Despite an already strong run, Xiamen Jihong Technology Co., Ltd. (SZSE:002803) shares have been powering on, with a gain of 26% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

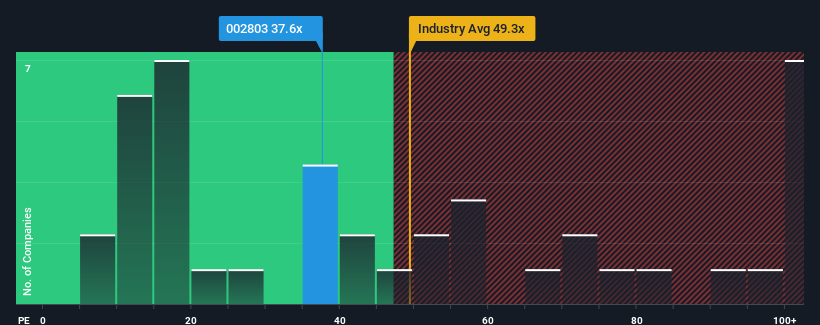

In spite of the firm bounce in price, it's still not a stretch to say that Xiamen Jihong Technology's price-to-earnings (or "P/E") ratio of 37.6x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 35x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Xiamen Jihong Technology has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Xiamen Jihong Technology's to be considered reasonable.

There's an inherent assumption that a company should be matching the market for P/E ratios like Xiamen Jihong Technology's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 48%. The last three years don't look nice either as the company has shrunk EPS by 59% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 202% over the next year. With the market only predicted to deliver 40%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Xiamen Jihong Technology's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Xiamen Jihong Technology's P/E

Its shares have lifted substantially and now Xiamen Jihong Technology's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Xiamen Jihong Technology's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 3 warning signs for Xiamen Jihong Technology that you need to take into consideration.

You might be able to find a better investment than Xiamen Jihong Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.