased. However, with the continuous increase in scale and the small adjustment difficulty, the potential for improvement of electric vehicles is huge.

The moderate development of charging piles has resulted in low utilization rates and an overall negative operating profit for charging facility operations. Currently, the ratio of the incremental pure electric passenger cars to public charging piles is 1.5:1. If one public charging pile serves at least three cars, then the ratio of the pure electric passenger car charging system is basically 1:1, which is relatively good.

From the perspective of operation of charging enterprises, leading operators are performing strongly. GAC Energy's charging stations averaged 7039 kWh in October, performing well each month. NIO's (09866) charging stations reached around 2599 kWh. However, some old charging stations only average over 100 kWh per month, while major charging enterprises average in the thousand kWh range, showing a significant disparity with efficiency gaps ranging from several to dozens of times. Tesla's (TSLA.US) monthly data remains stable, showing good results. Some are focused on the rapid growth trend of new energy autos, especially electric vehicles, which necessitates further construction of a high-quality charging infrastructure system, updating old low-power AC charging stations, and increasing the upgrade of high-power direct current fast charging to better meet the needs of the public for the purchase and use of new energy autos, assisting in promoting the green low-carbon transformation of transportation and the modernization of the infrastructure system.

1. Overall status of charging piles

Charging infrastructure provides charging and battery swapping services for electric vehicles and is an important transportation and energy integration class infrastructure.

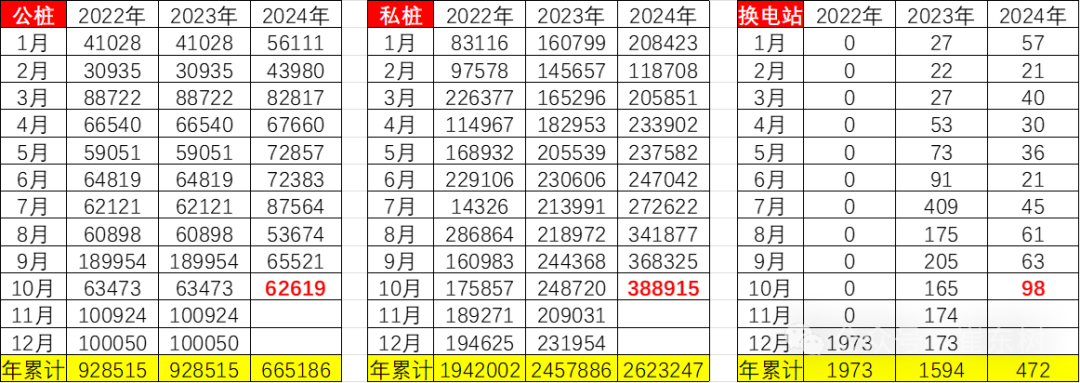

The number of public charging piles increased by 0.34 million in 2021, and the number of private charging piles increased by 0.6 million, YoY decreases of 18% and 32%, respectively.

Public charging piles increased by 0.65 million in 2022, and private charging piles increased by 1.94 million, YoY growth rates of 92% and 226%, respectively.

Public charging piles increased by 0.93 million in 2023, a growth rate of 43% YoY. The number of private charging piles increased by 2.457 million at the end of 2023 compared to July, with a growth rate of 27% YoY.

In October 2024, the total number of public charging stations reached 3.39 million, an increase of 0.0626 million compared to last month, which is slower than the year-on-year growth rate of 1%; the cumulative increase in public charging stations in 2024 is 0.665 million, a decrease of 9% compared to the same period last year. Currently, there are 8.49 million private charging stations, with an increase of 0.39 million in October compared to last month, a growth rate of 56%; the cumulative increase in private charging stations in 2024 is 2.62 million, with a year-on-year growth rate of 30%. The average monthly charging at public stations is 1474 kWh, which is a good increase compared to 1271 kWh in October last year.

2. Monthly growth status of the charging stations

From January to October 2024, the number of public charging stations has increased by 0.665 million compared to the end of 2023, with a decline of 9%, indicating a weak trend.

Charging stations are mainly for private use. According to surveys, charging is generally done through private charging stations, shared charging stations, and public charging stations in residential areas or companies, with each accounting for between 22% and 26%, reaching a total of about 75%. Some respondents who have insufficient access to charging stations outside their residential areas charge at public charging stations on the roadside, while others charge at public charging stations in places such as malls and cinemas.

3. Analysis of the characteristics of public charging stations in various regions.

From January to October 2024, the number of public charging stations in guangdong increased by 0.08 million, and the share of charging stations reached 19%. Last year, from January to October, the increase was 0.15 million, with a share of 21%, showing a decrease this year.

There are huge differences in the situation of public charging stations in various regions, mainly due to larger charging station scales in more developed cities. Charging stations in Guangdong, Jiangsu, Zhejiang, Shanghai, and Beijing are built relatively well.

From January to October 2024, the number of charging stations in shandong increased by approximately 0.0473 million, while in anhui, the increase was about 0.0324 million, with a relatively fast growth in share.

In peking, the status of charging facilities includes 0.14 million public charging stations, with an increase of 0.013 million this year, indicating a substantial scale and steady growth. The same situation applies to shanghai.

Currently, the vehicle-to-charging station ratio of public charging stations in the country is much better than in Europe and America, but there is an issue of insufficient utilization: First, the coverage is incomplete. Currently, 10% of the service areas on highways are not covered, and the coverage rate of rural charging infrastructure is less than 5%; Second, the structure is unreasonable. 99% of charging facilities are still fast and slow chargers, and 64% of public direct current charging stations are still low-voltage stations of 750V and below, which cannot support the development of ultra-fast charging above 800V in the next phase. From a micro-level perspective: First, the operation and maintenance costs are high. The proportion of dead equipment exceeds 30%, and the low degree of digitalization increases the difficulty and cost of operation and maintenance management; Second, the quality of traditional air-cooled equipment is poor. The equipment has a lifespan of only 3-5 years, and operators face replacement before recovering their investment; Third, the service quality is poor. The proportion of dead charging stations reaches 10%, which cannot charge and exacerbates users' charging anxiety.

4. Analysis of Charging Enterprise Characteristics

The charging station operators in our country can be roughly divided into four types: 1) Enterprises that integrate charging station production and charging network investment and operation, mainly using a heavy asset model, focusing on their own asset operation, and cooperating with other operators and third-party platforms, including Star Charging (affiliated with Wanbang Digital), Telecharge (qingdao tgood electric), Wanma Aichong (zhejiang wanma), Putian New Energy, Shanghai Yiwei Energy, Shenzhen Che Dian Wang (shareholding by shenzhen clou electronics), etc. 2) Charging station networks built by power grids, including State Grid (State Grid Electric Vehicle Service Co., Ltd.) and China Southern Power Grid (China Southern Power Grid Electric Vehicle Service Co., Ltd.). 3) Charging networks built by large auto groups, including Tesla, NIO, Xiaopeng, SAIC Anyue, GAC Energy, etc. Some of these auto companies outsource the construction and operation of charging networks to asset-based charging operators and third-party charging service providers. 4) Third-party charging network operators, such as Yun Kuaichong, Xiaoju Charging (affiliated with didi global inc), Shenzhen Huineng, etc., primarily adopting a light asset model, focusing on the massive long-tail market of charging stations, providing saas services for regional operators, essentially acting as IT service providers.

The domestic charging station operation industry faces four major competitive barriers: funding, site availability, grid capacity, and data resources. Currently, the Matthew Effect has emerged, with an increase in market concentration among leading enterprises. The development scale of current direct current charging stations is large, with strong performance from top operators. GAC Energy's charging stations averaged 7039 kilowatt-hours of charging in October, performing well every month. NIO's charging stations reached around 2599 kilowatt-hours of charging. Initially, Tesla reached 3634 kilowatt-hours, all performing well. However, some older charging stations only averaged over 100 kilowatt-hours a month, while the average monthly charging of leading charging enterprises is at a thousand kilowatt-hours level, showing a significant difference in charging amount with several to dozens of times in efficiency differences. Tesla's monthly data remains stable, and the figures are quite good.

Charging stations are divided into two categories: direct current (fast charging) and alternating current (slow charging) stations. Direct current charging stations are larger and have the characteristics of high voltage, large power, and fast charging. They have higher requirements for the grid and are generally built in places such as expressway service areas and buses. Therefore, the quantity is relatively small, accounting for about 20%. Alternating current charging stations are relatively cheaper in unit price, easier to install, usually privately owned, and therefore more numerous and widely distributed, accounting for more than 80%. From the development trend of technology, direct current charging stations are gradually moving towards high power.

From an international comparison, the benefits of public dedicated charging stations are the best, and the orderly charging effects of fixed charging demands, such as for buses, are excellent. The number of public direct current charging stations and their density are both on the rise globally. China is in a leading position in promoting direct current charging stations: for example, in 2024, the share of direct current charging stations in China's public network will exceed 42%. At the same time, the Middle East has become a rising 'star' in terms of direct current charging stations: the share of direct current charging stations increased by 7% in 2022, reaching over 21%; the density of direct current charging increased by 125%, reaching 1.3 direct current charging stations per 100 kilometers of road. The data in these two areas will further grow rapidly.

An ultimate charging experience should have three major features: first, worry-free charging. Provide one-click service, charging station status visibility, and intelligent guidance. Second, undisturbed charging. The charging process is ultra-quiet, and charging is successful without disconnecting midway. Third, carefree charging. Car-station cloud collaboration prevents electromagnetic interference, ensuring personal health and property safety. AC charging stations have two major defects: first, they cannot achieve interaction with the power grid, providing only unidirectional energy replenishment, and do not support V2G evolution; second, they are unable to collaborate with the car-station, lacking digital interconnectivity between car and charging station, resulting in no information exchange. Compared to traditional AC charging stations, small power direct current solutions can better achieve car-grid interaction and digital experiences, bringing three major values: faster charging, not limited by OBC, with charging speed increased by 3-5 times; long-term evolution, supporting plug and charge, point settlement, V2G, and other functions; and massive deployment, achieving three times the coverage rate under the same electrical utilities conditions, improving utilization of municipal electricity by 50%.

5. Analysis of the demand capacity of charging stations

The national new energy development plan clearly proposes that private slow charging is the development trend and should account for more than 90%. Currently, private charging station development is slightly slow, which seriously affects the popularization of electric vehicles.

According to surveys, users of self-owned charging piles have higher satisfaction in various aspects such as charging pile availability, reasonable layout, charging prices, and accurate settlement, compared to other respondents who chose other options.

Private charging stations are privately owned by vehicle owners to meet the needs of charging at home, and are usually built with the car. They have a large customer base and are the absolute main force of basic charging facilities.

From January to October 2024, the domestic retail sales of pure electric passenger vehicles reached 4.8 million units, with the establishment of 670,000 public charging stations and 2.62 million private charging stations. If we consider the public charging stations and private charging stations as a 1:1 user service comparison, the car-station ratio for pure electric passenger vehicles is 1.46:1, indicating that charging stations are relatively sufficient. Here, we need to separate the uniqueness of plug-in hybrid charging being less prevalent, which reflects the Shanghai model characterized by demand that only utilizes fuel without charging.

However, if we look at the utilization rate of public charging stations compared to private ones, it is three times higher, resulting in a 3:1 ratio. Thus, the ratio of charging facilities to pure electric sales reaches 1.04, essentially forming a 1:1 relationship. Due to the explosive increase in public charging station installations, the overall car-station ratio's increment has reached a relatively reasonable level of 1:1.

目前充电基础设施仍存在布局不够完善、结构不够合理、老旧充电桩技术落后、服务不够均衡、运营不够规范等问题亟待提升。部分低线级地区的电动车购买的反悔率有所提升。相信随着规模不断提升,调整难度小,电动车提升潜力大。

目前充电基础设施仍存在布局不够完善、结构不够合理、老旧充电桩技术落后、服务不够均衡、运营不够规范等问题亟待提升。部分低线级地区的电动车购买的反悔率有所提升。相信随着规模不断提升,调整难度小,电动车提升潜力大。