新しい道はどこにあるのか

茅台は、贈り物や客人を迎える際の硬通貨として公認されています。

しかし、かつては茅台と片仔癀がビジネス宴会の高級メニューとされていたことを知る人は少ない。福建省の人々の心の中では、片仔癀は茅台よりも高い地位を持っていることすらあります。

しかし、かつては茅台と片仔癀がビジネス宴会の高級メニューとされていたことを知る人は少ない。福建省の人々の心の中では、片仔癀は茅台よりも高い地位を持っていることすらあります。

パンデミックの後、飛天茅台と片仔癀の価格は急騰し、2021年にはピークに達しました。片仔癀の価格は一時1600元/粒にまで高騰しましたが、その後急速に下落し始めました。

最近、飛天茅台の価格は何度も2200元/瓶近くまで下落しました。「難兄難弟」の片仔癀も、ここ2年間で価格が急激に下がり、いくつかの転売業者の手にある価格は公式のガイド価格760元/粒を下回っています。

一連の値下げの背後には、希少性を握っている「茅台たち」が徐々に成長の危機に直面していることがあり、これは利益の成長速度の低下や株価の継続的下落に現れています。

2021年の歴史的高値と比較すると、茅台やzhangzhou pientzehuang pharmaceuticalの株価はほぼ半分になった。

過去には、「茅台たち」の株価が下落するたびに、それは買うチャンスだという信仰があった。

今もそうなのだろうか。

01

福建省の製薬会社で、主業が肝臓薬の同業者であるzhangzhou pientzehuang pharmaceuticalが、最近1.96億を出資してfujian cosunter pharmaceuticalの株を間接的に取得した。fujian cosunter pharmaceuticalの株主は割引で株を譲渡したことから、「肝肝相照」という幕を演じたと言える。

奥華グループは、円山fundに対してfujian cosunter pharmaceuticalの800万株を譲渡し、対価は1.96億元で、譲渡価格は契約締結前の取引日の終値の八割となっている。

そして、円山ファンドの最大出資者は漳州片仔癀投資管理有限公司であり、その他の普通パートナーと有限パートナーも大半が福建省漳州の国有企業であり、片仔癀と深い関係を持っています。

したがって、取引完了後、片仔癀は間接的に広生堂に投資することになります。

この取引に関して、最大の疑問は、中薬と西薬が肝疾患の分野で協力することができるのかどうかということです。

片仔癀に比べて、広生堂の知名度ははるかに低いです。初期の広生堂製品は比較的雑多で、抗肝炎系の中成薬や降圧茶、減肥茶などがありますが、主にジェネリック医薬品を製造しており、研究開発投資は低いです。しかし、ジェネリック医薬品市場には同類製品が多く、市場競争が激しく、広生堂には大きな優位性はありません。

その後、広生堂は徐々に市場を確立し、核苷類抗乙肝ウイルス薬の研究開発、製造および販売に特化し始め、それにより一定の市場シェアを獲得し始めました。

製品が集中的に調達されることに伴い、価格はさらに下落し、集中的に調達された医薬品の粗利率はこれ以上低下することはありません。

広生堂を例に挙げると、2023年、広生堂の集中調達チャンネルの粗利率はわずか16.86%で、直販の75.40%や卸売の30.70%を大きく下回り、同社の利益レベルは大幅に低下しました。

そのため、上場以来、広生堂は革新的医薬品企業への転換を明確に進めています。

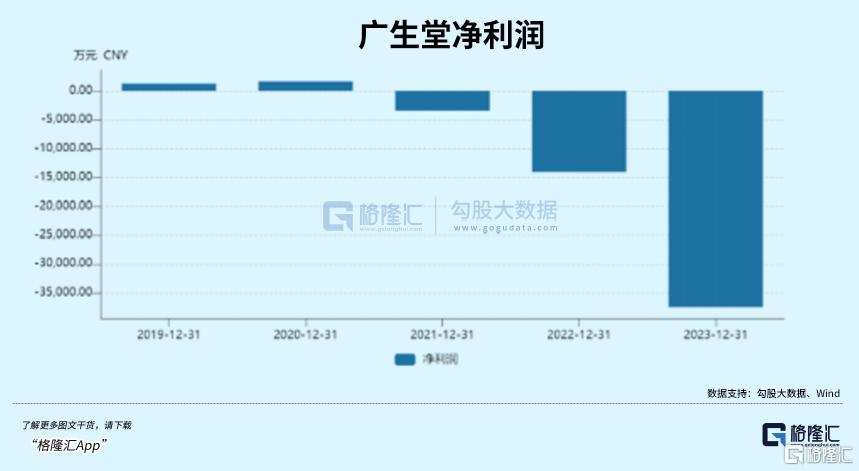

革新的医薬品の高額な研究開発投資と、伝統的業務の利益が継続的に圧縮される中で、fujian cosunter pharmaceuticalは近年、業績の圧力がさらに大きくなっています。2021年から2023年の間、fujian cosunter pharmaceuticalは連続して損失を出し、累計損失は5.11億元に達しました。

zhangzhou pientzehuang pharmaceuticalにとって、今回の投資の利益はそれほど顕著ではありませんが、現在のzhangzhou pientzehuang pharmaceuticalは、投資を通じて新しい成長方向を模索し、業績の成長を維持する必要があります。

今年の8月、zhangzhou pientzehuang pharmaceuticalは2.54億元を出資し、漳州国投会社が保有する明源香料の100%の株式を取得することを計画し、この間接的な取引で水仙薬業の30%の株式を取得します。これは我が国最古の風油精ブランドです。

しかし、この取引に対する疑問がより大きくなります。風油精市場の潜在力は限られており、zhangzhou pientzehuang pharmaceuticalのビジネスとの相乗効果を生むには難しいこと、さらに評価が過高であるため、多くの疑念が生じています。

すぐに、取引所はzhangzhou pientzehuang pharmaceuticalに対して監督業務の文書を発行し、関連する問題をさらに確認するよう求め、その後、zhangzhou pientzehuang pharmaceuticalは一部の問題に応じた後、取引を一時停止することを発表しました。

連続する買収の動きは、ある側面からzhangzhou pientzehuang pharmaceuticalの現状の不安を示しているのかもしれません。

今年上半期、zhangzhou pientzehuang pharmaceuticalの収入と当期純利益の成長率は、2016年以来の同時期で最低水準に達し、第2四半期にはzhangzhou pientzehuang pharmaceuticalの当期純利益が前年同期比で減少し、これは近7年間で初めてのことでもあります。

2021年の最高点と比べて、片仔癀の株価はすでにほぼ半分に下落しており、片仔癀錠剤という大口製品に依存する片仔癀にとって、長期的な高成長を維持することは容易ではない。

02

最も片仔癀を愛する福建省の人々が、もはや片仔癀を必需品として考えず、「酒席前後に一片」をしなくなった際に、消費関連としての片仔癀は消費のデフレ圧力の中で、より強く影響を受けている。

否定できないことは、片仔癀は現在でもその他製品では代替できない価値を持っているということだ。

同仁堂が手掛ける大口製品の安宮牛黄丸を例にとると、安宮牛黄丸の市場シェアの中で、同仁堂が50%以上のシェアを占めているにもかかわらず、安宮牛黄丸は同仁堂の独占品種ではない。

現在、安宮牛黄丸の製造許可を持つ企業は120社を超えており、片仔癀の安宮牛黄丸も市場シェアのほぼ5%を占めている。

しかし、片仔癀が扱う片仔癀錠剤は、成分と製法の二重の秘密保持によって、現在も絶対的な希少性を保持している。

天然の麝香と天然の牛黄の価格上昇に伴い、片仔癀の価格は過去20年にわたり、2004年の325元/粒から現在の760元/粒に上昇した。

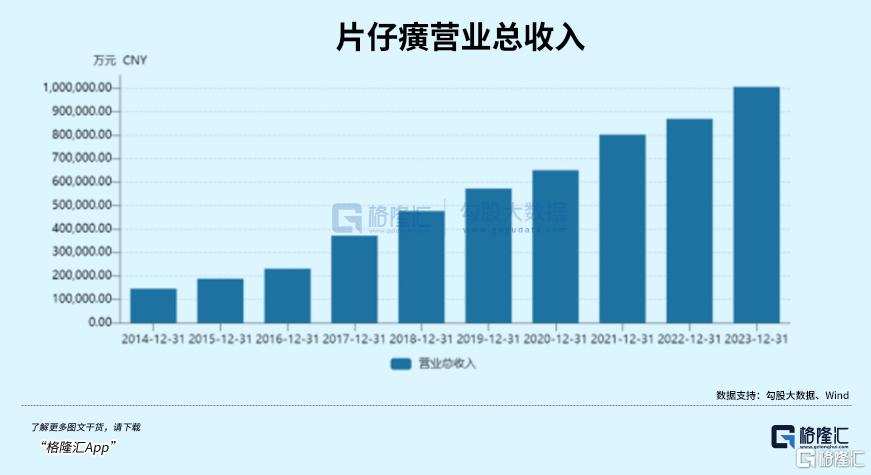

ただし、価格の上昇はユーザーの購入意欲には影響しておらず、2014年から2023年の10年間で、片仔癀の売上は14.54億元から100.6億元に急増し、当期純利益も4.29億元から27.97億元に増加しました。

片仔癀の売上年増加率は二桁に達し、片仔癀の錠剤価格の一桁の複合年増加率をはるかに上回っています。これにより、片仔癀の消費者は価格に対する感度が相対的に低いことがわかります。長期的に見れば、片仔癀の業績は安定を保つことができるでしょう。

さらに、全体の漢方薬業種の共通の特徴として、研究開発への投資がそれほど高くないことがあります。片仔癀の研究開発費用はわずか2%程度であり、片仔癀にとっては金山の上でお金を数えていると言えるでしょう。

安定した業績に加えて、片仔癀は会社の第二の成長曲線を探し始めています。

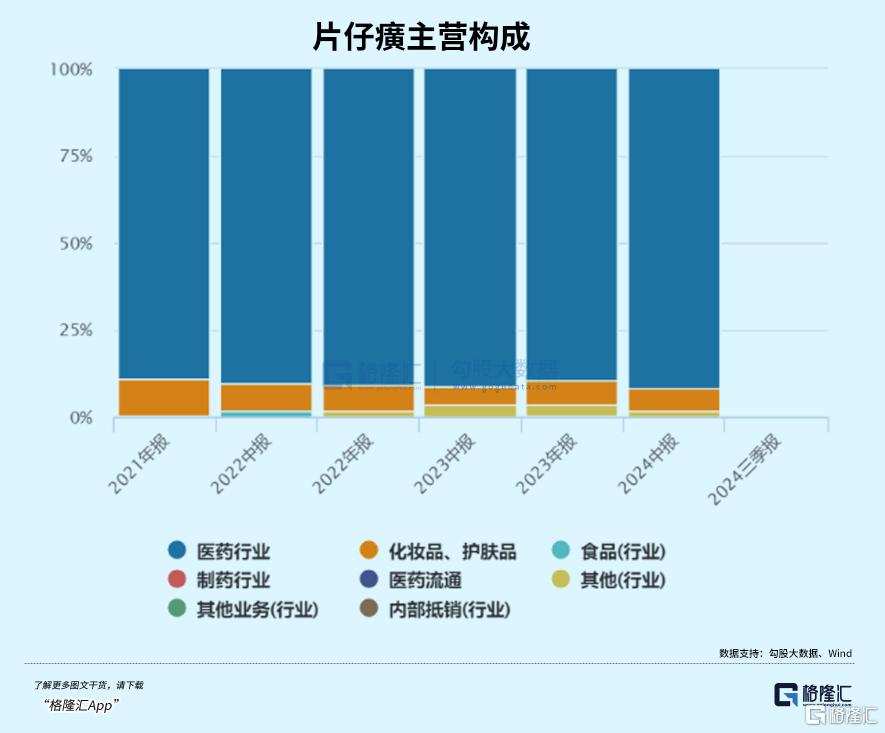

近年、片仔癀は化粧品ビジネスを積極的に展開しており、現在「片仔癀」「皇后」「金大夫」など複数のスキンケア、洗浄ブランドを持っていますが、全体の収入の中での占有率はまだ20%未満です。

医薬業界では、片仔癀の安宮牛黄丸も徐々に一定の市場シェアを占めており、潜在的な大口製品と見なされています。

増加に対する不安は片仔癀に限らず、片仔癀と状況が似ている茅台も、近年連名を発表したり、茅台アイスクリームを発売するなどして若い顧客を育てています。一方、主要な中薬企業の中で、云南白药が歯磨き粉の健康関連産業で成果を上げた以外は、同仁堂や東阿阿膠など他の企業は依然として自身の限られた領域から抜け出せず、新しい成長の方向性を見つけられていません。

これらの企業にとって、安定を求めて既存の基盤を守ることは成長が難しいですが、消極的に待つだけでは何も得られません。一方、革新によって新しい基盤を築くことは、より大きなリスクを伴うことになります。

変化するべきか、変化しないべきかは非常に厳しい問題です。

現在の片仔癀は、大量の投資が必要な成長段階を過ぎており、片仔癀の負の財務費用からもわかるように、会社の口座には現金が多く、大部分は銀行の金融商品に投資して利息を受け取っています。

しかし、片仔癀の株主にとっては、持有する体験はあまり良くないかもしれません。

過去のデータを観察すると、2022年以前、片仔癀の配当率は長年30%前後でしたが、2023年に入って約50%に上昇しました。上場以来、平均配当率は35.36%に過ぎません。

これに対し、云南白药は近年の配当率が80%前後を維持しており、上場以来の平均配当率は56.41%でした。また、贵州茅台の配当率も、これまで数年間維持された約50%から、最近2年間で80%以上に上昇しています。

現在、片仔癀の運営にはそれほど大きな支出はなく、新規プロジェクトの投入もあまり多くないため、50%の配当率はそれほど高くない。

長年にわたり、片仔癀の配当利回りは相対的に低く、約1%に過ぎません。2015年以降は基本的に1%以下となり続けており、株価が継続的に下落する中で配当利回りが上昇したものの、それでもなお相対的に低い。

しかし、近年片仔癀の主要株主は比較的安定している。

これは、株式構造において、片仔癀の株式構造が贵州茅台とほぼ一致しており、漳州市九龙江グループ株式会社が直接および間接的に54.78%の株式を支配しているためである。そのため、片仔癀の実際の支配者は九龙江グループの90%の株式を保有する漳州市国資委である。

2023年8月、片仔癀の会長が漳州市纪委で3年間働いていた林志辉に交代したが、これは贵州茅台と非常に似ている。

実際、運営モデルの観点から見ると、独占的で高粗利、消費関連が強く、稀少性を兼ね備えた片仔癀は、薬の中の茅台と称されるのは当然である。

しかし、茅台と比較すると、片仔癀が直面している議論はより多い。

これは、茅台が最近一連の値下げを行っているにもかかわらず、茅台の出荷価格と卸値の間の巨大な価格差から、現在の茅台は依然として供給不足の段階にあることが見て取れるためである。

片仔癀は21年にわたる過度な投機を経て、現在二次流通の片仔癀の価格は指導価格を下回っており、そのことから受け手の間での認知度が徐々に低下していることが明らかである。

これは確かに大きな環境の影響がある。結局のところ、以前は片仔癀にある程度の社交性と消費特性が付与されていたが、消費のダウングレードの波が押し寄せるにつれて、ユーザーの心理的期待が調整され、片仔癀の消費特性が最初に剥奪され、それが価格の下落に繋がった。

しかし同時に、片仔癀の本拠地である華東地域も失陥してしまった。

例年、華東地域は片仔癀の全体収益の60%以上を占めていたが、今年に入ってからは収益が持続的に単位数での成長にとどまっており、これも片仔癀の業績成長の鈍化の重要な要因の一つである。

主な業務の成長が鈍化し、副業の成長も限られている現状に直面し、片仔癀はおそらくまだしばらくの間困難な日々を過ごさなければならない。

結論

近年、全体の医薬セクターが集中的な調達の波の中で低迷する中、漢方薬は集中的な調達にあまり含まれないため、漢方薬セクターは相対的に高い粗利率を維持している。

中薬のリーダーとして、ビジネスモデルがほぼ完璧である片仔癀は、長期にわたって非常に高い評価を維持していますが、全体の中薬業種よりもはるかに高い評価を受けています。しかし、最近の2年間、片仔癀も大環境から逃れられず、評価が下落しました。

片仔癀の最新の動的PEは48倍で、この評価は歴史的な高値から半分以上が下落し、2016年初頭の株式市場のサーキットブレーカー時の水準に近づいていますが、全体の中薬業種に比べると依然として高めです。それに対して、同仁堂のPEは34、云南白薬のPEはわずか24です。また、片仔癀はしばしば他業種のシンボルである茅台と比較されますが、動的PEは23に過ぎません。

資本側の視点に立つと、片仔癀のような会社の魅力は主に2つの側面から来ています。一つは評価が過小評価されていること、つまり非常に安価であり、将来的に確実な評価の修復が期待できること、もう一つは投資家にリターンを提供するために多くの努力をしていること、たとえば非常に積極的な自社株買いや大盤振る舞いの配当などがあります。

しかし、この2つの側面において、片仔癀は特に優れたパフォーマンスを示していません。

長期的に見れば、片仔癀の基礎的な側面は揺るぎません。ただし、現在、大環境の変化に直面しており、新たな成長方向が見つかっていない片仔癀が、真に資本の関心を勝ち取るためには、全体の株式市場が回復し、評価が再び拡張に戻るのを待つか、管理層が成長のボトルネックを突破し、投資家にさらなる「誠意」を示す必要があります。(全文完)

殊不知,曾几何时,茅台+片仔癀,才是商务宴请高端局。在一些福建人的心中,片仔癀甚至有着比茅台更高的地位。

殊不知,曾几何时,茅台+片仔癀,才是商务宴请高端局。在一些福建人的心中,片仔癀甚至有着比茅台更高的地位。