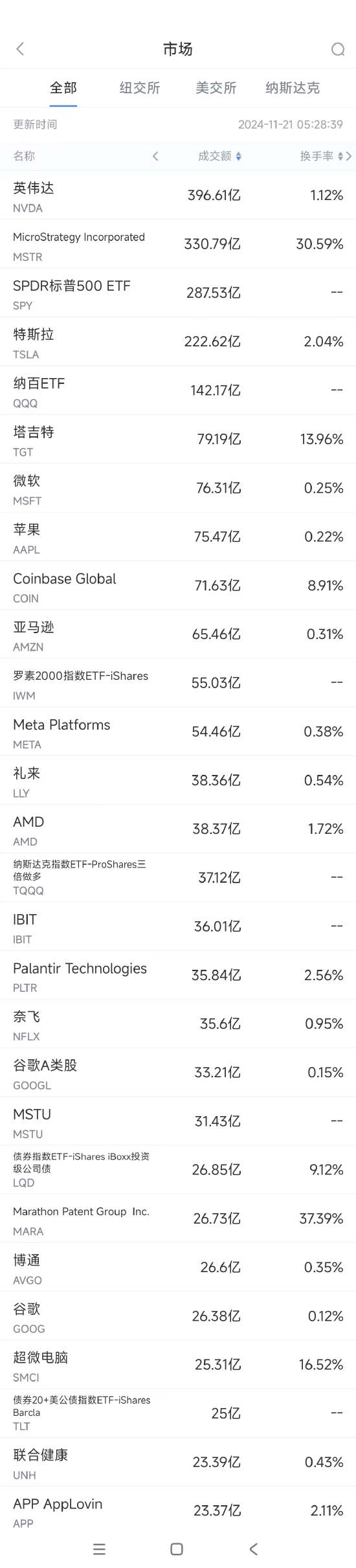

On Wednesday, the most traded stock in the USA was nvidia, which closed down 0.76%, with a trading volume of 39.661 billion USD. nvidia announced its earnings report after the market closed on Wednesday, with third-quarter revenue of 35.1 billion USD, exceeding the analyst's expectation of 33.25 billion USD. The third-quarter datacenter revenue was 30.8 billion USD, expected to be 29.14 billion USD. The adjusted eps for the third quarter was 0.81 USD, while it was estimated to be 0.74 USD.

nvidia CEO Jensen Huang predicted that demand for the Blackwell products/series will exceed supply in the coming quarters.

As the largest publicly traded company by market cap globally, Nvidia's stock price has continued to soar this year, thanks to the explosive growth of AI in the technology and other fields. As of Tuesday local time, Nvidia's stock price has risen 196% year-to-date, easily outpacing any chip manufacturer competitor. In contrast, its closest competitor AMD's stock price has fallen over 5% this year, while Intel's stock price, which is struggling to turn a profit, has plummeted nearly 52%.

Both Bank of America and Barclays believe that nvidia's earnings report has a greater impact on the S&P index than inflation and employment data, and even more than the Federal Reserve meeting.

Both Bank of America and Barclays believe that nvidia's earnings report has a greater impact on the S&P index than inflation and employment data, and even more than the Federal Reserve meeting.

The second most traded stock was microstrategy, which rose by 10.05%, with a trading volume of 33.079 billion USD. This stock's market cap has crossed 100 billion USD for the first time. So far this year, the stock has gained over 650%.

On Wednesday, bitcoin broke through 94,000 USD, reaching a new high for the second consecutive day, while MicroStrategy is the publicly traded company that holds the most bitcoin.

MicroStrategy is accelerating its large-scale purchases of the cryptos, with the company announcing on Wednesday an increase of nearly 50% in the issuance size of its convertible preferred notes plan to finance the purchase of bitcoin, raising it to 2.6 billion USD. Earlier this week, MicroStrategy stated it bought 4.6 billion USD worth of bitcoin, holding assets valued at over 30 billion USD.

The third most traded stock was tesla, which closed down 1.15%, with a trading volume of 22.262 billion USD. tesla's chairman, Robyn Denholm, cashed out over 35 million USD this month by selling shares. Regulatory filings showed that Denholm exercised 0.11239 million options that will expire next year and sold those shares on November 15. After considering the exercise cost, she netted about 32.5 million USD from the sale of the shares. Denholm had pre-arranged these transactions in July through a trading plan that allows corporate insiders in the usa to sell stocks.

Target, ranked 4th, fell by 21.41%, with a transaction volume of 7.919 billion USD. Target has lowered its full-year profit expectations, warning that weak quarterly sales and rising inventory have harmed profitability. The company now expects full-year eps to be between $8.30 and $8.90, down from a previous range of $9 to $9.70.

Data shows that Target's Q3 revenue was 25.67 billion USD, a year-on-year increase of 1.1%, which fell short of market expectations; Non-GAAP EPS was 1.85 USD, also below market expectations.

Comparable sales in the third quarter only increased by 0.3%, falling short of analysts' expectations and slowing down from the previous quarter. Specifically, physical store comparable sales declined by 1.9%, while digital comparable sales grew by nearly 11%. The increase in online sales also brought higher fulfillment costs, leading to a decrease in operating margin.

After releasing its financial report, citigroup lowered its target price from 188.00 USD to 130.00 USD. Deutsche bank cut its target price from 184.00 USD to 108.00 USD.

Microsoft, ranked 5th, fell by 0.55%, with a transaction volume of 7.631 billion USD. At the "Microsoft Ignite 2024" global developer conference, Microsoft updated several AI products, launching AI assistant tools and the Azure AI Foundry platform to help businesses enhance process automation and efficiency. The new AI assistant tools have been integrated into products like Microsoft 365 and Dynamics 365, supporting sectors like sales, service, finance, and supply chain. The Azure AI Agent Service allows developers to create and deploy AI assistants, expected to enter preview phase in December 2024. Since the launch of the AI agent ecosystem alliance, over 0.1 million organizations have created or edited AI assistants.

Apple, ranked 6th, increased by 0.32%, with a transaction volume of 7.547 billion USD. The Indonesian Ministry of Industry stated on Wednesday that the tech giant Apple has proposed a $0.1 billion investment plan to establish a factory for producing accessories and parts in Indonesia. This proposal came after Indonesia banned Apple from selling the iPhone 16 due to the company's failure to meet local regulations on parts. Indonesia requires certain smart phones sold domestically to contain at least 40% locally manufactured parts. Febri Hendri Antoni Arif, spokesperson for the Ministry of Industry, stated that the department would hold a meeting on Thursday to discuss Apple’s proposal to build a factory in West Java. He stated, "Holding a meeting on Thursday means the Minister of Industry welcomes Apple's investment commitment."

Amazon, ranked 8th, fell by 0.85%, with a transaction volume of 6.546 billion USD. JD.com and Amazon Global Purchase jointly announced on Tuesday (November 19) that the "Amazon Overseas Official Flagship Store" has officially opened on JD.com, offering consumers over 0.4 million hot-selling overseas products, more than 12,000 international brands, and providing a cross-border shopping experience with limited-time free shipping and delivery in as fast as 2 days. Additionally, the "Amazon Global Shopping Season for Black Friday" will be launched on JD.com on November 21, bringing an abundance of imported goods at discounts of up to 70%.

Eli Lilly and Co, ranked 10th, rose by 3.25%, with a transaction volume of 3.836 billion USD. Eli Lilly announced on Wednesday that Jon Moeller has been elected as a new member of its board of directors, effective December 1, 2024. Additionally, the company announced that Karen Walker has resigned from her position as a member of Eli Lilly's board of directors, effective December 31, 2024. Eli Lilly stated that in 2025, Ms. Walker will collaborate with Eli Lilly on certain digital business activities.

In 11th place, AMD closed down 1.28%, with a transaction volume of 3.837 billion dollars. At the "Microsoft Ignite 2024" global developer conference, Microsoft revealed a custom EPYC CPU developed in collaboration with AMD, which integrates HBM3 memory. This custom CPU is used in Microsoft's newly launched Azure HBv5 virtual machines, each equipped with four processors, offering up to 450GB of HBM3 memory and 352 Zen 4 cores, with a core frequency of up to 4GHz.

In 14th place, Google's Class A shares closed down 1.20%, with a transaction volume of 3.321 billion dollars. It has been reported that if a judge agrees to the proposal by the U.S. Department of Justice to sell the Chrome browser, Alphabet's Chrome browser could be sold for up to 20 billion dollars. This would be a significant blow to one of the largest technology companies in the world.

In 18th place, super micro computer closed down 8.74%, with a transaction volume of 2.531 billion dollars. Earlier, the stock had surged for three consecutive trading days due to news that the company had hired a new auditing firm and submitted a compliance plan.

(Screenshot from Sina Finance APP Market section - US Stocks - Market sector, slide left for more data) Download the Sina Finance APP

美银和巴克莱均认为,英伟达财报对标普指数的影响大于通胀与就业数据,甚至超过美联储会议。

美银和巴克莱均认为,英伟达财报对标普指数的影响大于通胀与就业数据,甚至超过美联储会议。