TJX announced financial results for the third quarter.

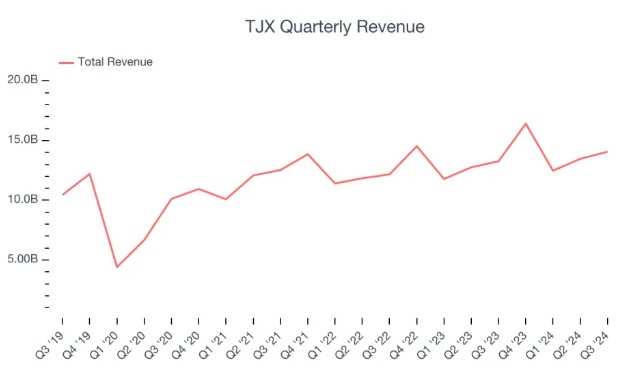

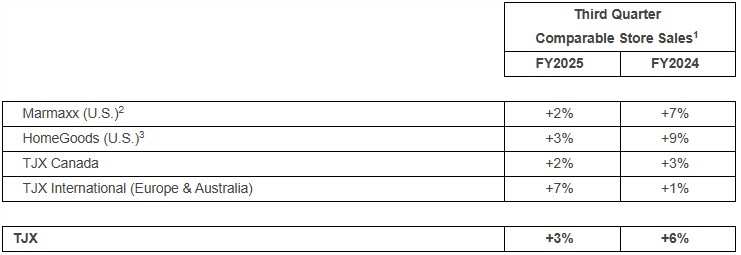

Zhitong Finance learned that TJX (TJX.US) announced financial results for the third quarter. Earnings per share for Q3 were $1.14, compared to $1.03 for the same period last year, and analysts expected $1.09. Total revenue increased 6% year over year to $14.1 billion, and analysts expected $13.95 billion. Same-store sales increased 3% in Q3, higher than market expectations. It was at the high end of the company's guidelines, driven by the growth in customer transactions.

Sales were strong in the third quarter, and executives said the holiday season had a strong start

Earlier this year, TJX's European business was in trouble due to execution issues, but the division reported strong results in the third fiscal quarter, and same-store sales on TJX international channels increased 7%.

Earlier this year, TJX's European business was in trouble due to execution issues, but the division reported strong results in the third fiscal quarter, and same-store sales on TJX international channels increased 7%.

Ahead of the company's earnings report, some analysts feared that other discount retailers such as TJX and ROST.US (ROST.US) might be disproportionately affected by the unusually warm weather in October. Bank of America analysts wrote in a research report that compared to traditional retailers, discount retailers tend to be more vulnerable to adverse weather patterns because low-income consumers usually buy products when they need them rather than in advance.

In the fall months, mass apparel retailers such as TJX expect customers to come and buy new jackets and other gear to cope with the colder weather. If lower-income consumers delay their purchases due to warmer weather, TJX sales may be affected. However, the warmer than expected weather did not seem to have had a significant impact on TJX sales. Same-store sales increased 3% in Q3, higher than market expectations. It was at the high end of the company's guidelines, driven by the growth in customer transactions.

TJX CEO Ernie Herrman said at a press conference: “We had a strong start to the fourth quarter and we are excited about the opportunities of the holiday sales season. In physical stores and online, we provide consumers with an ever-changing and inspiring shopping destination to buy gifts at an exceptional value, and we believe everyone will have something for them when they buy our products.”

TJX is a well-known discount retailer known for providing a diverse selection of products, including home apparel, home goods, jewelry, and more. The company operates well-known brands such as T.J. Maxx, Marshalls, and HomeGoods, which are major products in the discount retail industry. TJX is a discount retailer that sells designer clothing and other items at much lower prices than department stores, and was initially based on a strategy of buying excess inventory from manufacturers or other retailers. And as cost-conscious American consumers pour into its discount stores to buy products such as clothing and footwear, the company's stock price has risen 27% so far this year, better than the 24.05% increase in the S&P 500 index during the same period.

Same-store sales growth is slowing

The first is the number of stores. A retailer's number of stores usually determines how much revenue it can generate. TJX had 5057 stores in the most recent quarter. Over the past two years, it has opened new stores very fast, with an average annual growth rate of 2.7%. This growth rate is faster than the overall consumer retail industry. When a retailer opens a new store, it usually means it's investing in growth because demand outweighs supply, especially in regions where consumers may not be within a reasonable driving distance.

A fundamental change in the number of stores in a company is only one part of the story. Another is the performance of existing stores and e-commerce sales. Same-store sales are an excellent measure because it measures the organic growth of retailers' e-commerce platforms and physical stores. These physical stores have been in existence for at least a year.

Over the past two years, on average, the company's same-store sales have grown at an impressive 4.3% per year. This performance shows that the launch of its new store is beneficial to shareholders. This means that TJX's revenue growth can come from new stores, e-commerce, increased customer traffic to existing stores, and increased sales per customer.

However, in the most recent quarter, TJX's same-store sales increased by only 3% year over year. This growth rate has slowed from historical levels, indicating that although the business is still performing well, it has lost some momentum.

Meanwhile, in October, an American Retail Federation (NRF) forecast also showed that US holiday sales are expected to grow at a lower rate than last year in 2024. According to the NRF, the industry's sales are expected to increase by 2.5% to 3.5% in November and December compared to the same period last year, which is lower than the 5.3% growth rate last year. According to the organization, consumption is expected to be as high as $989 billion in US dollars.

“We've all seen that consumer spending patterns have become more moderate,” NRF President and CEO Matt Shay said during a conference call with reporters. He added that overall spending remains strong, although it has slowed compared to abnormally high growth during the pandemic.

Shay pointed out that the calendar effect of fewer shopping days between Thanksgiving and Christmas this year is also expected to have a negative impact on performance. Overall, according to the agency's analysis of industry forecasts, although retailers are expected to see year-on-year sales growth in the current quarter, their growth rate is probably the slowest since 2018. Also, consumers are spending less time during the holiday season this year, with 5 fewer shopping days between Thanksgiving and Christmas this year compared to 2023.

Performance guidance falls short of expectations

After a year of rapid growth, the discount store's sales are still growing. It has won the favor of value-seeking consumers who are moving from high-end department stores such as Macy's (M.US) and Kohl's (KSS.US) to more affordable discounters, and the company has gained a share of young shoppers who don't view discount shopping as a stigma.

Although TJX touted a “strong start” to the holiday shopping season, the company's announced performance guidelines disappointed Wall Street.

Looking ahead, for the fourth quarter of fiscal year 2025, the company continues to expect same-store sales to increase by 2% to 3%, which is lower than market expectations; currently, the pre-tax profit margin is expected to be between 10.8% and 10.9%, and the diluted earnings per share guide will be between $1.12 and $1.14. For the full year of fiscal year 2025, the company continues to expect same-store sales to grow 3%, which is lower than market expectations; the company raised the pre-tax profit margin forecast to 11.3%, and the diluted earnings per share forecast was raised to $4.15 to $4.17, lower than market expectations.

今年早些时候,由于执行问题,TJX的欧洲业务陷入困境,但该部门在第三财季公布了强劲的业绩,TJX国际渠道的同店销售额增长了7%。

今年早些时候,由于执行问题,TJX的欧洲业务陷入困境,但该部门在第三财季公布了强劲的业绩,TJX国际渠道的同店销售额增长了7%。