$Amcor PLC (AMC.AU)$ shares rose 3.90%, with trading volume expanding to A$52.82 million. Amcor shares has rose 4.75% over the past week, with a cumulative gain of 19.24% year-to-date.

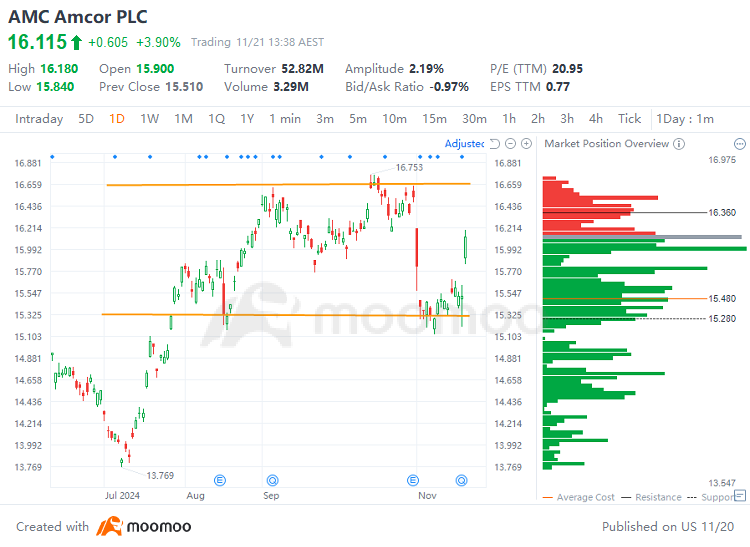

Amcor's technical analysis chart:

Technical Analysis:

Support: A$15.28

Resistance: A$16.65

Resistance: A$16.65Price range A$15.28 to A$16.65: The trading range indicates a heavy concentration of buy orders, with the stock price on an upward trend. The stock repeatedly touched the level near A$15.28, where it found significant support and subsequently rebounded. There is a strong presence of buy orders around A$15.28, suggesting a robust foundation for the price. There is considerable upward pressure near the resistance level of A$16.65, with a lot of profit-taking positions, which suggests strong selling pressure. Going forward, it will be crucial to monitor whether the stock can effectively break through the resistance level at A$16.65.

Market News :

Amcor filed the attached Form 8-K with the SEC on Tuesday 19 November 2024, regarding Amcor and Berry entering into a definitive merger agreement to combine in an all-stock transaction. A copy of the filing is attached, offering Berry shareholders 7.25 Amcor shares for each Berry share. Post-acquisition, Amcor and Berry shareholders will own 63% and 37% of the combined company, respectively, with expectations of over 35% EPS accretion and $650 million in synergies by the end of the third year.

Overall Analysis:

Fundamentally, focus on the company's performance and operational status. Technically, it is necessary to monitor whether the stock price continues to stay within the upward channel, whether the support at the bottom of the channel remains valid, and whether the resistance level can be effectively broken through.

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.