The Reserve Bank of Australia believes that the current policy setting is appropriate to reduce core inflation, which is still “too high.” At the meeting two weeks ago, it was discussed that interest rates might be cut, raised, or kept at a high level for a longer period of time.

The Reserve Bank of Australia said in the November 5 resolution minutes issued in Sydney on Tuesday (November 19): “Australia's monetary policy has been assessed as restrictive, but the extent to which this is still uncertain. The broader financial situation has eased over the past few months.”

The Reserve Bank of Australia Council stated that the staff forecast issued in conjunction with the resolution was based on technical assumptions that cash interest rates would remain at current levels for several months before several cuts in 2025 and 2026. The Board believes that the risks surrounding these projections are “balanced”.

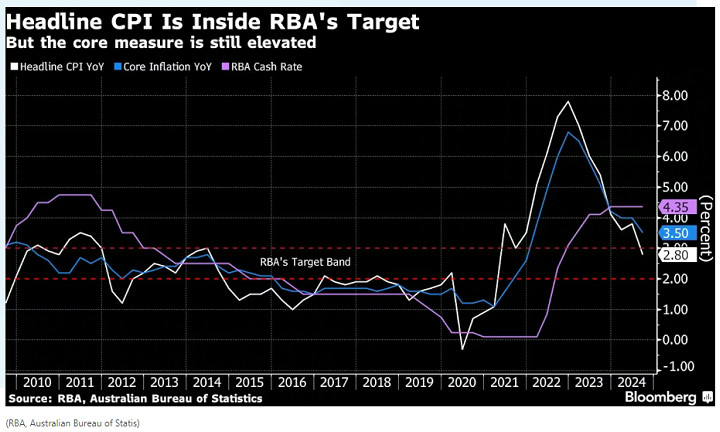

Figure: The overall CPI is within the RBA's target range, but the core CPI is still high (white line indicates overall YoY CPI, blue line indicates YoY core inflation, purple line indicates RBA cash interest rate)

Figure: The overall CPI is within the RBA's target range, but the core CPI is still high (white line indicates overall YoY CPI, blue line indicates YoY core inflation, purple line indicates RBA cash interest rate)

The central bank's hesitation about the future was reflected in a policy meeting held on the day of the US presidential election. Trump proposed raising import tariffs, and given that major Asian countries are Australia's biggest trading partners, the impact of this move could be huge.

The Reserve Bank of Australia has highlighted three major offshore risks:

1. There may be “major changes” in US economic policy

2. There is a difference between the size or composition of economic stimulus plans of major Asian countries and expectations

3. Common risks of unsustainable growth in government debt

The minutes of the meeting show: “The members agreed that it is currently impossible to take such events into account, given that the relevant details are unclear and still largely unpredictable.” It also reiterated RBA Chairman Bullock's comments during his testimony.

Over the past year, the Reserve Bank of Australia has maintained cash interest rates at 4.35% in an attempt to control consumer prices while protecting the labor market and making the economy achieve a soft landing. Although inflation has been cooling down (overall CPI fell sharply in the third quarter due to government energy subsidies), it remains high, and core prices will not continue to return to the target level of 2% -3% until 2026.

The Reserve Bank of Australia said it is still “wary” of upward inflation risks. Since inflation has been above target levels for a long time, it has adapted “minimal tolerance” to higher prices for a longer period of time.

Among several situations where interest rate cuts are possible, the bank emphasizes:

1. If it turns out that consumption continues to be substantially weaker than staff forecasts, this will greatly reduce inflation.

2. If labor market conditions ease far beyond expectations, inflation will be reduced.

If the recovery in consumption turns out to be stronger than expected, current policies may need to last longer than thought.

They also pointed out that if the supply capacity in the economy is much more limited than is assumed, there is a possibility that policy positions will need to be tightened.

The Reserve Bank of Australia said, “Members agree that it is important to keep monetary policy sufficiently restrictive until the Board is convinced that inflation is continuing to reach the target level. They also pointed out the importance of being forward-looking and avoiding excessive reliance on past information, which could cause the Council to react too late to changes in economic conditions.”

图:整体CPI在澳洲联储的目标范围内,但核心CPI仍然高企(白线指整体同比CPI,蓝线指同比核心通胀,紫线指澳洲联储现金利率)

图:整体CPI在澳洲联储的目标范围内,但核心CPI仍然高企(白线指整体同比CPI,蓝线指同比核心通胀,紫线指澳洲联储现金利率)