Track the latest trends of southbound funds.

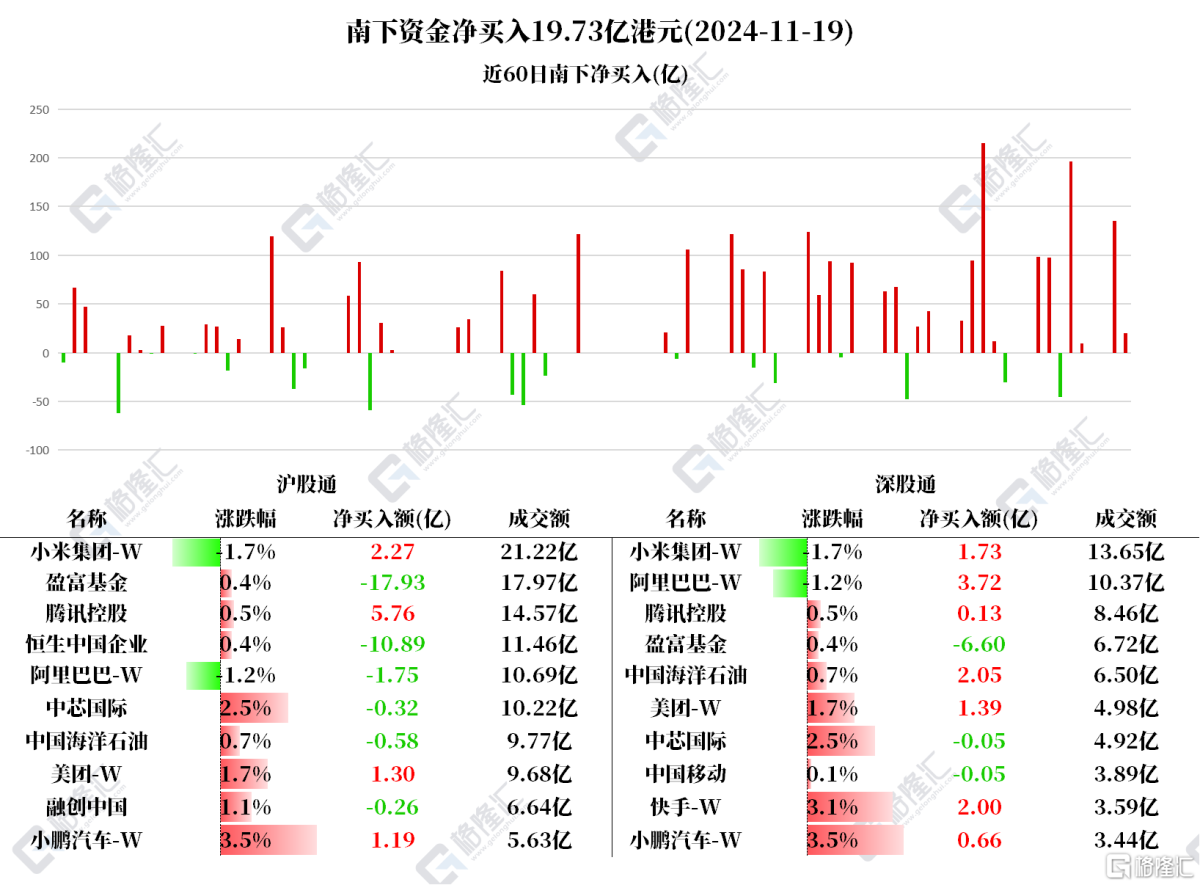

On November 19, southbound funds net bought Hong Kong stocks worth 1.973 billion HKD. Among them, the Hong Kong Stock Connect (Shanghai) net bought 0.197 billion HKD, and the Hong Kong Stock Connect (Shenzhen) net bought 1.776 billion HKD.

Net purchases include Tencent at 0.588 billion, Xiaomi at 0.4 billion, Meituan at 0.268 billion, Kuaishou at 0.199 billion, Alibaba at 0.196 billion, Xpeng Motors at 0.185 billion, and CNOOC at 0.146 billion; net sales include Tracker Fund of Hong Kong at 2.454 billion and Hang Seng H-Share Index ETF at 1.089 billion.

According to statistics, southbound funds have net bought Xiaomi for 7 consecutive days, totaling 3.79451 billion HKD; net bought Tencent for 6 consecutive days, totaling 5.09043 billion HKD; net bought CNOOC for 5 consecutive days, totaling 0.8619 billion HKD; net bought Meituan for 4 consecutive days, totaling 1.7679 billion HKD. Additionally, in the 42 trading days since being included in the Hong Kong Stock Connect, southbound funds have cumulatively net bought Alibaba worth 70.35235 billion HKD.

According to statistics, southbound funds have net bought Xiaomi for 7 consecutive days, totaling 3.79451 billion HKD; net bought Tencent for 6 consecutive days, totaling 5.09043 billion HKD; net bought CNOOC for 5 consecutive days, totaling 0.8619 billion HKD; net bought Meituan for 4 consecutive days, totaling 1.7679 billion HKD. Additionally, in the 42 trading days since being included in the Hong Kong Stock Connect, southbound funds have cumulatively net bought Alibaba worth 70.35235 billion HKD.

Materials of the companies of North Water

Tencent: On November 19, repurchased 1.73 million shares, with a total expenditure of approximately 0.703 billion HK dollars, at a price per share of 403.4-409 HK dollars.

Xiaomi Group: The total revenue for the third quarter was 92.5 billion yuan, an increase of 30.5% year-on-year; adjusted net income was 6.3 billion yuan. The currently popular Xiaomi autos contributed little to the financial report. In terms of revenue, Xiaomi's smart electric vehicle and other innovative business income amounted to 9.7 billion yuan, accounting for almost one-tenth of total revenue. If considering profit, the auto business lagged behind, with a net loss of 1.5 billion yuan in the third quarter. Goldman Sachs released a report indicating that it has raised Xiaomi's target price from 30.7 HKD to 33.3 HKD, maintaining a "buy" rating.

Semiconductor Manufacturing International Corporation: Tianfeng noted that the demand for domestic substitution of semiconductors is urgent, the market space is large, and external (international political instability) and internal (large factories expanding production, policy promotion, etc.) potential catalysts are bringing momentum to the sector. The firm determines that the domestic substitution of semiconductor equipment, materials, and EDA/IP is expected to accelerate continuously, and investment opportunities in the sector are worth noting. Semiconductor Manufacturing International Corporation reported its Q3 2024 financial results, with improved capacity utilization and a stable upward guidance for the fourth quarter, indicating that the industry may enter a peak season.

Xiaopeng Autos: Revenue for the third quarter is 10.1 billion yuan, an increase of 18.4% year-on-year and 24.5% quarter-on-quarter, with market expectations at 9.91 billion yuan; the net loss for the third quarter is 1.81 billion yuan, compared to a loss of 3.89 billion yuan in the same period of 2023, and a loss of 1.28 billion yuan in Q2 2024. The total auto delivery volume in the third quarter was 46,533 units, an increase of 16.3% compared to 40,008 units in the same period of 2023.

China Mobile: Informed sources revealed that China Mobile has been in talks with MBK Partners and TPG Inc., the private equity company of HKBN's major shareholders, regarding acquisition matters. It is reported that China Mobile has indicated a willingness to offer at least 5 Hong Kong dollars per share, which would value the company at over 6.5 billion Hong Kong dollars (0.835 billion USD). China Mobile has already conducted due diligence for the potential acquisition and is currently negotiating price with MBK and TPG.

据统计,南下资金已连续7日净买入小米,共计37.9451亿港元;连续6日净买入腾讯,共计50.9043亿港元;连续5日净买入中海油,共计8.619亿港元;连续4日净买入美团,共计17.679亿港元。另外,自纳入港股通以来的42个交易日,南下资金已累计净买入阿里巴巴703.5235亿港元。

据统计,南下资金已连续7日净买入小米,共计37.9451亿港元;连续6日净买入腾讯,共计50.9043亿港元;连续5日净买入中海油,共计8.619亿港元;连续4日净买入美团,共计17.679亿港元。另外,自纳入港股通以来的42个交易日,南下资金已累计净买入阿里巴巴703.5235亿港元。