The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

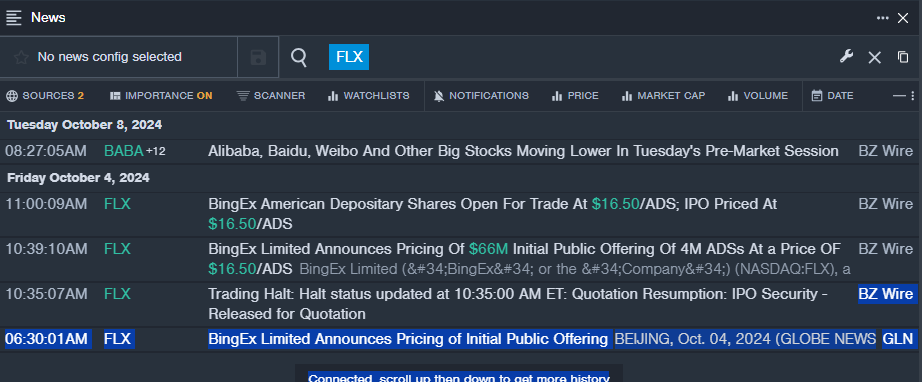

BingEx Ltd (NASDAQ:FLX)

- On Oct. 4, BingEx announced the pricing of $66 million initial public offering of 4 million ADSs at a price of $16.50 per ADS. The company's stock fell around 40% over the past month and has a 52-week low of $8.04.

- RSI Value: 27.38

- FLX Price Action: Shares of BingEx fell 1.5% to close at $8.71 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest FLX news.

Brinks Co (NYSE:BCO)

- On Nov. 6, Brink's posted weaker-than-expected quarterly results. The company's stock fell around 14% over the past month and has a 52-week low of $76.93.

- RSI Value: 25.00

- BCO Price Action: Shares of Brinks gained 0.5% to close at $91.76 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in BCO stock.

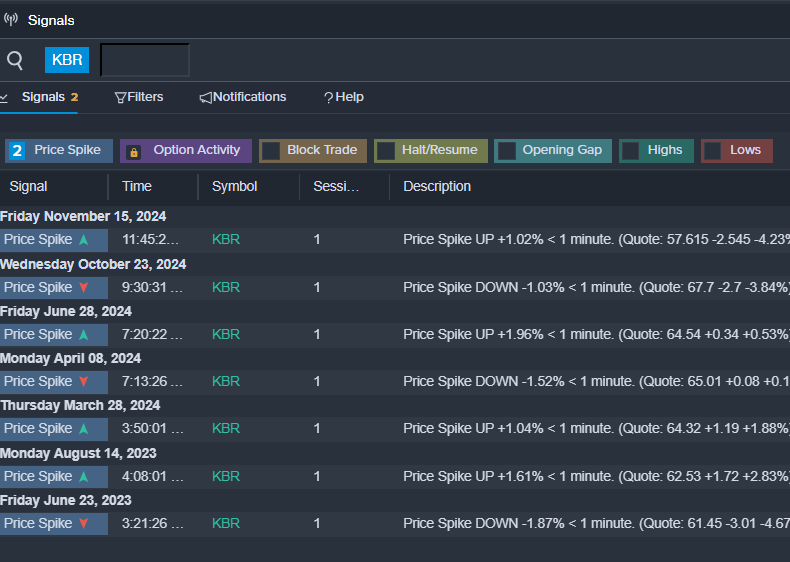

KBR Inc (NYSE:KBR)

- On Oct. 23, KBR posted in-line quarterly earnings. "KBR's exceptional team has once again exceeded expectations with outstanding third-quarter results," stated Stuart Bradie, KBR's President and CEO. The company's stock fell around 17% over the past five days and has a 52-week low of $50.45.

- RSI Value: 27.09

- KBR Price Action: Shares of KBR gained 0.2% to close at $58.29 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in KBR shares.

Read This Next:

Read This Next:

- Wall Street's Most Accurate Analysts Weigh In On 3 Defensive Stocks With Over 5% Dividend Yields