With EPS Growth And More, Applied Industrial Technologies (NYSE:AIT) Makes An Interesting Case

With EPS Growth And More, Applied Industrial Technologies (NYSE:AIT) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

投资者通常以发现 “下一件大事” 的想法为指导,即使这意味着在没有任何收入的情况下购买 “故事股票”,更不用说利润了。但是,正如彼得·林奇在 One Up On Wall Street 中所说的那样,“远射几乎永远不会得到回报。”亏损公司可以像资本海绵一样行事,因此投资者应谨慎行事,不要浪费好钱。

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Applied Industrial Technologies (NYSE:AIT). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

因此,如果这种高风险和高回报的想法不适合,那么你可能会对应用工业技术公司(纽约证券交易所代码:AIT)等盈利、成长中的公司更感兴趣。尽管这并不一定说明其估值是否被低估,但该业务的盈利能力足以保证一定的升值——尤其是在其增长的情况下。

Applied Industrial Technologies' Earnings Per Share Are Growing

应用工业技术的每股收益正在增长

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Applied Industrial Technologies has grown EPS by 33% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

通常,每股收益(EPS)增长的公司的股价应该会出现类似的趋势。因此,有很多投资者喜欢购买每股收益不断增长的公司的股票。令人印象深刻的是,在过去三年中,应用工业技术公司的每股收益每年复合增长33%。如果公司能够维持这种增长,我们预计股东会感到满意。

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It was a year of stability for Applied Industrial Technologies as both revenue and EBIT margins remained have been flat over the past year. That's not a major concern but nor does it point to the long term growth we like to see.

仔细考虑收入增长和息税前收益(EBIT)利润率有助于为近期利润增长的可持续性提供信息。这是应用工业技术保持稳定的一年,因为在过去的一年中,收入和息税前利润率都保持不变。这不是一个主要问题,但它并不表明我们希望看到的长期增长。

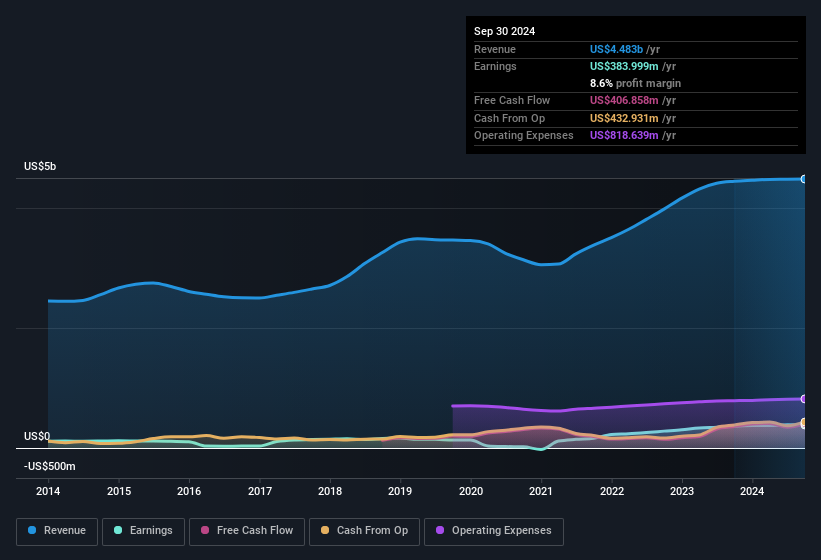

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

在下图中,您可以看到公司如何随着时间的推移实现收益和收入的增长。要了解更多细节,请点击图片。

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Applied Industrial Technologies' future profits.

你开车时不要注视后视镜,因此你可能会对这份免费报告更感兴趣,该报告显示了分析师对应用工业技术未来利润的预测。

Are Applied Industrial Technologies Insiders Aligned With All Shareholders?

应用工业技术内部人士是否与所有股东保持一致?

We would not expect to see insiders owning a large percentage of a US$10b company like Applied Industrial Technologies. But we do take comfort from the fact that they are investors in the company. With a whopping US$98m worth of shares as a group, insiders have plenty riding on the company's success. This would indicate that the goals of shareholders and management are one and the same.

我们预计不会看到内部人士拥有像应用工业技术这样的100亿美元公司的很大一部分股份。但是,他们是公司的投资者,这确实令我们感到欣慰。集团拥有高达9800万美元的股票,业内人士对该公司的成功有充分的依据。这将表明股东和管理层的目标是相同的。

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Applied Industrial Technologies, with market caps over US$8.0b, is around US$13m.

很高兴看到内部人士投资于公司,但是薪酬水平是否合理?对首席执行官薪酬的简要分析表明确实如此。市值超过80亿美元的规模与应用工业技术公司首席执行官的总薪酬中位数约为1300万美元。

Applied Industrial Technologies' CEO took home a total compensation package of US$6.3m in the year prior to June 2024. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

应用工业技术首席执行官在2024年6月之前的一年中获得了630万美元的总薪酬待遇。这看起来像是微不足道的工资待遇,可能暗示着对股东利益的某种尊重。尽管首席执行官的薪酬水平不应成为公司看法的最大因素,但适度的薪酬是积极的,因为这表明董事会将股东利益放在心上。从更广泛的意义上讲,它也可以是诚信文化的标志。

Does Applied Industrial Technologies Deserve A Spot On Your Watchlist?

应用工业技术值得在您的关注清单上占有一席之地吗?

You can't deny that Applied Industrial Technologies has grown its earnings per share at a very impressive rate. That's attractive. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. This may only be a fast rundown, but the key takeaway is that Applied Industrial Technologies is worth keeping an eye on. Before you take the next step you should know about the 1 warning sign for Applied Industrial Technologies that we have uncovered.

你不能否认应用工业技术公司的每股收益以非常惊人的速度增长。这很有吸引力。如果您除了每股收益增长率之外还需要更多说服力,请不要忘记合理的薪酬和较高的内部所有权。这可能只是一个简短的概述,但关键要点是应用工业技术值得关注。在采取下一步行动之前,您应该了解我们发现的应用工业技术的 1 个警告标志。

Although Applied Industrial Technologies certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

尽管应用工业技术确实看起来不错,但如果内部人士买入股票,它可能会吸引更多的投资者。如果你想看到拥有更多风险的公司,那么看看这些精心挑选的公司,这些公司不仅拥有强劲的增长,而且有强大的内部支持。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

请注意,本文中讨论的内幕交易是指相关司法管辖区内应报告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗?直接联系我们。或者,发送电子邮件给编辑组(网址为)simplywallst.com。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It was a year of stability for Applied Industrial Technologies as both revenue and EBIT margins remained have been flat over the past year. That's not a major concern but nor does it point to the long term growth we like to see.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It was a year of stability for Applied Industrial Technologies as both revenue and EBIT margins remained have been flat over the past year. That's not a major concern but nor does it point to the long term growth we like to see.