① How did Jinshan Cloud and Jinshan Software perform in the third quarter? ② How do organizations view the performance of these companies?

Financial Services Association, November 20 (Editor: Hu Jiarong) Benefiting from the third quarter results, individual Hong Kong stocks strengthened today. As of press release, Jinshan Cloud (03896.HK) and Jinshan Software (03888.HK) have risen 16.19% and 10.27% respectively.

First, let's take a look at the third-quarter results of Jinshan Cloud and Jinshan Software.

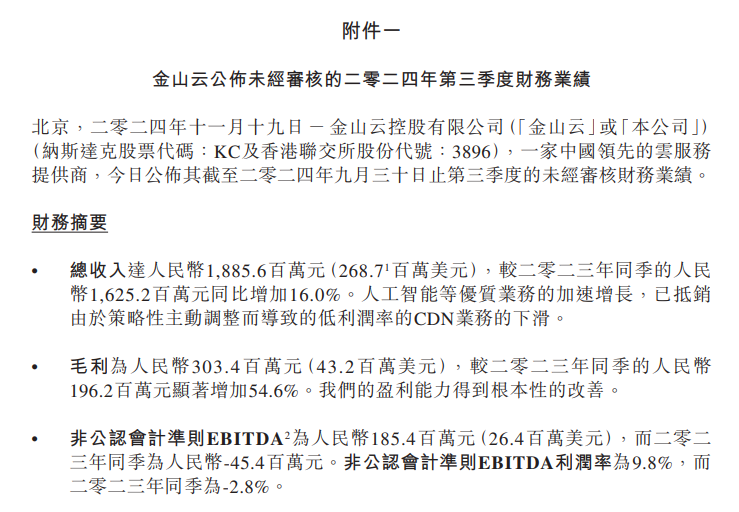

Jinshan Cloud's total revenue for the third quarter reached 1.886 billion yuan, up 16% year on year; public cloud achieved revenue of 1.18 billion yuan, up 15.6% year on year; industry cloud achieved revenue of 0.71 billion yuan, up 16.7% year on year; and gross profit was 0.3034 billion yuan, up 54.6% year on year.

Jinshan Cloud's total revenue for the third quarter reached 1.886 billion yuan, up 16% year on year; public cloud achieved revenue of 1.18 billion yuan, up 15.6% year on year; industry cloud achieved revenue of 0.71 billion yuan, up 16.7% year on year; and gross profit was 0.3034 billion yuan, up 54.6% year on year.

Note: Jinshan Cloud's third quarter performance

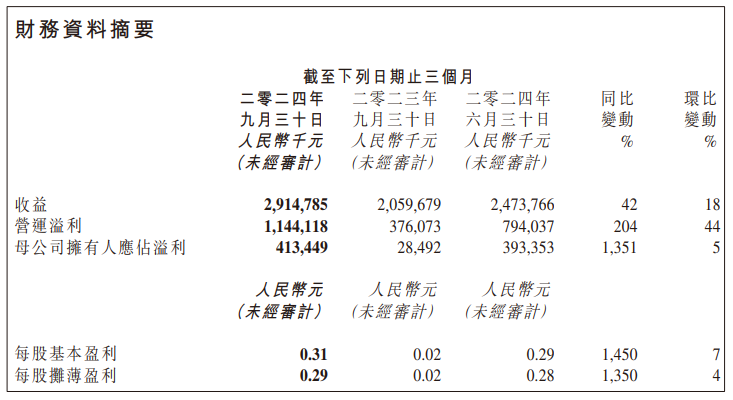

The performance of Jinshan Software during the same period is also worth watching. The company's third-quarter revenue was 2.915 billion yuan, up 42% year on year; profit attributable to parent company owners was 0.413 billion yuan, a sharp increase of 1,351% year over year.

Note: Jinshan Software's third quarter performance

In terms of specific business, revenue from office software and services was 1.207 billion yuan, up 10% year on year; revenue from online games and other products was 1.708 billion yuan, up 78% year on year. Overall operating profit reached 1.144 billion yuan, a year-on-year increase of 204%.

Judging from the above, Jinshan Cloud and Jinshan Software both showed growth in the third quarter.

Agencies say Jinshan Software's gaming business is expected to maintain growth in 2025

Bank of China International released a report saying that Jinshan Software's performance for the third quarter exceeded expectations, mainly due to the excellent performance of the online gaming business. Among them, game revenue increased by 78% year-on-year, mainly due to the successful release of “Sword Net 3: Unbounded”, and “Sword Net 3” doubled daily activity and contributed considerable revenue.

The report also pointed out that the company expects the online game business to maintain good momentum in 2025, which will help hedge that office software revenue falls short of expectations due to the weak overall macro environment. The bank believes that as expectations of government stimulus policies heat up, the company's office software is still an attractive long-term SaaS target. At the same time, the strong performance of the online game business this year and next year is a benefit worth paying attention to.

金山云的三季度总收入达18.86亿元,同比增加16%;公有云实现收入11.8亿元,同比增长15.6%;行业云实现收入7.1亿元,同比增长16.7%;毛利为3.034亿元,同比增加54.6%。

金山云的三季度总收入达18.86亿元,同比增加16%;公有云实现收入11.8亿元,同比增长15.6%;行业云实现收入7.1亿元,同比增长16.7%;毛利为3.034亿元,同比增加54.6%。