Zhejiang Jinggong Integration Technology Co., Ltd. (SZSE:002006) shares have continued their recent momentum with a 25% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 2.3% isn't as impressive.

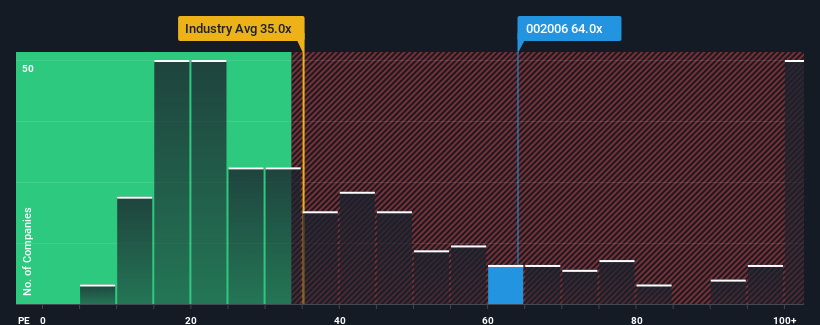

After such a large jump in price, Zhejiang Jinggong Integration Technology may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 64x, since almost half of all companies in China have P/E ratios under 35x and even P/E's lower than 20x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Zhejiang Jinggong Integration Technology has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

Does Growth Match The High P/E?

In order to justify its P/E ratio, Zhejiang Jinggong Integration Technology would need to produce outstanding growth well in excess of the market.

In order to justify its P/E ratio, Zhejiang Jinggong Integration Technology would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 58%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 30% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 150% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 40% growth forecast for the broader market.

In light of this, it's understandable that Zhejiang Jinggong Integration Technology's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Zhejiang Jinggong Integration Technology's P/E

The strong share price surge has got Zhejiang Jinggong Integration Technology's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Zhejiang Jinggong Integration Technology maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Zhejiang Jinggong Integration Technology you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.