ECB Vice President Luis de Guindos said it was “very clear” that interest rates would be cut further, but due to uncertainties such as heightened trade tension and global conflict, officials should not act hastily.

“My impression is that we will continue to make our monetary policy stance less restrictive in the coming months and quarters,” Guindos said on Wednesday. Even so, “you have to be very careful”.

Earlier, in its financial stability assessment, the ECB warned that trade now poses an additional threat to the region's economy. Guindos expressed confidence that the 2% inflation target will be achieved next year and refuted claims that inflation will fall below the target level.

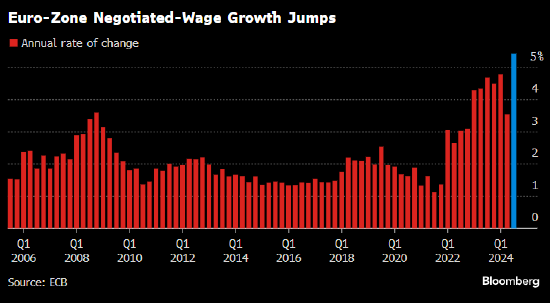

Data released on Wednesday showed that one of the key indicators for measuring salary levels in the Eurozone created the biggest increase since the birth of the euro, making the ECB's interest rate cut plan complicated.

Data released on Wednesday showed that one of the key indicators for measuring salary levels in the Eurozone created the biggest increase since the birth of the euro, making the ECB's interest rate cut plan complicated.

“If inflation continues to move closer to our target, I think the trajectory of monetary policy is very clear,” Guindos said.

Meanwhile, Donald Trump's election and the political turmoil in Germany have added uncertainty to the future. The ECB said in its report that the heightened global trade tension has also increased the possibility of a tail-end incident.

Guindos believes that the ECB needs to be wary of the Russian-Ukrainian war and the Middle East conflict, as well as the potential impact of US trade and fiscal policies.

“You have to be very careful to avoid making mistakes,” he said.

周三公布的数据显示,衡量欧元区薪资水平的一个关键指标创出了欧元诞生以来的最大增幅,令欧洲央行降息计划面临复杂性。

周三公布的数据显示,衡量欧元区薪资水平的一个关键指标创出了欧元诞生以来的最大增幅,令欧洲央行降息计划面临复杂性。