GameStop's Options Frenzy: What You Need to Know

GameStop's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bearish stance on GameStop (NYSE:GME).

有大量資金可以花的投資者對GameStop(紐約證券交易所代碼:GME)採取了看跌立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,當交易出現在我們在本辛加追蹤的公開期權歷史記錄上時,我們注意到了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.

無論這些是機構還是僅僅是富人,我們都不知道。但是,當 GME 發生這麼大的事情時,通常意味着有人知道某件事即將發生。

So how do we know what these investors just did?

那麼我們怎麼知道這些投資者剛才做了什麼?

Today, Benzinga's options scanner spotted 45 uncommon options trades for GameStop.

今天,Benzinga的期權掃描儀發現了GameStop的45筆不常見的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 17% bullish and 51%, bearish.

這些大資金交易者的整體情緒分爲17%的看漲和51%的看跌。

Out of all of the special options we uncovered, 36 are puts, for a total amount of $1,085,100, and 9 are calls, for a total amount of $882,465.

在我們發現的所有特殊期權中,有36個是看跌期權,總額爲1,085,100美元,9個是看漲期權,總額爲882,465美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $13.0 and $125.0 for GameStop, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場推動者正在關注GameStop在過去三個月中13.0美元至125.0美元之間的價格區間。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

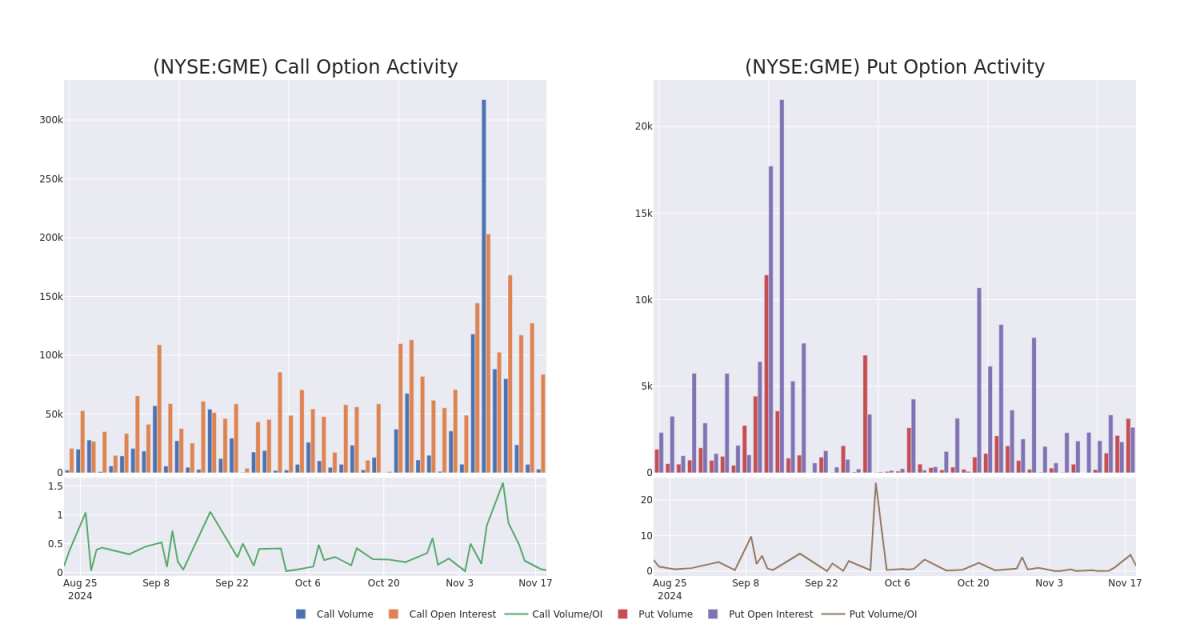

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平倉合約是一種對股票進行盡職調查的有見地的方法。

This data can help you track the liquidity and interest for GameStop's options for a given strike price.

這些數據可以幫助您跟蹤給定行使價下GameStop期權的流動性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GameStop's whale activity within a strike price range from $13.0 to $125.0 in the last 30 days.

下面,我們可以分別觀察過去30天在13.0美元至125.0美元行使價範圍內GameStop所有鯨魚活動的看漲和看跌期權交易量和未平倉合約的變化。

GameStop Call and Put Volume: 30-Day Overview

GameStop 看漲和看跌交易量:30 天概述

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | SWEEP | BEARISH | 01/17/25 | $3.3 | $3.05 | $3.05 | $40.00 | $270.6K | 28.2K | 943 |

| GME | CALL | TRADE | BEARISH | 01/16/26 | $16.75 | $16.0 | $16.1 | $13.00 | $217.3K | 1.4K | 136 |

| GME | CALL | SWEEP | BEARISH | 01/17/25 | $7.75 | $7.7 | $7.7 | $20.00 | $192.5K | 19.6K | 384 |

| GME | CALL | TRADE | BEARISH | 01/17/25 | $5.45 | $5.1 | $5.15 | $25.00 | $51.5K | 28.2K | 440 |

| GME | CALL | SWEEP | BEARISH | 12/06/24 | $1.9 | $1.65 | $1.71 | $28.00 | $42.9K | 1.3K | 258 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 遊戲 | 打電話 | 掃 | 粗魯的 | 01/17/25 | 3.3 美元 | 3.05 美元 | 3.05 美元 | 40.00 美元 | 270.6 萬美元 | 28.2K | 943 |

| 遊戲 | 打電話 | 貿易 | 粗魯的 | 01/16/26 | 16.75 美元 | 16.0 美元 | 16.1 美元 | 13.00 美元 | 217.3 萬美元 | 1.4K | 136 |

| 遊戲 | 打電話 | 掃 | 粗魯的 | 01/17/25 | 7.75 美元 | 7.7 美元 | 7.7 美元 | 20.00 美元 | 192.5 萬美元 | 19.6 K | 384 |

| 遊戲 | 打電話 | 貿易 | 粗魯的 | 01/17/25 | 5.45 美元 | 5.1 美元 | 5.15 美元 | 25.00 美元 | 51.5 萬美元 | 28.2K | 440 |

| 遊戲 | 打電話 | 掃 | 粗魯的 | 12/06/24 | 1.9 美元 | 1.65 美元 | 1.71 美元 | 28.00 美元 | 42.9 萬美元 | 1.3K | 258 |

About GameStop

關於 GameStop

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp 是一家美國多渠道視頻遊戲、消費電子產品和服務零售商。該公司在歐洲、加拿大、澳大利亞和美國開展業務。GameStop主要通過GameStop、EB Games和Micromania商店以及國際電子商務網站銷售新的和二手的視頻遊戲硬件、實體和數字視頻遊戲軟件以及視頻遊戲配件。大部分銷售來自美國。

Where Is GameStop Standing Right Now?

GameStop 現在在哪裏?

- With a volume of 3,568,577, the price of GME is up 1.74% at $26.9.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 15 days.

- GME的交易量爲3568,577美元,價格上漲了1.74%,至26.9美元。

- RSI 指標暗示標的股票可能處於超買狀態。

- 下一份業績預計將在15天后公佈。

Turn $1000 into $1270 in just 20 days?

在短短 20 天內將 1000 美元變成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年專業期權交易員透露了他的單線圖技術,該技術顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊此處訪問。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GameStop options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時提醒,隨時了解最新的GameStop期權交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.