Despite an already strong run, Goodwill E-Health Info Co., Ltd. (SHSE:688246) shares have been powering on, with a gain of 28% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 12% in the last twelve months.

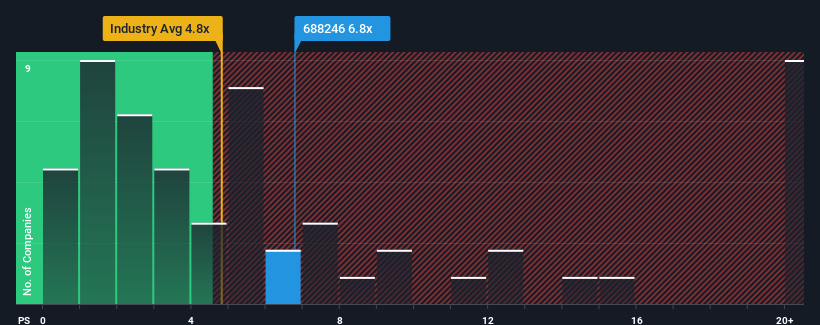

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Goodwill E-Health Info's P/S ratio of 6.8x, since the median price-to-sales (or "P/S") ratio for the Healthcare Services industry in China is also close to 7.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has Goodwill E-Health Info Performed Recently?

While the industry has experienced revenue growth lately, Goodwill E-Health Info's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Goodwill E-Health Info's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Goodwill E-Health Info's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Goodwill E-Health Info's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 43% during the coming year according to the four analysts following the company. With the industry predicted to deliver 138% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that Goodwill E-Health Info's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Goodwill E-Health Info's P/S Mean For Investors?

Goodwill E-Health Info appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Goodwill E-Health Info's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about this 1 warning sign we've spotted with Goodwill E-Health Info.

If you're unsure about the strength of Goodwill E-Health Info's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.