Whales with a lot of money to spend have taken a noticeably bullish stance on AbbVie.

Looking at options history for AbbVie (NYSE:ABBV) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $1,433,900 and 5, calls, for a total amount of $514,031.

From the overall spotted trades, 3 are puts, for a total amount of $1,433,900 and 5, calls, for a total amount of $514,031.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $190.0 for AbbVie over the recent three months.

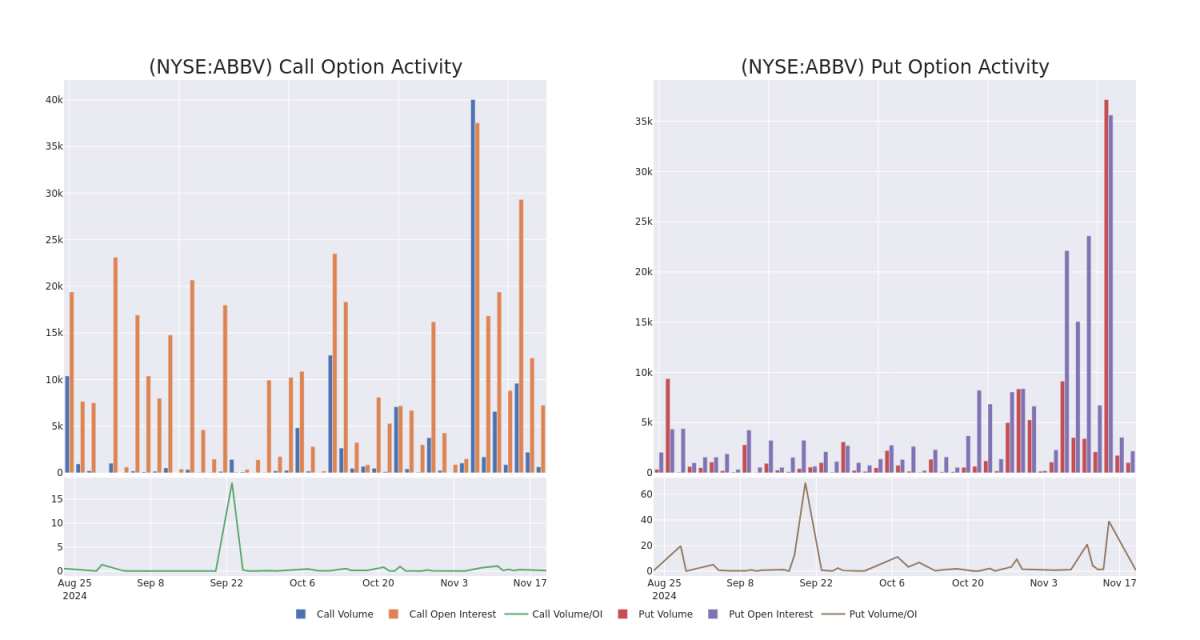

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for AbbVie's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AbbVie's whale trades within a strike price range from $150.0 to $190.0 in the last 30 days.

AbbVie Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | PUT | TRADE | BULLISH | 12/20/24 | $2.06 | $1.31 | $1.38 | $160.00 | $1.2M | 1.8K | 1.0K |

| ABBV | CALL | SWEEP | BEARISH | 05/16/25 | $21.6 | $21.55 | $21.6 | $150.00 | $254.8K | 14 | 118 |

| ABBV | PUT | SWEEP | BULLISH | 12/20/24 | $1.4 | $1.36 | $1.4 | $160.00 | $145.9K | 1.8K | 1.0K |

| ABBV | CALL | SWEEP | NEUTRAL | 05/16/25 | $3.6 | $3.4 | $3.52 | $190.00 | $130.6K | 207 | 380 |

| ABBV | CALL | TRADE | BEARISH | 01/17/25 | $7.1 | $7.05 | $7.05 | $165.00 | $69.7K | 4.1K | 116 |

About AbbVie

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

Present Market Standing of AbbVie

- Trading volume stands at 1,463,877, with ABBV's price up by 0.16%, positioned at $166.84.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 72 days.

What The Experts Say On AbbVie

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $215.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on AbbVie with a target price of $231. * In a cautious move, an analyst from Wolfe Research downgraded its rating to Outperform, setting a price target of $205. * Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on AbbVie with a target price of $200. * An analyst from Citigroup has decided to maintain their Buy rating on AbbVie, which currently sits at a price target of $215. * Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on AbbVie with a target price of $224.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.