BellRing Brands Analysts Increase Their Forecasts After Upbeat Earnings

BellRing Brands Analysts Increase Their Forecasts After Upbeat Earnings

BellRing Brands (NYSE:BRBR) reported better-than-expected earnings for its fourth quarter, after the closing bell on Monday.

BellRing Brands(纽约证券交易所代码:BRBR)在周一收盘后公布的第四季度收益好于预期。

The company posted quarterly earnings of 51 cents per share, which beat the analyst consensus estimate of 50 cents per share. The company reported quarterly sales of $555.80 million which beat the analyst consensus estimate of $536.13 million.

该公司公布的季度收益为每股51美分,超过了分析师普遍预期的每股50美分。该公司公布的季度销售额为5.558亿美元,超过了分析师普遍预期的5.3613亿美元。

"We finished the year strong, with our results coming in at the high end of our expectations. Premier Protein consumption accelerated, lifted by better in stocks and meaningful distribution gains. Additionally, Premier Protein achieved all time highs this quarter for household penetration and total distribution points, and saw strong market share gains in both shakes and powders," said Darcy H. Davenport, President and Chief Executive Officer of BellRing. "Our momentum remains high as we enter 2025. The convenient nutrition category continues to provide strong tailwinds, with ready-to-drink shakes and powders in the early stages of growth. We have leading mainstream brands that deeply resonate with consumers, giving us confidence in the long-term prospects for our company."

“我们在今年结束时表现强劲,业绩达到了预期的最高水平。受库存增加和分配收益大幅提振,Premier Protein的消费加速了。此外,Premier Protein本季度的家庭渗透率和总分销点均创下历史新高,奶昔和粉末的市场份额均强劲增长。” BellRing总裁兼首席执行官达西·达文波特说。“随着我们进入2025年,我们的势头仍然很高。方便的营养品类别继续提供强劲的推动力,即饮奶昔和粉末处于增长的早期阶段。我们拥有领先的主流品牌,这些品牌引起了消费者的深刻共鸣,这使我们对公司的长期前景充满信心。”

BellRing Brands said it sees FY25 net sales of $2.24 billion to $2.32 billion and adjusted EBITDA of $460 million to $490 million.

BellRing Brands表示,预计25财年净销售额为22.4亿美元至23.2亿美元,调整后的息税折旧摊销前利润为4.6亿美元至4.9亿美元。

BellRing Brands shares fell 0.2% to close at $73.26 on Tuesday.

周二,BellRing Brands股价下跌0.2%,收于73.26美元。

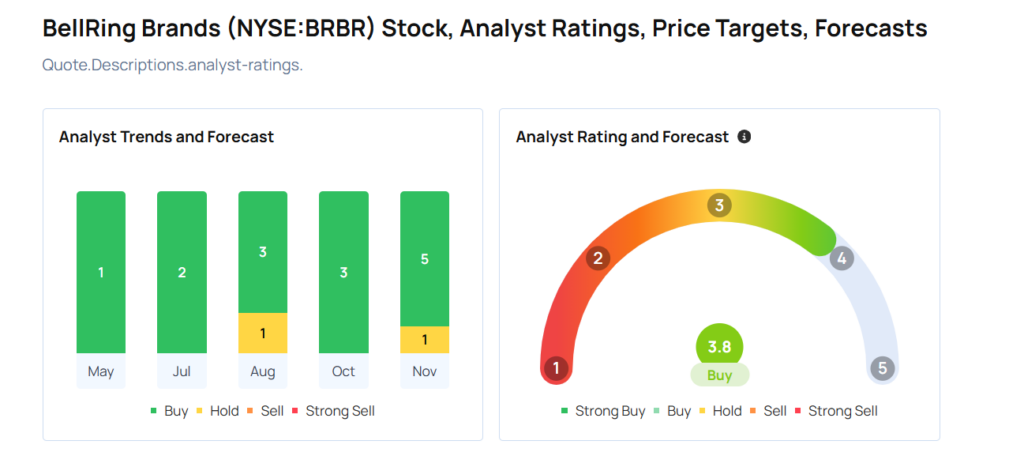

These analysts made changes to their price targets on BellRing Brands following earnings announcement.

财报公布后,这些分析师调整了BellRing Brands的目标股价。

- B of A Securities analyst Bryan Spillane maintained BellRing Brands with a Buy and raised the price target from $75 to $82.

- Deutsche Bank analyst Steve Powers maintained BellRing Brands with a Buy and raised the price target from $73 to $77.

- Stifel analyst Matthew Smith maintained the stock with a Buy and raised the price target from $67 to $81.

- b of A Securities分析师布莱恩·斯皮兰维持BellRing Brands的买入并将目标股价从75美元上调至82美元。

- 德意志银行分析师史蒂夫·鲍尔斯维持BellRing Brands的买入,并将目标股价从73美元上调至77美元。

- Stifel分析师马修·史密斯维持该股买入,并将目标股价从67美元上调至81美元。

- Considering buying BRBR stock? Here's what analysts think:

- 考虑购买 BRBR 股票?以下是分析师的想法:

Read This Next:

接下来阅读这篇文章:

- Jim Cramer Likes Devon Energy, But Calls Another Stock 'Far Superior'

- 吉姆·克莱默喜欢德文能源公司,但称另一只股票 “好得多”

BellRing Brands said it sees FY25 net sales of $2.24 billion to $2.32 billion and adjusted

BellRing Brands said it sees FY25 net sales of $2.24 billion to $2.32 billion and adjusted