Not in a hurry to cut interest rates.

Prior to the December interest rate meeting, several Federal Reserve officials discussed their differing views on the direction of monetary policy.

On Wednesday, November 20th, Federal Reserve Board members Bauman, Cook, and Boston Fed President Collins each spoke out.

Among them, the 'hawkish' representative Bauman is cautious about further interest rate cuts; Cook and Collins believe that continuing to cut interest rates is appropriate, but must proceed with caution to avoid acting too quickly or too slowly.

Among them, the 'hawkish' representative Bauman is cautious about further interest rate cuts; Cook and Collins believe that continuing to cut interest rates is appropriate, but must proceed with caution to avoid acting too quickly or too slowly.

Caution in cutting interest rates?

For the Federal Reserve, Trump 2.0 will bring too much uncertainty, and the market's confidence in the December rate cut expectation is starting to waver.

Because future policies such as additional tariffs, tax cuts, and immigration restrictions could change the direction of inflation and employment.

As the most hawkish member of the Federal Reserve.BowmanThe latest call to be cautious about further interest rate cuts. Do not cut interest rates too much or too quickly, lest inflation resurges.

"In the absence of achieving the inflation target, I would prefer to cautiously lower the policy interest rate to better assess our distance from the final target, while closely monitoring changes in the labor market."

If the labor market remains strong and inflation decline stalls, Bowman may not support further rate cuts.

Fed Governor Cookbelieves that continuing to cut interest rates is appropriate, although not explicitly supporting a rate cut in December.

She pointed out that overall inflation in the USA is still decreasing, and wages and the labor market are gradually cooling off.

However, the scale and timing of rate cuts will depend on the upcoming data, economic outlook, and balance of risks. Monetary policy is not pre-set on a trajectory.

It is expected that next year, both the overall inflation rate and the core inflation rate will decrease to the level of 2.2%, and then even lower; at the same time, the economy will continue to expand, and the labor market will also remain "stable".

Boston Fed President CollinsIt is also stated that due to the continued restrictive policies, it is necessary to further cut interest rates, but caution should be exercised.

She pointed out that over time, further adjustments may be appropriate to gradually move policy interest rates back from their current restrictive stance to a more neutral range.

"The policy adjustments made so far have allowed for cautious and prudent progress, taking time to fully assess the impact of existing data on the outlook and the balance of risks."The Federal Open Market Committee (FOMC)forward with caution and prudence, taking time to comprehensively evaluate the impact of the existing data on the outlook and the balance of risks.

The pace of interest rate cuts will slow down next year.

In September of this year, the Federal Reserve significantly cut interest rates by 50 basis points, initiating an easing cycle, and then cut interest rates by another 25 basis points this month.

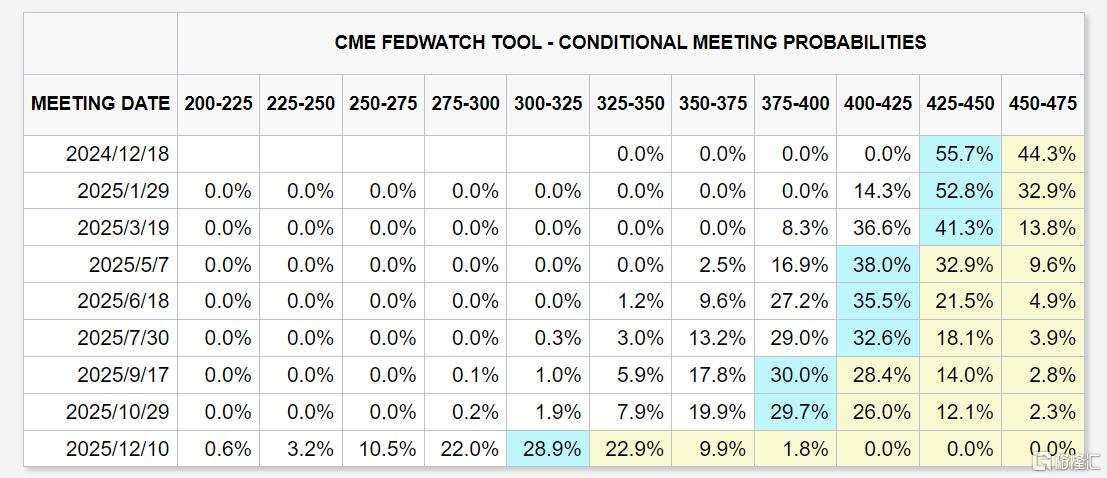

Currently, the market generally expects the Federal Reserve to cut interest rates in December, but due to the inflation risks, the pace of rate cuts in 2025 will slow down.

Most economists believe that due to the inflation risks posed by Trump's proposed policies, the Federal Reserve will cut interest rates in December, but the rate cut in 2025 will be lower than previously expected.

Due to the inflation risks brought by Trump 2.0 policies (including raising tariffs and cutting taxes), the market has priced in a nearly halved rate cut by the end of 2025, to around 75 basis points.

According to a Reuters survey, the Federal Reserve will cut interest rates by 25 basis points in the first three quarters, and then maintain the interest rate.

By the end of 2025, the federal funds rate will reach 3.50%-3.75%, 50 basis points higher than last month's forecast.

Strong economic performance, persistent inflation, and a stock market near historical highs have become obstacles to hasty rate cuts.

The median in the opinion poll also indicates a significant upward revision in the inflation outlook for the next two years compared to the previous month, with the expected indicator favored by the Federal Reserve - Personal Consumption Expenditures (PCE) inflation likely to remain above the Federal Reserve's 2% target level, at least until 2027.

The US economy grew at an annualized rate of 2.8% last quarter, is projected to grow by 2.7% this year, and is expected to grow by 2% in 2025 and 2026.

This is faster than the Fed officials' current forecast of non-inflationary growth rate of 1.8% in the coming years.

Last week, Federal Reserve Chairman Powell also mentioned that the economy has not shown any signals indicating an urgent need for interest rate cuts.

Bank of America economists believe that there will be a rate cut in December because the data will perform well. However, the economy remains very strong, and the inflation rate is still above the target.