Traders think Bitcoin has the potential to break more records.

The Zhitong Finance App learned that the first batch of options bets on BlackRock's $44 billion iShares Bitcoin ETF (IBIT.US) indicates that traders think Bitcoin is likely to break more records. More than 0.35 million contracts changed hands after iShares Bitcoin ETF options were listed on the NASDAQ on Tuesday, according to data compiled by Bloomberg, of which around 80% were bullish bets.

Of the 10 most traded options, 9 bets rose. The most actively traded options expiring in January with an execution price of $55, followed by bullish options due in December, with an execution price of $65 — 25% higher than the fund's closing price on Monday.

Driven by the ETF options listing, Bitcoin hit a record high of $94,000 on Tuesday. Some investors expect US Bitcoin ETF options to attract more money into this digital asset. Bitcoin prices soared after cryptocurrency supporter Donald Trump won the US election. Some analysts believe that Bitcoin is expected to reach the $0.1 million milestone by the end of this year.

Driven by the ETF options listing, Bitcoin hit a record high of $94,000 on Tuesday. Some investors expect US Bitcoin ETF options to attract more money into this digital asset. Bitcoin prices soared after cryptocurrency supporter Donald Trump won the US election. Some analysts believe that Bitcoin is expected to reach the $0.1 million milestone by the end of this year.

Caroline Mauron, co-founder of crypto derivatives liquidity provider Orbit Markets, said the options trading volume “is a good start, showing the growing connection between the native cryptocurrency ecosystem and the traditional financial world. The trading volume alone is not enough to drive the underlying asset, but the positive news certainly fueled the bullish sentiment.”

Bitcoin funds are crazy about attracting money

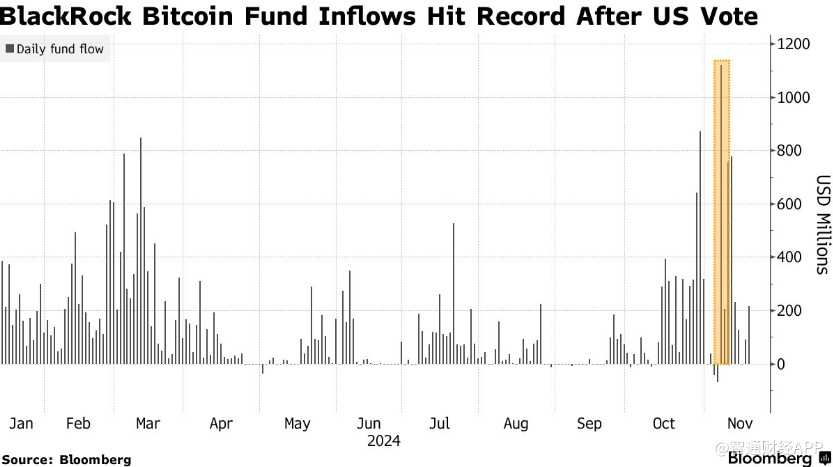

According to reports, the iShares Bitcoin ETF is the world's largest Bitcoin fund and one of the 12 US spot Bitcoin ETFs. According to data compiled by Bloomberg, the fund has attracted around $29 billion in net inflows since it went public in January this year. Of this, the inflow of about 5 billion US dollars occurred after the US election day on November 5.

After the US election, large sums of money flowed into BlackRock Bitcoin funds

Trump promised to establish a US regulatory framework favorable to digital assets and establish a Bitcoin strategic reserve. However, there is still uncertainty about whether these promises will be fulfilled.

Until now, non-US platforms such as Binance and Deribit have taken up a large portion of crypto derivatives trading. However, open futures contracts managed by CME have reached a record high, indicating that US institutions are increasingly interested in regulated crypto exposure.

Noelle Acheson, corresponding author of “Crypto Is Macro Now,” said: “The Bitcoin derivatives market is very active, but in the US, compared to other asset classes, the size of Bitcoin derivatives is still very small and mainly limited to institutional investors.” She added that the deeper US cryptocurrency derivatives market will attract new groups of investors and enable more diverse investment strategies.

As of press time, Bitcoin is trading at $92,631. According to CoinGecko data, Bitcoin has more than doubled this year, making the overall value of the crypto market surpass its peak during the pandemic.

在ETF期权上市的推动下,比特币周二突破94000美元创下历史新高。一些投资者预计,美国比特币ETF期权将吸引更多资金流入这种数字资产。在加密货币支持者唐纳德•特朗普赢得美国大选后,比特币价格飙升。部分分析师认为比特币有望在今年年底达到10万美元的里程碑。

在ETF期权上市的推动下,比特币周二突破94000美元创下历史新高。一些投资者预计,美国比特币ETF期权将吸引更多资金流入这种数字资产。在加密货币支持者唐纳德•特朗普赢得美国大选后,比特币价格飙升。部分分析师认为比特币有望在今年年底达到10万美元的里程碑。