Whales with a lot of money to spend have taken a noticeably bullish stance on Carpenter Tech.

Looking at options history for Carpenter Tech (NYSE:CRS) we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 66% of the investors opened trades with bullish expectations and 22% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $648,005 and 5, calls, for a total amount of $235,677.

From the overall spotted trades, 4 are puts, for a total amount of $648,005 and 5, calls, for a total amount of $235,677.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $220.0 for Carpenter Tech, spanning the last three months.

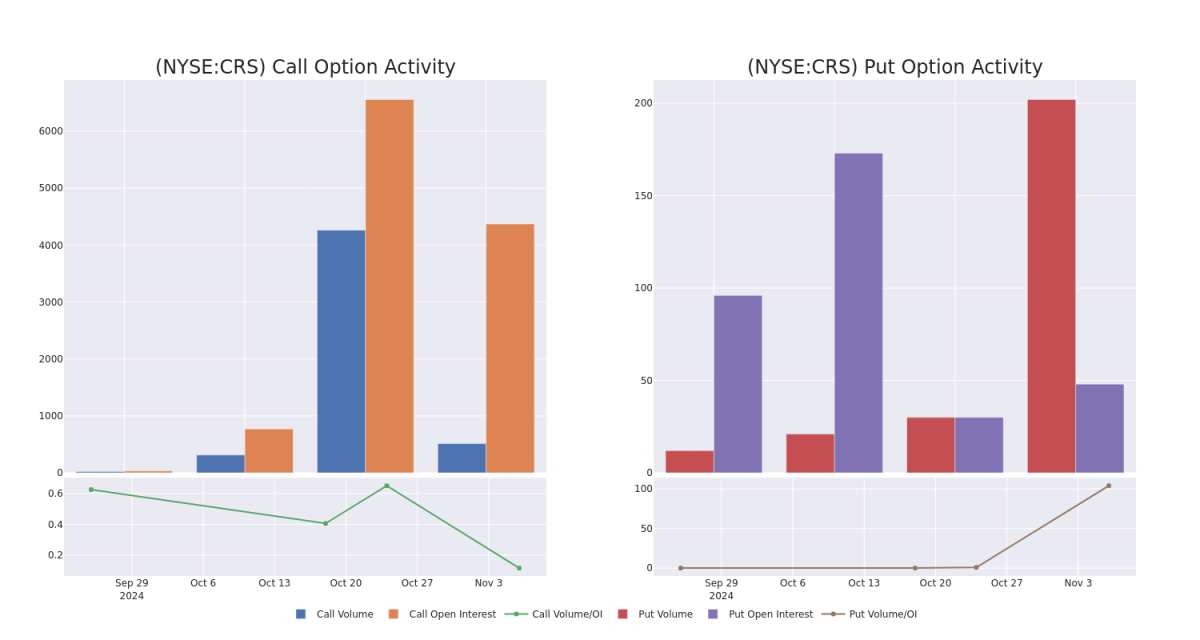

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Carpenter Tech's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Carpenter Tech's significant trades, within a strike price range of $150.0 to $220.0, over the past month.

Carpenter Tech Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRS | PUT | SWEEP | BEARISH | 05/16/25 | $43.1 | $43.1 | $43.2 | $220.00 | $228.9K | 0 | 62 |

| CRS | PUT | SWEEP | BEARISH | 05/16/25 | $43.2 | $41.4 | $43.2 | $220.00 | $151.2K | 0 | 150 |

| CRS | PUT | SWEEP | BULLISH | 05/16/25 | $43.2 | $43.2 | $43.2 | $220.00 | $151.2K | 0 | 0 |

| CRS | PUT | SWEEP | BULLISH | 05/16/25 | $43.3 | $43.2 | $43.2 | $220.00 | $116.6K | 0 | 62 |

| CRS | CALL | SWEEP | BULLISH | 03/21/25 | $7.7 | $7.6 | $7.67 | $220.00 | $58.3K | 5 | 291 |

About Carpenter Tech

Carpenter Technology Corp supplies specialty metals to a variety of end markets, including aerospace and defense, industrial machinery and consumer durables, medical, and energy, among others. The company's reportable segments include; Specialty Alloys Operations and Performance Engineered Products. It generates maximum revenue from the Specialty Alloys Operations segment. The SAO segment is comprised of the company's alloy and stainless steel manufacturing operations. This includes operations performed at mills predominantly in Reading and Latrobe, Pennsylvania, and surrounding areas as well as South Carolina and Alabama. Geographically, the company derives its maximum revenue from the United States and the rest from Europe, Asia Pacific, Mexico, Canada, and other regions.

After a thorough review of the options trading surrounding Carpenter Tech, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Carpenter Tech's Current Market Status

- With a volume of 296,558, the price of CRS is down -0.33% at $183.9.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 64 days.

Professional Analyst Ratings for Carpenter Tech

In the last month, 1 experts released ratings on this stock with an average target price of $175.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* In a cautious move, an analyst from Benchmark downgraded its rating to Buy, setting a price target of $175.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Carpenter Tech with Benzinga Pro for real-time alerts.