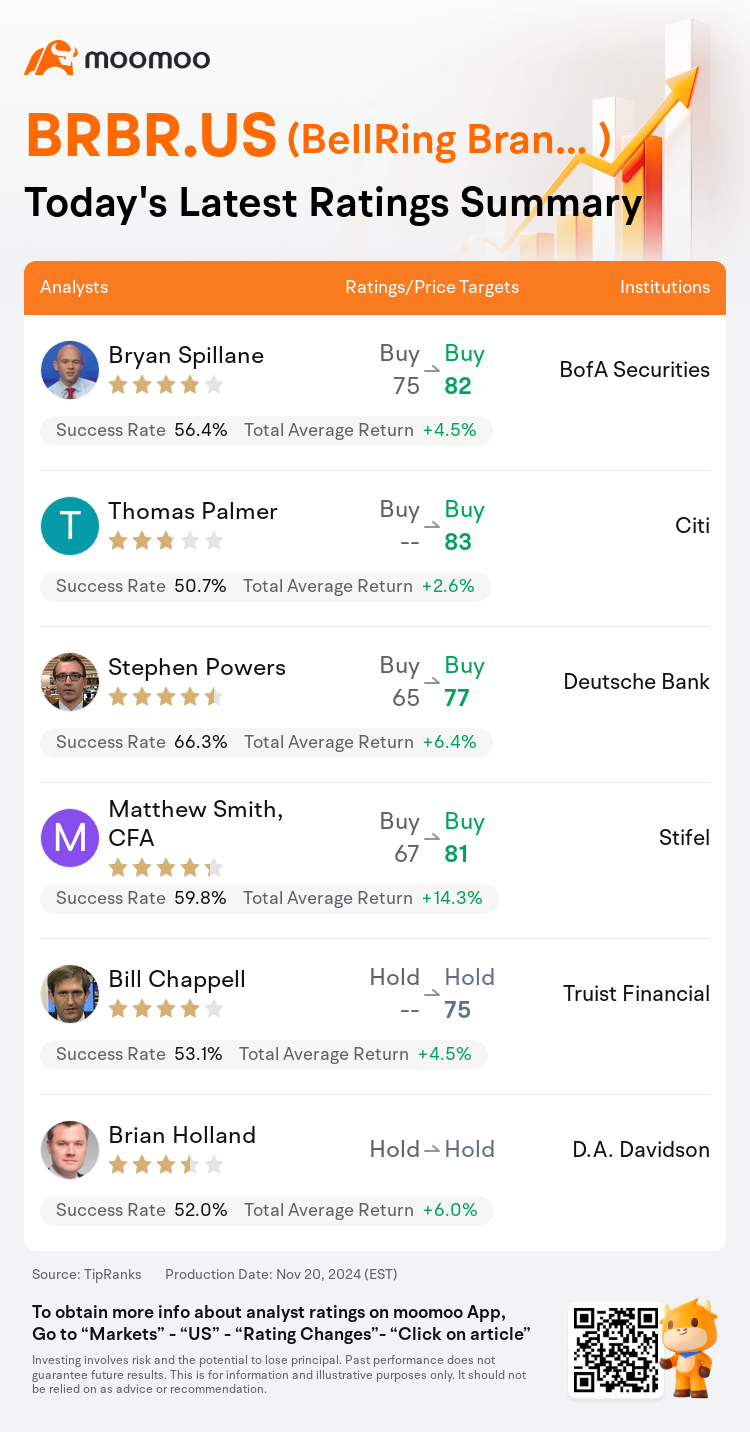

On Nov 20, major Wall Street analysts update their ratings for $BellRing Brands (BRBR.US)$, with price targets ranging from $75 to $83.

BofA Securities analyst Bryan Spillane maintains with a buy rating, and adjusts the target price from $75 to $82.

Citi analyst Thomas Palmer maintains with a buy rating, and sets the target price at $83.

Deutsche Bank analyst Stephen Powers maintains with a buy rating, and adjusts the target price from $65 to $77.

Deutsche Bank analyst Stephen Powers maintains with a buy rating, and adjusts the target price from $65 to $77.

Stifel analyst Matthew Smith, CFA maintains with a buy rating, and adjusts the target price from $67 to $81.

Truist Financial analyst Bill Chappell maintains with a hold rating, and sets the target price at $75.

Furthermore, according to the comprehensive report, the opinions of $BellRing Brands (BRBR.US)$'s main analysts recently are as follows:

BellRing Brands posted fiscal Q4 results that were closely aligned with expectations, yet their fiscal 2025 guidance exceeded analyst forecasts considerably. The company's positive outlook is supported by a strong supply chain and a robust pipeline of innovation, alongside comprehensive annual advertising and promotional campaigns. This optimism is also extended to the company's future prospects and performance in the stock market.

The firm is revising its estimates upwards after a solid fourth-quarter performance and a positive outlook for FY25. They believe the increased multiple applied to the calendar 2025 EPS estimate is justified, citing BellRing's potential for future growth due to strong consumer interest.

BellRing Brands exceeded expectations with its fiscal Q4 sales and earnings, and provided fiscal 2025 guidance that surpassed consensus at the midpoint. Despite a recent 29% price surge in three months, which indicated a potential pause in momentum, the company's EBITDA margin outlook slightly missed expectations. Nonetheless, profit growth is anticipated to exceed previous estimates, supporting the company's premium valuation due to its continued strong growth trajectory.

BellRing Brands exhibited notable performance in their fourth quarter, with revenue growth and EBITDA surpassing expectations. The company's forecast for FY25, indicating a 12%-16% increase in revenues and an EBITDA growth ranging from 5%-11%, surpasses expectations and aligns the lower end of this forecast with the upper range of their long-term growth objectives.

Here are the latest investment ratings and price targets for $BellRing Brands (BRBR.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

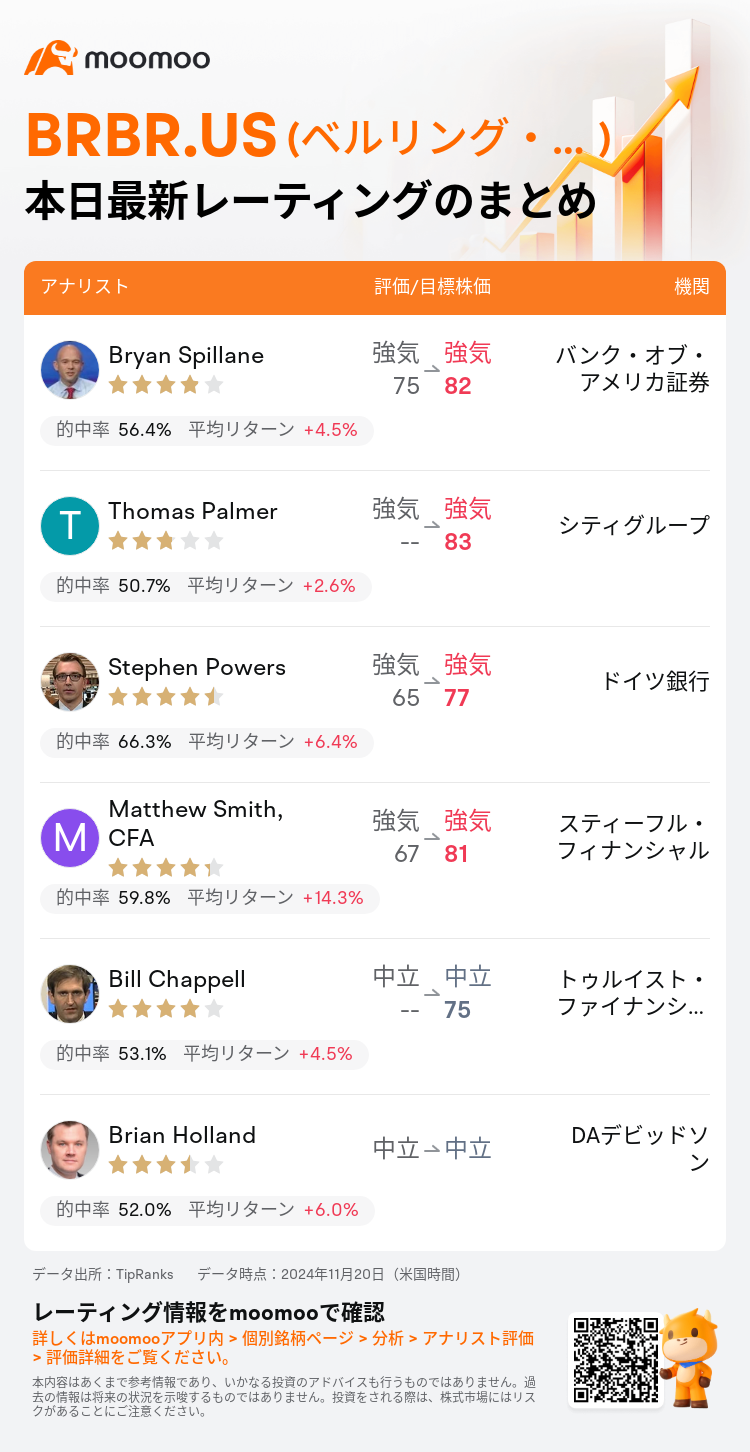

11月20日(米国時間)、ウォール街主要機関のアナリストが$ベルリング・ブランズ (BRBR.US)$のレーティングを更新し、目標株価は75ドルから83ドル。

バンク・オブ・アメリカ証券のアナリストBryan Spillaneはレーティングを強気に据え置き、目標株価を75ドルから82ドルに引き上げた。

シティグループのアナリストThomas Palmerはレーティングを強気に据え置き、目標株価を83ドルにした。

ドイツ銀行のアナリストStephen Powersはレーティングを強気に据え置き、目標株価を65ドルから77ドルに引き上げた。

ドイツ銀行のアナリストStephen Powersはレーティングを強気に据え置き、目標株価を65ドルから77ドルに引き上げた。

スティーフル・フィナンシャルのアナリストMatthew Smith, CFAはレーティングを強気に据え置き、目標株価を67ドルから81ドルに引き上げた。

トゥルイスト・ファイナンシャルのアナリストBill Chappellはレーティングを中立に据え置き、目標株価を75ドルにした。

また、$ベルリング・ブランズ (BRBR.US)$の最近の主なアナリストの観点は以下の通りである:

ベルリングインターメディエイトホールディングスは、期待に密接に一致した2023年度第4四半期の結果を報告しましたが、2025年度のガイダンスはアナリストの予測を大きく上回りました。企業のポジティブな見通しは、強力なサプライチェーンと堅実なイノベーションのパイプライン、包括的な年間広告およびプロモーションキャンペーンによって支えられています。この楽観主義は、企業の将来の展望と株式市場でのパフォーマンスにも及びます。

同社は、堅実な第4四半期のパフォーマンスと2025年度の前向きな見通しを受けて、予想を上方修正しています。彼らは、カレンダー2025のeps推定値に適用される増加した倍率が正当化されると信じており、強い消費関連の関心がベルリングの将来の成長の可能性を示しています。

ベルリングインターメディエイトホールディングスは、2023年度第4四半期の売上高と利益で期待を超え、合意の中央値を上回る2025年度のガイダンスを提供しました。最近の3ヶ月間で29%の価格上昇が見られ、勢いに一時的な停滞が示唆されましたが、同社のEBITDAマージンの見通しは期待をわずかに下回りました。それにもかかわらず、利益成長は以前の見積もりを上回ると予想されており、継続的な強い成長軌道により、同社のプレミアムな評価を支えています。

ベルリングインターメディエイトホールディングスは、第4四半期に注目すべきパフォーマンスを示し、売上高の成長とEBITDAが期待を上回りました。2025年度の同社の予測は、売上高の12%-16%の増加とEBITDAの5%-11%の成長を示しており、この予測の下限を長期的な成長目標の上限と一致させています。

以下の表は今日6名アナリストの$ベルリング・ブランズ (BRBR.US)$に対する最新レーティングと目標価格である。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

ドイツ銀行のアナリストStephen Powersはレーティングを強気に据え置き、目標株価を65ドルから77ドルに引き上げた。

ドイツ銀行のアナリストStephen Powersはレーティングを強気に据え置き、目標株価を65ドルから77ドルに引き上げた。

Deutsche Bank analyst Stephen Powers maintains with a buy rating, and adjusts the target price from $65 to $77.

Deutsche Bank analyst Stephen Powers maintains with a buy rating, and adjusts the target price from $65 to $77.