David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Lands' End, Inc. (NASDAQ:LE) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Lands' End's Debt?

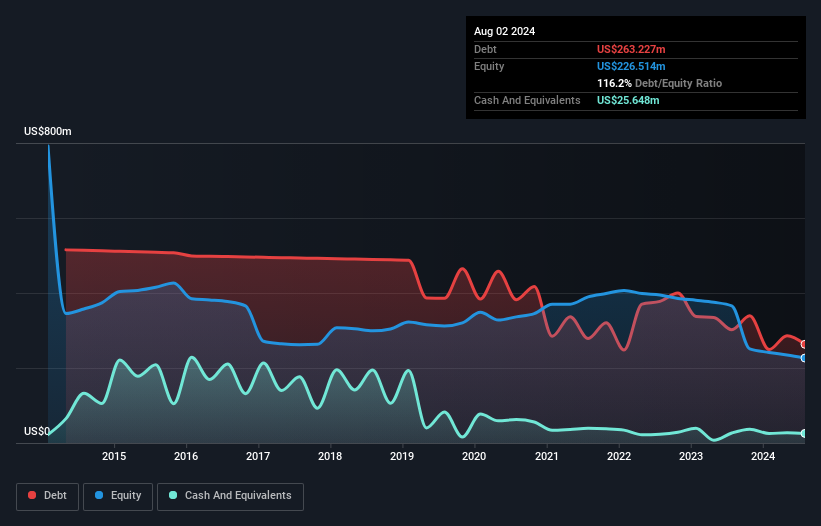

The image below, which you can click on for greater detail, shows that Lands' End had debt of US$263.2m at the end of August 2024, a reduction from US$301.8m over a year. However, because it has a cash reserve of US$25.6m, its net debt is less, at about US$237.6m.

How Strong Is Lands' End's Balance Sheet?

We can see from the most recent balance sheet that Lands' End had liabilities of US$253.4m falling due within a year, and liabilities of US$322.6m due beyond that. Offsetting this, it had US$25.6m in cash and US$27.4m in receivables that were due within 12 months. So it has liabilities totalling US$522.9m more than its cash and near-term receivables, combined.

We can see from the most recent balance sheet that Lands' End had liabilities of US$253.4m falling due within a year, and liabilities of US$322.6m due beyond that. Offsetting this, it had US$25.6m in cash and US$27.4m in receivables that were due within 12 months. So it has liabilities totalling US$522.9m more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's US$480.4m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While we wouldn't worry about Lands' End's net debt to EBITDA ratio of 3.6, we think its super-low interest cover of 0.63 times is a sign of high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Another concern for investors might be that Lands' End's EBIT fell 19% in the last year. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Lands' End's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, Lands' End recorded free cash flow of 44% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

On the face of it, Lands' End's EBIT growth rate left us tentative about the stock, and its interest cover was no more enticing than the one empty restaurant on the busiest night of the year. But at least its conversion of EBIT to free cash flow is not so bad. We're quite clear that we consider Lands' End to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. Even though Lands' End lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.