① The activity of speculative capital has significantly increased compared to previous days, with multiple stocks receiving trading orders exceeding 100 million. ② China Greatwall Technology Group received a total buy of 0.975 billion from four leading speculative capitals; Grinm Advanced Materials received a total buy of over 0.4 billion from four leading speculative capitals.

Today, the total transaction of the Shanghai and Shenzhen Stock Connect reached 223.998 billion, with Kweichow Moutai and Contemporary Amperex Technology ranking first in transaction amount among the stocks in Shanghai and Shenzhen Stock Connect respectively. In terms of sector main funds, the nonferrous metals sector saw the highest net inflow of main funds. Regarding ETF transactions, the NASDAQ Technology ETF (159509) recorded a 92% week-on-week increase in trading volume. In terms of futures contract holdings, the short position reduction in IH and IF contracts exceeded that of long positions. On the leaderboard, Qingdao Kutesmart Co., Ltd. received a buy of 0.103 billion from institutions and over 40 million from a quantitative position; Beijing Hotgen Biotech Co., Ltd. received a buy of 0.146 billion from institutions; Visionox Technology Inc. received over 60 million from institutions; Funeng Oriental Equipment Technology received over 60 million from institutions; Guoguang Electric faced a sell of 0.123 billion from institutions; Shenyang Jinbei Automotive faced a sell of over 70 million from institutions; Hytera Communications Corporation was sold 0.288 billion by Citic Sec's Putuo Mountain branch, while receiving a buy of 0.118 billion from GTJA at Xianning Xianning Avenue.

1. The top ten turnover of Shanghai and Shenzhen Stock Connect.

The total transaction amount of Shanghai-Hong Kong Stock Connect today was 125.634 billion, and the total transaction amount of Shenzhen-Hong Kong Stock Connect was 131.564 billion.

The total transaction amount of Shanghai-Hong Kong Stock Connect today was 125.634 billion, and the total transaction amount of Shenzhen-Hong Kong Stock Connect was 131.564 billion.

From the top ten trading stocks in the Shanghai Stock Connect, Kweichow Moutai ranked first; Chongqing Sokon Industry Group Stock and Citic Sec ranked second and third.

From the top ten trading stocks in the Shanghai Stock Connect, Kweichow Moutai ranked first; Chongqing Sokon Industry Group Stock and Citic Sec ranked second and third.Looking at the top ten traded stocks in the Shenzhen Stock Connect, Contemporary Amperex Technology ranked first; East Money Information and BYD ranked second and third respectively.

2. Sector individual stock block orders funding.

In terms of sector performance, lithium, humanoid robots, and controlled nuclear fusion sectors saw significant gains, while a few sectors like special treat and coal experienced declines.

From the data monitoring of block orders, the nonferrous metals sector ranks first in net inflows of block orders.

From the data monitoring of block orders, the nonferrous metals sector ranks first in net inflows of block orders.In terms of sector capital outflow, the transportation equipment sector has the highest net outflow of block orders.

From the monitoring data of block orders in individual stocks, the top ten stocks with net inflow of block orders are from various sectors, with China Greatwall Technology Group having the highest net inflow.

From the monitoring data of block orders in individual stocks, the top ten stocks with net inflow of block orders are from various sectors, with China Greatwall Technology Group having the highest net inflow.The top ten stocks with net outflow of block orders belong to various sectors, with Wintime Energy having the highest net outflow.

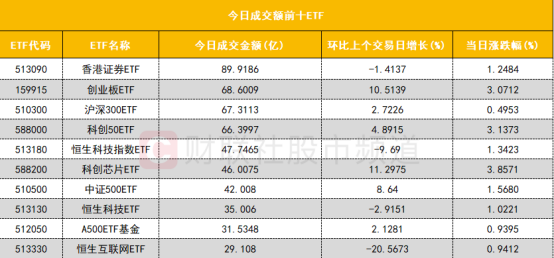

III. ETF trading

From the top ten ETFs by trading volume, the e fund csi hongkong bond investment theme etf (513090) ranks first; the yifangda gem etf (159915) ranks second.

From the top ten ETFs by trading volume, the e fund csi hongkong bond investment theme etf (513090) ranks first; the yifangda gem etf (159915) ranks second. From the top ten ETFs by month-on-month growth in trading volume, the Nasdaq technology ETF (159509) has a month-on-month growth of 92%, ranking first; the new energy vehicles etf (515030) has a month-on-month growth of 73%, ranking third.

From the top ten ETFs by month-on-month growth in trading volume, the Nasdaq technology ETF (159509) has a month-on-month growth of 92%, ranking first; the new energy vehicles etf (515030) has a month-on-month growth of 73%, ranking third.IV. Futures contract positions

The main contracts of the four major index futures have significantly reduced positions, with a larger reduction in short positions for IH and IF contracts; meanwhile, IC and IM contracts have seen a larger reduction in long positions.

The main contracts of the four major index futures have significantly reduced positions, with a larger reduction in short positions for IH and IF contracts; meanwhile, IC and IM contracts have seen a larger reduction in long positions.Five, Dragon and Tiger List

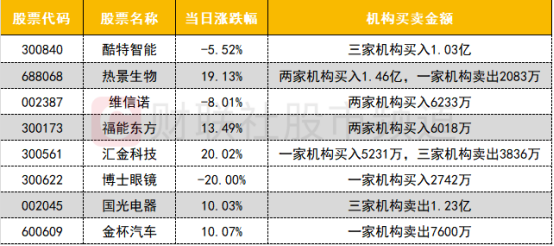

1. Institutions

Today, the activity level of institutions on the dragon and tiger list is average. In terms of buying, the AI smart body concept stock qingdao kutesmart co.,ltd. was bought by institutions for 0.103 billion; the pharmaceutical stock beijing hotgen biotech co.,ltd was bought by institutions for 0.146 billion; the restructuring concept stock visionox technology inc. was bought by institutions for over 60 million; the solid state battery concept stock funeng oriental equipment technology was bought by institutions for over 60 million.

Today, the activity level of institutions on the dragon and tiger list is average. In terms of buying, the AI smart body concept stock qingdao kutesmart co.,ltd. was bought by institutions for 0.103 billion; the pharmaceutical stock beijing hotgen biotech co.,ltd was bought by institutions for 0.146 billion; the restructuring concept stock visionox technology inc. was bought by institutions for over 60 million; the solid state battery concept stock funeng oriental equipment technology was bought by institutions for over 60 million.On the selling side, the consumer electronics concept stock guoguang electric was sold by institutions for 0.123 billion; shenyang jinbei automotive was sold by institutions for over 70 million.

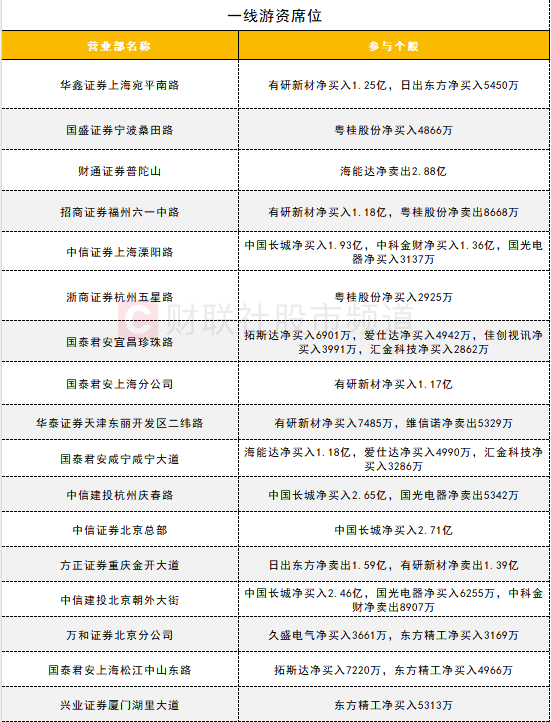

2. Retail Investors

The activity level of first-tier retail investors has significantly increased, with china greatwall technology group receiving a total of 0.975 billion from four first-tier retail investor seats; grinm advanced materials received over 0.4 billion from four first-tier retail investor seats; hytera communications corporation was sold by caitong at the Putuo Mountain branch for 0.288 billion, while it was bought by gtja at Xianning Xianning Avenue for 0.118 billion.

The activity level of first-tier retail investors has significantly increased, with china greatwall technology group receiving a total of 0.975 billion from four first-tier retail investor seats; grinm advanced materials received over 0.4 billion from four first-tier retail investor seats; hytera communications corporation was sold by caitong at the Putuo Mountain branch for 0.288 billion, while it was bought by gtja at Xianning Xianning Avenue for 0.118 billion. The activity level of algo funds is average, with qingdao kutesmart co.,ltd. receiving over 40 million from one algo seat.

The activity level of algo funds is average, with qingdao kutesmart co.,ltd. receiving over 40 million from one algo seat.

今日沪股通总成交金额为1256.34亿,深股通总成交金额为1315.64亿。

今日沪股通总成交金额为1256.34亿,深股通总成交金额为1315.64亿。