shandong chenming paperのAH株価が大幅に下落しました

製紙業界のリーダーであるshandong chenming paperが雷を落としました!

造紙業務が低迷しているため、企業は23.94億元もの負債支払い期限超過に直面しており、現在凍結されている銀行口座が65個あり、この影響で約71.7%の生産能力が生産停止や制限を余儀なくされています。

本日の始値では、shandong chenming paperのAH株価が大幅に下落しました。そのうち企業A株の株価は始値で一字下落し、現在3.37元/株で時価総額は99.64億元;香港株の値下がり率は28%に拡大し、1.21香港ドル/株で時価総額は35.78億香港ドルです。

本日の始値では、shandong chenming paperのAH株価が大幅に下落しました。そのうち企業A株の株価は始値で一字下落し、現在3.37元/株で時価総額は99.64億元;香港株の値下がり率は28%に拡大し、1.21香港ドル/株で時価総額は35.78億香港ドルです。

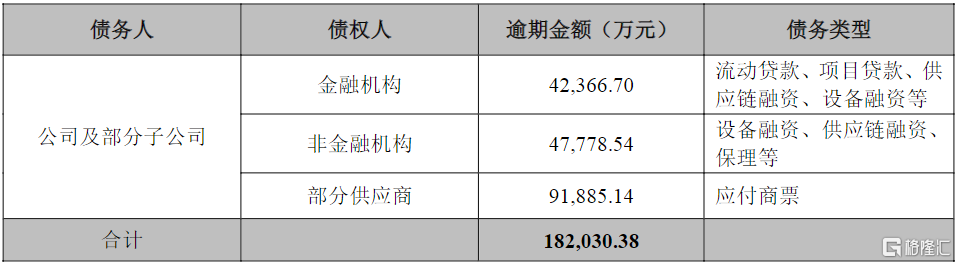

支払期限を超過した債務の元金利息は18.2億元です

11月19日夜、shandong chenming paperが突然公告を発表し、一部の債務が超過して一部の銀行口座が凍結されたことを公表しました。

公告によると、2021年11月18日時点で、晨鳴製紙とその子会社の累積未払い債務の総額は182億元に達し、会社の直近の監査純資産の10.91%を占めています。同社は子会社の関連融資に連帯保証を提供し、未払い金額は57.4億元で、会社の直近の監査純資産の3.44%を占めています。

同時に、晨鳴製紙とその子会社の凍結された銀行口座の数は65で、凍結金額は6483.7万元に達し、会社の直近の監査純資産の0.39%を占めます。商業手形の遅延支払いや債務紛争などの理由で、法廷は計51口座を封鎖しました。

負債総額は550億元を超えます

前三四半期の損失は70億元を超えます

近年、業種の供給やコストなど複数の要因の影響を受け、晨鳴製紙の業績は大きく変動しています。

2022年に晨鳴製紙は収入320.04億元を達成し、前年比3.08%減少し、親会社当期純利益は18.9億元で、前年比90.84%大幅に減少しました。

2023年に晨鳴製紙は収入が300億元を下回り、年間損失が128.1億元に達し、上場以来初めての損失となりました。

2024年の第3四半期までに、晨鳴紙業の収益は198.25億元に達し、前年比わずか0.52%増加し、当期純利益は損失71億元で前年比で若干縮小しています。

現在、shandong chenming paperは依然として高い負債圧力を抱えています。2024年9月末までに、shandong chenming paperの負債率は73.51%に達し、現金は100.53億元、短期借入金は約300億元、総負債額は550億元を超えています。

分析によると、shandong chenming paperの業績は圧迫されており、業界供給の変化などの影響だけでなく、以前の急激な拡張投資による過剰生産能力も関連しています。shandong chenming paperが拡大期を迎えた際、企業は頻繁に投資して生産能力を拡大しました。

7割以上の生産能力が停止しています

shandong chenming paperは発表によると、第3四半期以降、主要製品の価格、特に白金紙の価格が持続的に低下し、企業の運営損失が深刻化し、一部の金融機関が企業の融資規模を縮小し、企業の流動資金が逼迫しています。損失を減らすため、11月以降、shandong chenming paperは一部の製造拠点で生産制限や停止を行いました。

現在、shandong chenming paperの寿光基地では白金紙生産ライン1本、文化用紙生産ライン1本、銅版紙生産ライン1本、江西基地および吉林基地などが一時的に停止しており、総停止パルプ、紙の生産能力は703万トンで、総生産能力の71.7%を占め、月間パルプ紙生産量に約58万トン、紙の販売量に約35万トンの影響を及ぼしています。

11月8日の夜、37年間shandong chenming paperで働いていた陳洪国が社長職を辞任することを発表し、彼の妻である李雪芹も副総経営職を辞任しました。陳洪国の後任として新しい社長に就任したのは、晨鸣纸业の古参である胡長青で、彼は着任と同時に「新晨鸣、新出発」のスローガンを提唱しました。

現在の債務不履行について、shandong chenming paperの発表では、現在、会社は融資チャネルを多角的に拡大し、債務資金を調達し、債務者と積極的に対話し、支払い期日の延長や支払い計画の調整などの債務案を協議していると述べています。同時に、会社は生産経営を最大限保証するために効果的な措置を講じ、非主要資産の処分を積極化し、経営状況の改善に努めるとしています。

今日开盘,

今日开盘,