The wave of artificial intelligence spending is far from over, and the "crazy surge" journey of NVIDIA's stock price is to be continued.

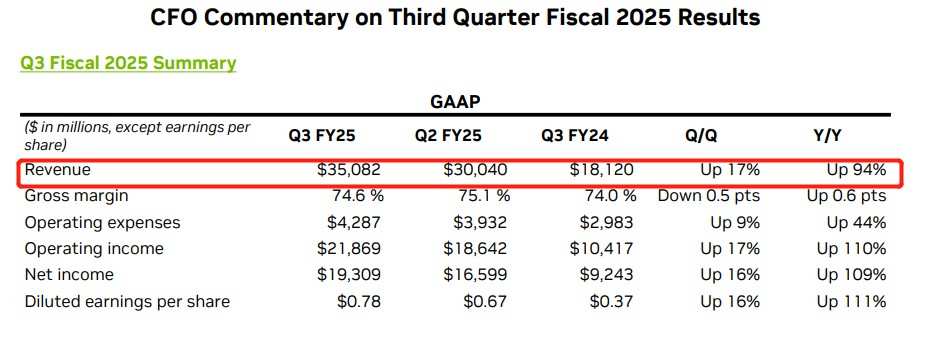

According to the Securities Times, NVIDIA (NVDA.US), the chip giant with the highest global market cap, referred to as the "most important stock on Earth" by Goldman Sachs and at the core of the artificial intelligence frenzy, delivered quarterly earnings significantly exceeding analysts' average expectations. This highlights that AI technology development is still in a "very early stage" — the stage of building AI infrastructure, with NVIDIA being the perfect answer to the current 'AI infrastructure spending version'. The giant's total revenue for the third quarter skyrocketed by 94%, with net income doubling. The forecasted revenue for the next quarter also exceeded average expectations, but fell short of some analysts' extremely optimistic projections, leading these analysts to question the limits of the dizzying growth and causing NVIDIA's stock price to fluctuate downward after hours.

In its earnings report released on Wednesday Eastern Time, NVIDIA stated that it expects the total revenue for the fourth quarter (ending January next year) to reach approximately $37.5 billion, fluctuating by 2%. Data compiled by institutions shows that despite Wall Street analysts' average forecast of $37.1 billion, some analysts have pegged the highest forecast at $41 billion.

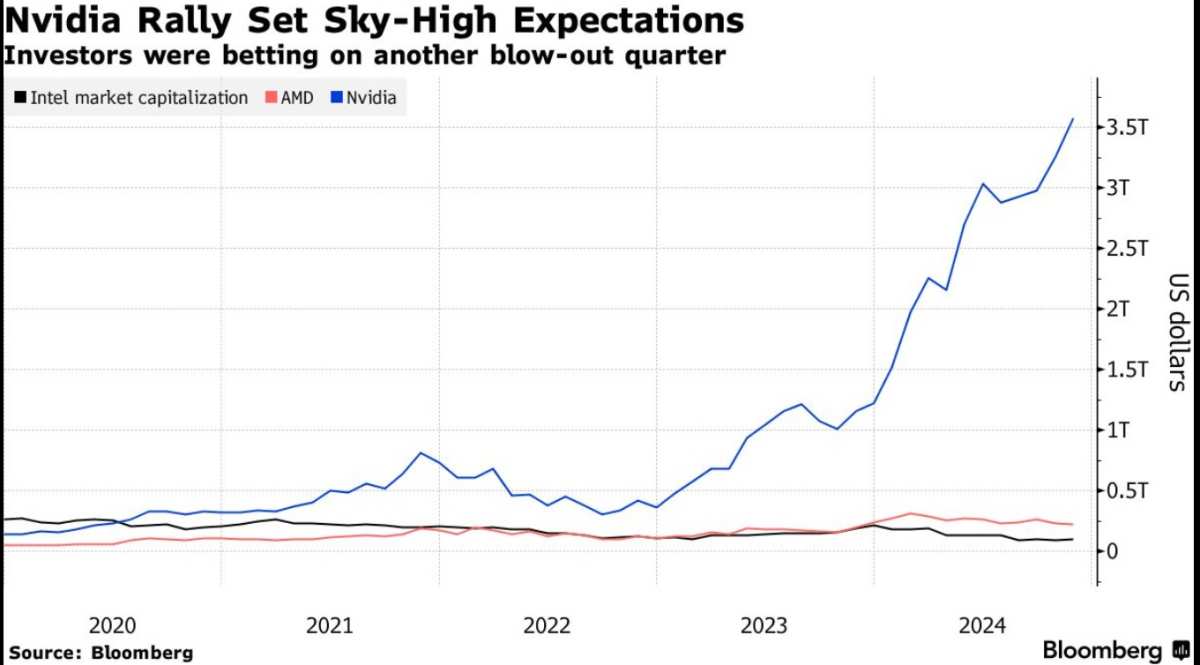

This harsh extreme expectation indicates that the market's fervor for NVIDIA, the 'AI leader', is taking on a 'surreal' form. In 2024, fueled by the global 'AI belief' wave, NVIDIA's stock price surged nearly 200%, making it the world's most valuable company. Back in 2023, NVIDIA's stock price had already skyrocketed over 240%.

This harsh extreme expectation indicates that the market's fervor for NVIDIA, the 'AI leader', is taking on a 'surreal' form. In 2024, fueled by the global 'AI belief' wave, NVIDIA's stock price surged nearly 200%, making it the world's most valuable company. Back in 2023, NVIDIA's stock price had already skyrocketed over 240%.

Despite falling short of the most extreme and overly demanding expectations, NVIDIA's revenue growth over the past two years has been unparalleled, with the third fiscal quarter ending in October being equally explosive, reigniting investors' faith in artificial intelligence and potentially sparking another round of 'AI frenzy' in the global stock market. From a fiscal year perspective, NVIDIA's total revenue is expected to double for two consecutive fiscal years, and more significantly, currently, NVIDIA's quarterly net income far exceeds the revenue scale of the past few quarters.

The latest financial data shows that in NVIDIA's third fiscal quarter of the 2025 fiscal year ending on October 27th, total revenue surged by 94% year-on-year to reach $35.1 billion, the highest historical revenue level. Excluding certain items, EPS under the NON-GAAP criteria was 81 cents. In comparison, Wall Street analysts had an average expectation of around $33.25 billion for the company's third fiscal quarter revenue and an estimated EPS of about 74 cents for the NON-GAAP. In terms of net income, under GAAP criteria, NVIDIA's Q3 net income soared by 109% year-on-year to $19.3 billion, representing a 16% increase from the previous quarter.

In recent years, nvidia's performance has truly outperformed Wall Street expectations. In the past five years, nvidia has only failed to meet Wall Street analysts' average expectations in one quarter. In the last few quarters, its actual total revenue has even exceeded Wall Street's expectations by at least 20%, which has led analysts to set very high performance expectations for nvidia in recent quarters. nvidia has always been able to significantly exceed expectations, highlighting the gradual shift of human society into the AI era with the emergence of heavy-duty generative AI applications such as ChatGPT and Sora. The continuous explosive growth in demand for nvidia's high-performance AI GPU, the most core infrastructure for artificial intelligence (AI) by global enterprises and key government departments, is evident.

Based on the disclosed spending expectations of the tech giants, Meta, Microsoft, Google, and amazon, in the disclosed financial reports, continue to significantly increase their spending on the most core artificial intelligence infrastructure - nvidia AI GPU, presenting a strong signal of "burning money to buy nvidia GPU." In addition, leading AI application leaders such as OpenAI, xAI, Anthropic, and Palantir, as well as major government departments focusing on "sovereign AI systems," continue to invest heavily in building AI data centers. This global frenzy of AI deployment shows no signs of abating.

nvidia's current revenue from the data center business department alone has far exceeded the latest total revenue of its two most direct competitors in the AI chip field - AMD (AMD.US) and intel (INTC.US). nvidia's net income for the fiscal year 2025 is expected to surpass intel's total revenue, with intel having been the most profitable chip company in the industry for decades. nvidia, now known as the "new king" of the global chip industry, has a market cap far exceeding AMD and the veteran giant intel.

The latest performance proves that nvidia still deserves the title of the world's "strongest shovel seller" in the AI field, with a market share as high as 80%-90% in the AI training/inference field. Riding the unprecedented wave of global enterprise AI deployment, nvidia was initially globally renowned for selling PC-side graphics processors (i.e., computer GPUs). However, after discovering that its parallel architecture was suitable for artificial intelligence and a wide range of high-performance computing, it has been fully committed to artificial intelligence chips in recent years. The nvidia AI GPU, with a large number of computing cores capable of executing multiple highly intensive AI tasks simultaneously, and extremely adept at parallel computing, has become the core hardware in the chip field in recent years, establishing an extremely wide moat with the AI GPU + CUDA ecosystem. Especially in the AI training process, the nvidia AI GPU helps software learn large models to recognize and respond to natural language inputs from the real world. Since 2023, nvidia AI GPUs have been extensively used in running large-scale AI server clusters hosting super AI large models like the GPT series, a process known as AI inference.

Since the introduction of ChatGPT, as AI's influence on the global high-tech industry and technological development continues to grow, CPUs focusing on single-thread performance and general-purpose computing are still an indispensable part of the chip field. However, their position and importance in the chip field are far less prominent than GPUs. After all, CPU design was originally intended for general computing tasks among various conventional tasks, not to handle massive parallel computing patterns and high-density matrix operations like GPUs. nvidia CEO Jensen Huang emphasizes that the global shift to artificial intelligence has only just begun. He believes that accelerating specific task GPU accelerated computing by breaking down specific tasks into smaller parts and processing them in parallel is taking the lead.

On the eve of nvidia's financial report release, Wall Street's major banks collectively significantly raised the target stock price of nvidia within the next 12 months. Wall Street financial giant Bank of America reiterated a "buy" rating for nvidia and raised its target price from $165 to $190 within the next 12 months. HSBC even raised nvidia's target stock price from $145 to $200, jointly ranking it with the $200 target price given by Rosenblatt Securities as the highest expectation on Wall Street. In comparison, nvidia's stock price closed at $145.89 on Wednesday.

"The impact of artificial intelligence can be said to be increasingly significant, with large tech companies globally investing billions of dollars, of which NVIDIA can be said to benefit the most," said Anina from James Investment. "Overall, its prospects are still very optimistic."

In terms of U.S. policy expectations, with Trump's lock on the U.S. election victory, Trump has promised to reduce regulation and taxes on large companies, increase oil production, implement strict immigration policies, all of which indicate that economic growth and inflation will strengthen, but this is seen as a bullish factor for the stock market. Industries such as banks, technology, defense, and fossil fuels may benefit, especially in technology. According to Trump's own policy framework, the U.S. government under his leadership will likely focus on accelerating the development of cutting-edge technologies in areas like artificial intelligence, quantum computing, nuclear fusion, and aviation and aerospace.

Nvidia, known as the "male lead in cool novels"! The AI trend is in full swing, with a sharp increase in data center revenue.

Nvidia recently squeezed out Intel and successfully joined the Dow Jones Industrial Average. Shortly afterwards, its total market cap surpassed Apple's, reclaiming the title of "Stock Market King" after 5 months. We have witnessed how artificial intelligence reshapes the stock market. However, the 'Nvidia myth' seems to be far from over! In the eyes of many Wall Street analysts, Nvidia's crazy surge in stock price shows no signs of stopping.

Nvidia's “godly journey” is like the core male protagonist in charismatic fiction. Since the end of 2022, Nvidia's stock price has skyrocketed by a surprising 850%, from the temporary low point in October 2022, the surge has reached an unbelievable 1000%.

The data center business division is currently Nvidia's most core business unit, providing extremely powerful AI computing infrastructure for data centers worldwide through the H100/H200 and Blackwell architecture AI GPUs provided by this division. Financial reports show that with the global AI trend in full swing, this business unit's revenue increased by a staggering 112% year-on-year, reaching an amazing $30.8 billion. This figure significantly exceeds Wall Street expectations and surpasses the combined revenue of Intel and AMD.

"In the past few quarters, people seem to be mainly concerned about inflation data, employment data, and 'Nvidia data'." said Farr Alnina, director of research at James Investment Research. "Nvidia's market cap surpassing Apple not only means that it is one of the biggest beneficiaries of the artificial intelligence infrastructure cycle, but also indicates that people expect the AI boom to continue to sweep the globe." Bank of America stated that Nvidia's performance may have a greater impact on the S&P 500 index compared to the next non-farm payroll data, CPI, or the Fed's decision.

According to statistics, chip giant Nvidia currently accounts for approximately 8% of the total weight of the S&P 500 index, contributing about 25% to the 21% increase in this benchmark index this year. Nvidia once closed for the first time in June as the 'world's largest market cap company,' when its market cap slightly exceeded the tech giant Microsoft, becoming the world's largest listed company. However, this prestigious title was held for only one day and was later dominated by Apple in the long term. In November, Nvidia surpassed Microsoft first, shortly after surpassing Apple, once again claiming the 'number one market cap'.

In the US stock market, including Nvidia, seven major technology giants (known as the Magnificent Seven), the 'ai content' is increasingly high, and the other 'six giants' are Nvidia's core customers. The seven major US technology giants with high weights in the S&P 500 index and the Nasdaq, known as the 'Magnificent Seven', include Nvidia, Apple, Microsoft, Google, Amazon, Meta Platforms, and Tesla. And they still emphasized in the recent earnings conference calls their commitment to significant spending in artificial intelligence, with executives of these technology giants making statements about 'continuing to spend money'. Wall Street investment institutions generally believe that Nvidia will continue to prosper and remain one of the biggest beneficiaries of the global AI trend for the foreseeable future.

Huang Renxun loudly declares that the demand for Blackwell is 'unbelievable'.

Focusing on the Blackwell production capacity and demand that Wall Street is concerned about, Huang Renxun, the CEO of Nvidia, stated that the design flaws of the Blackwell architecture AI GPU of the new product series from Nvidia have been completely resolved and it is now 'fully in production', emphasizing that the anticipated demand for this highly anticipated high-performance AI GPU product is expected to far exceed expectations for several quarters. The Nvidia management team emphasized in the earnings conference that Blackwell is expected to ship this quarter and the pace of supply will accelerate in the coming year.

Huang Renxun added that the market demand for the previously released Nvidia Hopper architecture AI GPUs, namely H100/H200, remains very strong. Huang Renxun's latest statements effectively dispel concerns in the market about production capacity constraints for Blackwell due to heat dissipation and design flaws.

Huang Renxun exclaimed in the earnings statement that the market demand for Blackwell and Hopper is 'unbelievable'. 'The era of artificial intelligence is advancing comprehensively, driving the global transition to Nvidia's computing power.' 'As base model manufacturers expand the scale of AI pre-training, training, and cloud AI inference computing power deployment, the demand for Hopper and the expectation for the fully produced Blackwell - is unbelievable.'

'Artificial intelligence is changing every industry, every company, and every country,' 'With the comprehensive breakthrough of physical artificial intelligence, investment in industrial AI robots is surging, and countries have realized the importance of developing sovereign-level AI large models and infrastructure.' Huang Renxun stated in the earnings declaration.

Nvidia hopes to maintain its leading position by accelerating its pace of innovation. These efforts include committing to updating its AI GPU product line annually and providing an all-in-one AI solution capability to help companies train, develop, and deploy artificial intelligence applications. With Blackwell, Nvidia has a range of new chips that offer the strongest performance in the industry, with significantly improved connectivity compared to other semiconductor products.

In the MLPerf Training benchmark test, Blackwell's performance in the GPT-3 pre-training task is twice as high as Hopper's per GPU. This means that using Blackwell can complete model training faster on the same number of GPUs. For the LoRA fine-tuning task of the Llama 2 70B model, Blackwell's performance per GPU is 2.2 times higher than Hopper's, indicating that Blackwell is more efficient in handling specific high-load AI tasks.

However, manufacturing challenges have slowed down the launch process of Blackwell. Nvidia has stated that the company is still unable to fulfill all received orders, as Huang Renxun said,"The demand is incredible."

Nvidia once again warned at the earnings conference that the supply of Blackwell architecture AI GPUs is extremely tight. Huang Renxun stated in response to analyst questions that the supply may become more abundant once Taiwan Semiconductor's production of Blackwell ramps up.

"Key questions surrounding Blackwell's output growth and customer concentration remain the focus," said Emarketer analyst Jacob Burns in a report. "Nvidia has little room for execution errors in 2025."

The wave of AI spending is far from over, and Nvidia's stock price's "crazy journey" is to be continued.

Global tech giants are increasing their spending to build AI data centers to meet the almost endless demand for AI inference/training power. As tech giants continue to make comments about increasing AI capital expenditure, D.A. Davidson, a Wall Street investment firm, believes that Nvidia will continue to thrive and remain one of the biggest beneficiaries of the global trend in AI investments. For example, as long as Microsoft continues to invest heavily in upgrading its massive data centers, we believe it will continue to shift shareholder value from Microsoft to Nvidia. The D.A. Davidson research team stated.

When discussing the market demand for AI chips, taiwan semiconductor's leader C.C. Wei stated in the earnings conference that the demand outlook for AI chips is very optimistic, emphasizing that taiwan semiconductor's clients have a demand for advanced packaging CoWoS that far exceeds the company's supply. "The company will fully respond to clients' demand for CoWoS advanced packaging capacity. Even if this year capacity doubles, and continues to double next year, it will still be far from enough." taiwan semiconductor's CoWoS S/L/R advanced packaging capacity is crucial for nvidia's Blackwell AI GPU and other broader AI chip capacities.

According to the latest forecast data from Citigroup, by 2025, the capital expenditure related to data centers of the four largest tech giants in the United States is expected to grow by at least 40% year-on-year, with these massive capital expenditures largely tied to generative AI, meaning that the computing power demand for AI applications such as ChatGPT remains significant. Citigroup refers to the four major tech giants in the research report as global cloud computing giants Amazon, Google, Microsoft, together with social media Facebook and Instagram's parent company. In this latest published research report, Citigroup expects that by 2025, the data center capital expenditure of these four major tech giants will increase by 40% to 50% year-on-year. The significant increase in capital expenditure by tech giants in data centers is expected to drive the stock prices of data center networking technology giants like Nvidia and Arista Networks, which dominate the international market in the field of AI.

Citigroup's latest report by the analysis team also involves the indispensable datacenter AI servers needed for large-scale AI model training/inference computation power, the choice between customized AI ASIC and AI GPU, and points out that AI GPU has become the preferred option due to its hardware flexibility and universal adaptability to rapidly evolving AI applications and AI large model updates and iterations, especially with the extremely broad moat built by the powerful performance AI GPU+CUDA ecosystem, allowing Nvidia to have the capability to long-term hold up to 80%-90% market share in the datacenter AI server field.

The CUDA ecosystem barrier can be described as Nvidia's "strongest moat," while also being Nvidia's "accessory." Nvidia has been deeply cultivating the global high-performance computing field for many years, especially its self-developed CUDA computing platform that has become popular worldwide, serving as the preferred software-hardware coordinated system in the field of high-performance computing for AI training/inference and others.

CUDA acceleration computing ecosystem is an exclusive parallel computing acceleration platform and programming assistance software developed by Nvidia, allowing software developers and engineers to accelerate parallel general-purpose computing using Nvidia GPUs (only supports Nvidia GPUs, not compatible with mainstream GPUs such as AMD and Intel). CUDA can be described as a platform ChatGPT and other generative AI applications heavily rely on, its importance is as crucial as the hardware system, essential for developing and deploying large AI models. With its high technical maturity, absolute performance optimization advantages, and extensive ecosystem support, CUDA has become the most widely used and universally popular collaborative platform in AI research and commercial deployment.

Global renowned strategic consulting firm Bain predicts that as artificial intelligence (AI) technology rapidly disrupts enterprises and economies, all markets related to AI are expanding, reaching $990 billion by 2027. This consulting firm pointed out in its fifth annual "Global Tech Report" released on Wednesday that the overall AI market size, including AI-related services and core hardware like AI GPU, will grow at a rate of 40% to 55% annually from the base of $185 billion last year. This means a massive revenue of $780 billion to $990 billion by 2027.

The global enterprises, including the "Big Six," are still unstoppable in the "burning money wave" of artificial intelligence, supported by extremely hardcore stock logic closely related to AI chips. The rising trend of AI chip leaders such as Nvidia may be far from over. Especially for the dominant Nvidia with an AI chip market share as high as 80%-90% in data centers, the stock price may continue to set new historical highs, surpassing the widely expected $165 mark by Wall Street analysts, and even the highest expected $200 stock price by Wall Street, which may only be a matter of time.

这一堪称苛刻的极端预期表明,市场对于“人工智能总龙头”英伟达的亢奋情绪呈现出“超现实”形式。2024年,在席卷全球的“AI信仰”助力之下,AI信徒们推动英伟达股价暴涨近200%,使其成为全球市值最高的公司,而在2023年,英伟达股价已经暴涨超240%。

这一堪称苛刻的极端预期表明,市场对于“人工智能总龙头”英伟达的亢奋情绪呈现出“超现实”形式。2024年,在席卷全球的“AI信仰”助力之下,AI信徒们推动英伟达股价暴涨近200%,使其成为全球市值最高的公司,而在2023年,英伟达股价已经暴涨超240%。