In the second half of 2024, passenger car exports from Chinese car brands are expected to reach 2.5 million vehicles, and the total annual volume will reach 4.5 million vehicles, an increase of 29% over the previous year.

The Zhitong Finance App learned that Canalys published an article stating that in the second half of 2024, passenger car exports from Chinese car brands are expected to reach 2.5 million vehicles, and the total annual volume will reach 4.5 million vehicles, an increase of 29% over the previous year. Affected by EU tariffs and falling demand for new energy vehicles, the export growth rate of China's pure electric models will slow to 9% (0.86 million vehicles), and the share of exports will drop from 22.5% in 2023 to 19.0% in 2024. Meanwhile, plug-in hybrid vehicles (PHEVs) and oil-electric hybrid vehicles (HEVs) will account for the first time in three years for the first time in 10 years, reaching 0.31 million units and 240,000 units, respectively. Latin America and Europe are the main regions driving growth in exports of plug-in hybrid vehicles and oil-electric hybrid vehicles from Chinese car brands.

Liu Ceyuan, senior analyst at Canalys, said, “Passenger car exports are expected to maintain strong growth in 2024, with a growth rate of 24%, and the total export volume will reach 3.1 million vehicles. The success of MG, Chery, and Great Wall Motors (02333) in the overseas fuel vehicle market proves that Chinese car brands have improved significantly in fuel vehicle technology. Among them, Chery and Great Wall Motors seized the opportunity for international brands to withdraw from the Russian market and rapidly expanded their market share. The gradual implementation of new global expansion strategies by manufacturers such as Dongfeng and Guangzhou Automobile (02238) has further boosted export growth in the Chinese market. In 2024, the export volume of the two brands is expected to quadruple and triple respectively, accounting for 10% of the exports of Chinese automobile brands. ”

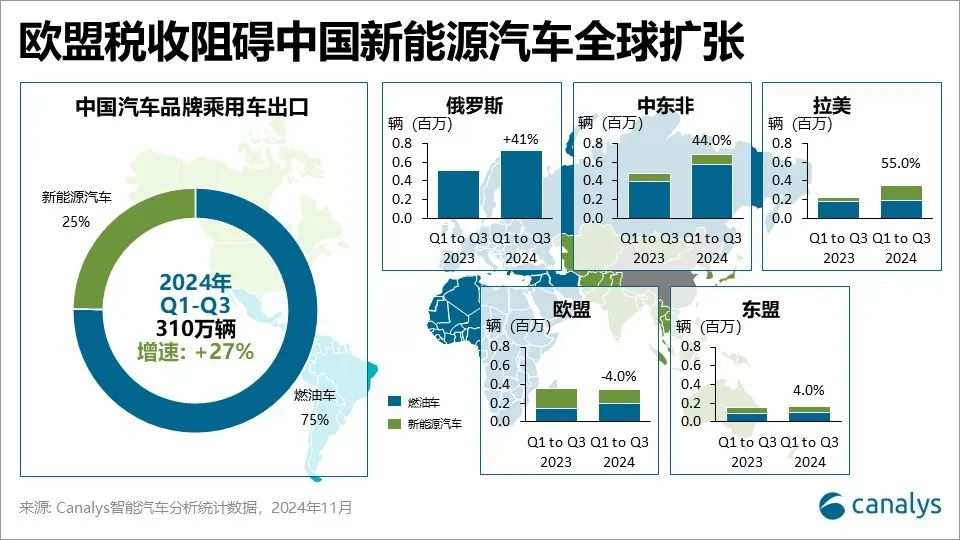

In the first three quarters of 2024, passenger car exports from Chinese car brands increased 27% to 3.1 million vehicles. Affected by the EU's imposition of tariffs on China's new energy vehicles, Europe is the only regional market where exports have declined by 4%. As exports from other regions increased, the EU declined from the largest export market for Chinese car brands in 2023 to the fourth largest market in 2024.

In the first three quarters of 2024, passenger car exports from Chinese car brands increased 27% to 3.1 million vehicles. Affected by the EU's imposition of tariffs on China's new energy vehicles, Europe is the only regional market where exports have declined by 4%. As exports from other regions increased, the EU declined from the largest export market for Chinese car brands in 2023 to the fourth largest market in 2024.

Liu Ceyuan continued: “Despite declining export volume and weak demand for NEVs, the EU is still China's largest NEV export market, accounting for 28.4% of total exports. Weakening demand for new energy vehicles in Europe and political uncertainty will slow the investment process of Chinese automakers in the region, but Europe is still the core market for Chinese manufacturers in the process of globalization. Chinese automobile manufacturers are expanding their overseas product matrix by rapidly launching hybrid models to avoid tariffs and meet local consumer demand for economical vehicles, while expanding brand awareness and preparing for a recovery in local NEV demand. With two hybrid products, the MG3 and MG ZS, SAIC Motor Group aims to challenge the position of Japanese cars in the European market. ”

Liu Ceyuan added, “China's total automobile exports are growing rapidly, yet manufacturers are still facing many uncertainties when going overseas. Differences in channel system capabilities and product localization capabilities of various manufacturers have led to significant differences in actual sales volume and inventory conditions in overseas markets. Relevant capabilities are particularly important in the current context where pure trade and exports are restricted, manufacturers are setting up overseas factories, and seeking integration into the local industrial chain. ”

Although Chinese cars have achieved global leadership in electrification and intelligent technology. However, in the European market, the competitive advantages of ADAS and smart cockpit technology have yet to be fully realized. In the context of long-term industrial development, Chinese manufacturers should rationally view the concept of “new energy vehicle curve overtaking” and carefully evaluate the possibility of directly replicating the successful path of the Chinese market to the global market. Although the market share of Japanese and Korean car companies in China is gradually shrinking, their globalization path is still worth focusing on by Chinese manufacturers.

Liu Jiansen, chief analyst at Canalys, said, “The dispute between the EU and China over tariffs on new energy vehicles has caused a major obstacle to the electrification process of the global automotive industry. Geopolitical tension may hinder the sharing of expertise and investment in joint research and development between manufacturers of the two sides. If the dispute escalates, the EU could weaken the competitiveness of the development of its NEV ecosystem, thereby losing its place in global automotive and green energy leadership. However, we are still optimistic that the Chinese market will remain open and provide opportunities for cooperation in NEV technology and supply chains for the global market. At the same time, the market potential of the two regions will attract continued close cooperation between the two regions to find long-term solutions. ”

2024年前三季度,中国汽车品牌乘用车出口量增长27%,达310万辆。受欧盟对中国新能源汽车加征关税影响,欧洲是唯一出口量下降的区域市场,降幅为4%。随其他区域出口量增加,欧盟从2023年中国汽车品牌最大出口市场下降至2024年的第四大市场。

2024年前三季度,中国汽车品牌乘用车出口量增长27%,达310万辆。受欧盟对中国新能源汽车加征关税影响,欧洲是唯一出口量下降的区域市场,降幅为4%。随其他区域出口量增加,欧盟从2023年中国汽车品牌最大出口市场下降至2024年的第四大市场。