Gold prices have dropped nearly 6% from their late October peak of $2,790 to $2,630. Last week marked gold’s steepest weekly decline in over three years, as market jitters over President Donald Trump’s tariff policies potentially stoking inflation could prompt the Federal Reserve to ease its rate-cutting pace.

Gold rebounded on Monday, snapping a six-day losing streak, driven by a pause in the dollar’s rise and renewed safe-haven demand amid uncertainties in the Russia-Ukraine conflict. As of Tuesday, gold is up more than 27% this year.

Geopolitical risks and expectations of rate cuts have fueled gold’s ascent over the past year, repeatedly hitting new highs. Post-Trump’s election, a stronger dollar contributed to gold’s pullback, raising questions on whether its upward trajectory can resume.

Analysts Remain Bullish on Gold

Goldman Sachs strategist Daan Struyven remains bullish, identifying gold as a top commodity for 2025. He suggests prices could climb further during Trump’s presidency, citing increased tariffs and potential deficit concerns that could heighten worries over U.S. fiscal sustainability. Struyven forecasts gold could hit $3,000 an ounce by the end of 2025, contingent on more aggressive Fed rate cuts and a subdued dollar.

Goldman Sachs strategist Daan Struyven remains bullish, identifying gold as a top commodity for 2025. He suggests prices could climb further during Trump’s presidency, citing increased tariffs and potential deficit concerns that could heighten worries over U.S. fiscal sustainability. Struyven forecasts gold could hit $3,000 an ounce by the end of 2025, contingent on more aggressive Fed rate cuts and a subdued dollar.

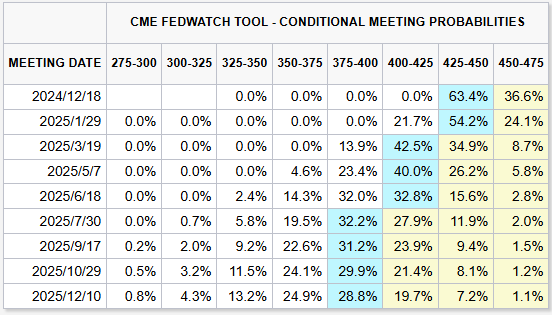

High interest rates reduce the allure of non-yielding assets like gold, with rate hikes potentially applying additional pressure on prices. Markets widely anticipate a third Fed rate cut in December.

Panmure Liberum analyst Tom Price views last week’s gold dip as a temporary reset, with underlying themes like war and geopolitical risks still present since Trump’s election.

Gold Related Stocks

Besides physical gold and futures, gold mining stocks offer attractive investment avenues.

This year, gold miners $Harmony Gold Mining (HMY.US)$, $Kinross Gold (KGC.US)$, $AngloGold Ashanti (AU.US)$, $Agnico Eagle (AEM.US)$, and $Alamos Gold (AGI.US)$ have surged 53%, 63%, 34%, 50%, and 36%, respectively.

Gold stocks typically provide greater liquidity compared to physical gold, with financially strong companies often yielding substantial dividends. As gold prices rise, mining companies’ profits tend to expand.

Not all gold mining companies strictly extract gold; some also mine other precious metals, complicating assessments of their gold price gains. Investors should consider revenue from gold, debt coverage, growth, and dividend yield when selecting gold mining stocks.

Source: Bloomberg, AAStocks, Reuters, Abrdn, State Street