Jiayin Group Inc. Reports Third Quarter 2024 Unaudited Financial Results

Jiayin Group Inc. Reports Third Quarter 2024 Unaudited Financial Results

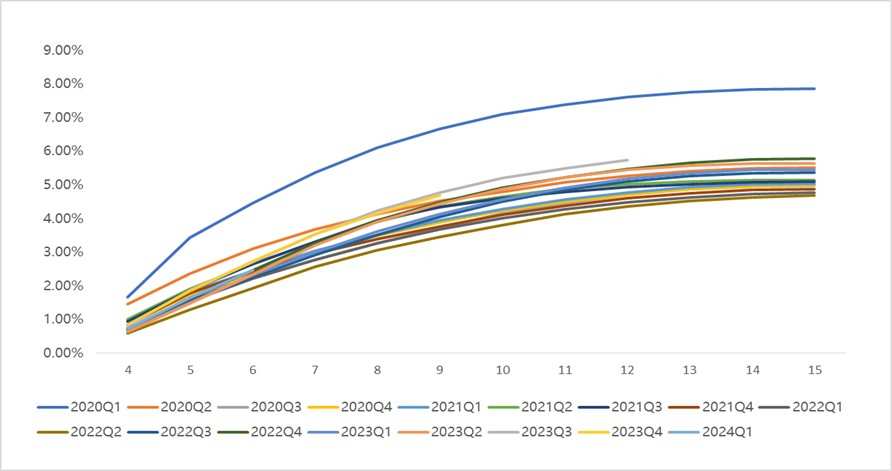

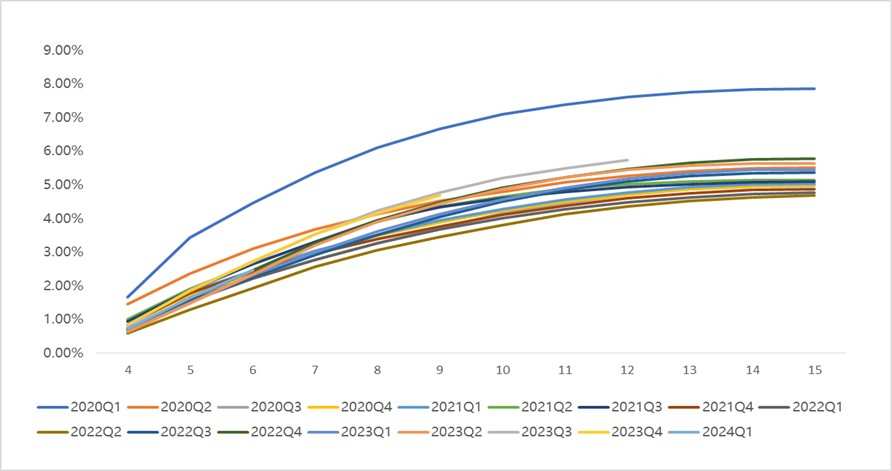

M3+ Delinquency Rate by Vintage

按年份划分的 M3+ 拖欠率

SHANGHAI, Nov. 20, 2024 (GLOBE NEWSWIRE) -- Jiayin Group Inc. ("Jiayin" or the "Company") (NASDAQ: JFIN), a leading fintech platform in China, today announced its unaudited financial results for the third quarter ended September 30, 2024.

上海,2024年11月20日(GLOBE NEWSWIRE)——中国领先的金融科技平台佳银集团有限公司(“佳音” 或 “公司”)(纳斯达克股票代码:JFIN)今天公布了截至2024年9月30日的第三季度未经审计的财务业绩。

Third Quarter 2024 Operational and Financial Highlights:

2024 年第三季度运营和财务亮点:

- Loan facilitation volume1 was RMB26.7 billion (US$3.8 billion), representing an increase of 10.3% from the same period of 2023.

- Average borrowing amount per borrowing was RMB7,629 (US$1,087), representing a decrease of 30.5% from the same period of 2023.

- Repeat borrowing rate2 was 67.8% compared with 71.5% in the same period of 2023.

- Net revenue was RMB1,444.9 million (US$205.9 million), representing a decrease of 1.5% from the same period of 2023.

- Income from operation was RMB311.9 million (US$44.4 million), representing a decrease of 18.3% from the same period of 2023.

- Net income was RMB269.6 million (US$38.4 million), representing a decrease of 16.8% from the same period of 2023.

- 贷款便利额1为人民币267元(38亿美元),较2023年同期增长10.3%。

- 每次借款的平均借款额为人民币7,629元(合1,087美元),比2023年同期下降了30.5%。

- 重复借款利率2为67.8%,而2023年同期为71.5%。

- 净收入为人民币144490万元(2.059亿美元),比2023年同期下降1.5%。

- 运营收入为人民币31190万元(合4,440万美元),比2023年同期下降18.3%。

- 净收入为人民币26960万元(合3,840万美元),比2023年同期下降了16.8%。

Mr. Yan Dinggui, the Company's Founder, Director and Chief Executive Officer, commented: "As we close out the third quarter of 2024, I'm proud to report continued strong performance, with a significant year-over-year increase in both loan facilitation volume and related revenue. Our loan facilitation volume reached RMB26.7 billion in the third quarter, a 10.3% increase compared with the same period last year. Loan facilitation service revenue grew 18.1% to RMB1,105.7 million. This growth reflects our strategic focus on innovation, risk management, and market diversification. We've successfully leveraged technology to enhance operational efficiency and borrower experience, while maintaining a sharp eye on risk resilience. We are confident that our adaptable business model and commitment to sustainable growth will enable us to capture new opportunities and deliver long-term value to our shareholders."

公司创始人、董事兼首席执行官严定贵先生评论说:“在我们结束2024年第三季度之际,我很自豪地报告持续强劲的业绩,贷款便利额和相关收入同比均大幅增长。我们的贷款便利额在第三季度达到人民币267元,与去年同期相比增长了10.3%。贷款便利服务收入增长了18.1%,达到人民币110570万元。这种增长反映了我们对创新、风险管理和市场多元化的战略重点。我们成功地利用技术来提高运营效率和借款人体验,同时保持对风险抵御能力的敏锐关注。我们相信,我们适应性强的商业模式和对可持续增长的承诺将使我们能够抓住新的机遇,为股东创造长期价值。”

___________________________

_____________________

1 "Loan facilitation volume" refers the loan facilitation volume facilitated in Mainland China during the period presented.

2 "Repeat borrowing rate" refers to the repeat borrowers as a percentage of all of our borrowers in Mainland China.

"Repeat borrowers" during a certain period refers to borrowers who have borrowed in such period and have borrowed at least twice since such borrowers' registration on our platform until the end of such period.

Third Quarter 2024 Financial Results

1 “贷款便利额” 是指报告期内中国内地便利的贷款便利额。

2 “重复借款利率” 是指重复借款人占中国大陆所有借款人的百分比。

特定时期内的 “重复借款人” 是指在该期限内借款并且自此类借款人在我们的平台上注册至该期限结束以来至少借款两次的借款人。

2024 年第三季度财务业绩

Net revenue was RMB1,444.9 million (US$205.9 million), representing a decrease of 1.5% from the same period of 2023.

净收入为人民币144490万元(2.059亿美元),比2023年同期下降1.5%。

Revenue from loan facilitation services was RMB1,105.7 million (US$157.6 million), representing an increase of 18.1% from the same period of 2023. The increase was primarily driven by service fee optimization within our loan facilitation operations and increased loan facilitation volume from the Company's institutional funding partners.

贷款便利化服务的收入为人民币110570万元(1.576亿美元),比2023年同期增长18.1%。增长主要是由我们的贷款便利化业务中的服务费优化以及公司机构融资合作伙伴的贷款便利额增加所推动的。

Revenue from releasing of guarantee liabilities was RMB251.7 million (US$35.9 million) compared with RMB397.9 million in the same period of 2023.The year-over-year decrease was primarily due to the decrease in average outstanding loan balances for which the Company provided guarantee services.

解除担保负债的收入为人民币25170万元(合3590万美元),而2023年同期为人民币39790万元。同比下降的主要原因是公司提供担保服务的平均未偿贷款余额减少。

Other revenue was RMB87.5 million (US$12.4 million), compared with RMB131.9 million for the same period of 2023. The decrease was mainly due to the decrease in revenue from individual investor referral services.

其他收入为人民币8750万元(合1,240万美元),而2023年同期为人民币13190万元。下降的主要原因是个人投资者推荐服务的收入减少。

Facilitation and servicing expense was RMB419.1 million (US$59.7 million) compared with RMB544.3 million for the same period of 2023. This was primarily due to decreased expenses related to financial guarantee services, which was partially offset by the effect of increased loan facilitation volume.

便利和服务费用为人民币41910万元(合5,970万美元),而2023年同期为人民币54430万元。这主要是由于与金融担保服务相关的费用减少,但贷款便利额增加的影响部分抵消了这一减少。

Allowance for uncollectible receivables, contract assets, loans receivable and others was RMB11.6 million (US$1.7 million), representing an increase of 36.5% from the same period of 2023, primarily due to increased balances of receivables arising from loan facilitation.

无法收回的应收账款、合同资产、应收贷款和其他准备金为人民币1160万元(合170万美元),比2023年同期增长了36.5%,这主要是由于贷款便利化产生的应收账款余额增加。

Sales and marketing expense was RMB550.3 million (US$78.4 million), representing an increase of 34.9% from the same period of 2023, primarily due to an increase in borrower acquisition expenses.

销售和营销费用为人民币55030万元(合7,840万美元),比2023年同期增长了34.9%,这主要是由于借款人收购费用的增加。

General and administrative expense was RMB56.1 million (US$8.0 million), representing an increase of 5.5% from the same period of 2023, primarily driven by an increase in expenditures for employee compensation and related benefits.

一般和管理费用为人民币5610万元(合800万美元),比2023年同期增长5.5%,这主要是由员工薪酬和相关福利支出增加所推动的。

Research and development expense was RMB95.9 million (US$13.7 million), representing an increase of 36.0% from the same period of 2023, primarily driven by an increase in expenditures for employee compensation and related benefits.

研发费用为人民币9590万元(合1,370万美元),比2023年同期增长36.0%,这主要是由员工薪酬和相关福利支出增加所推动的。

Income from operation was RMB311.9 million (US$44.4 million), representing a decrease of 18.3% from the same period of 2023.

运营收入为人民币31190万元(合4,440万美元),比2023年同期下降18.3%。

Net income was RMB269.6 million (US$38.4 million), representing a decrease of 16.8% from RMB323.9 million in the same period of 2023.

净收入为人民币26960万元(合3,840万美元),较2023年同期的人民币32390万元下降了16.8%。

Basic and diluted net income per share were both RMB1.27 (US$0.18) compared with RMB1.51 in the third quarter of 2023. Basic and diluted net income per ADS were both RMB5.08 (US$0.72) compared with RMB6.04 in the third quarter of 2023. Each ADS represents four Class A ordinary shares of the Company.

基本和摊薄后的每股净收益均为人民币1.27元(0.18美元),而2023年第三季度为人民币1.51元。每股ADS的基本和摊薄净收益均为人民币5.08元(0.72美元),而2023年第三季度为人民币6.04元。每股ADS代表公司的四股A类普通股。

Cash and cash equivalents were RMB741.2 million (US$105.6 million) as of September 30, 2024, compared with RMB880.2 million as of June 30, 2024.

截至2024年9月30日,现金及现金等价物为人民币74120万元(1.056亿美元),而截至2024年6月30日为人民币88020万元。

The following table provides the delinquency rates of all outstanding loans on the Company's platform in Mainland China as of the respective dates indicated.

下表提供了截至所示日期该公司在中国大陆平台上所有未偿贷款的拖欠率。

| Delinquent for | ||||||

| As of | 1-30 days |

31-60 days |

61-90 days |

91 -180 days |

More than 180 days | |

| (%) | ||||||

| December 31, 2021 | 1.31 | 0.90 | 0.72 | 1.78 | 2.12 | |

| December 31, 2022 | 1.01 | 0.67 | 0.51 | 1.18 | 2.02 | |

| December 31, 2023 | 1.13 | 0.90 | 0.68 | 1.48 | 2.07 | |

| March 31, 2024 | 0.99 | 0.85 | 0.68 | 1.63 | 2.62 | |

| June 30, 2024 | 0.96 | 0.83 | 0.67 | 1.61 | 2.60 | |

| September 30, 2024 | 0.93 | 0.76 | 0.55 | 1.32 | 2.49 | |

| 违规了 | ||||||

| 截至 | 1-30 天 |

31-60 天 |

61-90 天 |

91 -180 天 |

超过 180 天 | |

| (%) | ||||||

| 2021年12月31日 | 1.31 | 0.90 | 0.72 | 1.78 | 2.12 | |

| 2022年12月31日 | 1.01 | 0.67 | 0.51 | 1.18 | 2.02 | |

| 2023 年 12 月 31 日 | 1.13 | 0.90 | 0.68 | 1.48 | 2.07 | |

| 2024 年 3 月 31 日 | 0.99 | 0.85 | 0.68 | 1.63 | 2.62 | |

| 2024 年 6 月 30 日 | 0.96 | 0.83 | 0.67 | 1.61 | 2.60 | |

| 2024 年 9 月 30 日 | 0.93 | 0.76 | 0.55 | 1.32 | 2.49 | |

The following chart and table display the historical cumulative M3+ Delinquency Rate by Vintage for loan products facilitated through the Company's platform in Mainland China.

以下图表和表格显示了Vintage在中国大陆通过公司平台提供的贷款产品的历史累计M3+拖欠率。

Business Outlook

商业展望

The Company expects its loan facilitation volume for the fourth quarter of 2024 to reach no less than RMB25 billion. This forecast reflects the Company's current and preliminary views on the market and operational conditions, which are subject to change.

该公司预计,其2024年第四季度的贷款便利额将达到不少于250元人民币。该预测反映了公司对市场和运营状况的当前和初步看法,这些看法可能会发生变化。

Recent Development

近期发展

Dividend Policy

股息政策

The board of directors of the Company (the "Board") previously approved and adopted a dividend policy on March 28, 2023, (the "Existing Dividend Policy") under which the Company may choose to declare and distribute a cash dividend twice each fiscal year, starting from 2023, at an aggregate amount of no less than 15% of the net income after tax of the Company in the previous fiscal year.

公司董事会(“董事会”)此前于2023年3月28日批准并通过了一项股息政策(“现有股息政策”),根据该政策,公司可以选择从2023年开始在每个财政年度申报和分配两次现金分红,总额不低于公司上一财年税后净收入的15%。

On November 19, 2024, the Board approved and adopted an amended dividend policy (the "Amended Dividend Policy") to replace the Company's Existing Dividend Policy in its entirety, with immediate effect. Under the Amended Dividend Policy, the Company may choose to declare and distribute a cash dividend once each fiscal year, starting from 2025, at an aggregate amount of no less than 15% of the net income after tax of the Company in the previous fiscal year. The determination to make dividend distributions in any particular fiscal year will be made at the discretion of the Board based upon factors such as the Company's results of operations, cash flow, general financial condition, capital requirements, contractual restrictions and other factors as the Board may deem relevant.

2024 年 11 月 19 日,董事会批准并通过了经修订的股息政策(“经修订的股息政策”),以完全取代公司现有的股息政策,立即生效。根据修订后的股息政策,公司可以选择从2025年起在每个财政年度申报和分配一次现金分红,总金额不少于公司上一财年税后净收入的15%。董事会将根据公司的经营业绩、现金流、总体财务状况、资本要求、合同限制和其他董事会认为相关的因素酌情决定在任何特定财年进行股息分配。

Share Repurchase Plan Update

股票回购计划更新

In March 2024, the Company's Board of Directors approved an adjustment to the existing share repurchase plan, pursuant to which the aggregate value of ordinary shares authorized for repurchase under the plan shall not exceed US$30 million.

2024 年 3 月,公司董事会批准了对现有股票回购计划的调整,根据该计划,根据该计划批准回购的普通股的总价值不得超过 3,000 万美元。

On June 4, 2024, the Company's Board of Directors approved to extend the share repurchase plan for a period of 12 months, commencing on June 13, 2024, and ending on June 12, 2025. Pursuant to the extended share repurchase plan, the Company may repurchase its ordinary shares through June 12, 2025, with an aggregate value not exceeding the remaining balance under the share repurchase plan. As of November 20, 2024, the Company had repurchased approximately 3.5 million of its ADSs for approximately US$15.0 million.

2024 年 6 月 4 日,公司董事会批准将股票回购计划延长 12 个月,从 2024 年 6 月 13 日开始,到 2025 年 6 月 12 日结束。根据延期股票回购计划,公司可以在2025年6月12日之前回购其普通股,总价值不超过股票回购计划下的剩余余额。截至2024年11月20日,该公司已以约1,500万美元的价格回购了约350万份美国存托凭证。

Conference Call

电话会议

The Company will conduct a conference call to discuss its financial results on November 20, 2024, at 8:00 AM U.S. Eastern Time (9:00 PM Beijing/Hong Kong Time on the same day).

公司将在美国东部时间2024年11月20日上午8点(北京/香港时间当天晚上9点)举行电话会议,讨论其财务业绩。

To join the conference call, all participants must use the following link to complete the online registration process in advance. Upon registering, each participant will receive access details for this event including the dial-in numbers, a PIN number, and an e-mail with detailed instructions to join the conference call.

要加入电话会议,所有参与者必须使用以下链接提前完成在线注册流程。注册后,每位参与者将收到此活动的访问详细信息,包括拨入号码、PIN码和一封包含加入电话会议的详细说明的电子邮件。

Participant Online Registration:

参与者在线注册:

A live and archived webcast of the conference call will be available on the Company's investors relations website at .

电话会议的直播和存档网络直播将在公司的投资者关系网站上播出,网址为。

About Jiayin Group Inc.

关于佳音集团有限公司

Jiayin Group Inc. is a leading fintech platform in China committed to facilitating effective, transparent, secure and fast connections between underserved individual borrowers and financial institutions. The origin of the business of the Company can be traced back to 2011. The Company operates a highly secure and open platform with a comprehensive risk management system and a proprietary and effective risk assessment model which employs advanced big data analytics and sophisticated algorithms to accurately assess the risk profiles of potential borrowers. For more information, please visit .

Jiayin Group Inc. 是中国领先的金融科技平台,致力于促进服务不足的个人借款人与金融机构之间的有效、透明、安全和快速的连接。公司业务的起源可以追溯到2011年。该公司运营一个高度安全和开放的平台,拥有全面的风险管理系统和专有且有效的风险评估模型,该模型采用先进的大数据分析和复杂的算法来准确评估潜在借款人的风险状况。欲了解更多信息,请访问。

Exchange Rate Information

汇率信息

This announcement contains translations of certain RMB amounts into U.S. dollars ("US$") at a specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB7.0176 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System as of September 30, 2024. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

本公告仅为方便读者而将某些人民币金额按指定汇率翻译成美元(“美元”)。除非另有说明,否则所有从人民币到美元的折算均按人民币7.0176元兑1美元的汇率进行,该汇率是联邦储备系统理事会截至2024年9月30日发布的H.10统计报告中规定的汇率。公司未就所提及的人民币或美元金额可视情况按任何特定汇率或根本兑换成美元或人民币作出任何陈述。

Safe Harbor / Forward-Looking Statements

安全港/前瞻性陈述

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company's beliefs and expectations, are forward-looking statements. Forward-looking statements in this announcement include, but are not limited to, statements in the section entitled, "Business Outlook," such as forecast of loan facilitation volume, and statements made by the Company's Founder, Director and Chief Executive Officer, such as the Company's future growth. Forward-looking statements involve inherent risks and uncertainties and are based on current expectations, assumptions, estimates and projections about the Company and the industry. Potential risks and uncertainties include, but are not limited to, those relating to the Company's ability to retain existing investors and borrowers and attract new investors and borrowers in an effective and cost-efficient way, the Company's ability to increase the investment volume and loan facilitation volume of loans facilitated through its marketplace, effectiveness of the Company's credit assessment model and risk management system, PRC laws and regulations relating to the online individual finance industry in China, general economic conditions in China, and the Company's ability to meet the standards necessary to maintain listing of its ADSs on the Nasdaq Stock Market or other stock exchange. All information provided in this press release is as of the date hereof, and the Company undertakes no obligation to update any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that its expectations will turn out to be correct, and investors are cautioned that actual results may differ materially from the anticipated results. Further information regarding risks and uncertainties faced by the Company is included in the Company's filings with the U.S. Securities and Exchange Commission, including its annual report on Form 20-F.

For investor and media inquiries, please contact:

本公告包含前瞻性陈述。这些声明是根据1995年《美国私人证券诉讼改革法》的 “安全港” 条款作出的。这些前瞻性陈述可以通过 “将”、“期望”、“预期”、“未来”、“打算”、“计划”、“相信”、“估计” 等术语和类似陈述来识别。公司还可以在向美国证券交易委员会提交的定期报告、向股东提交的年度报告、新闻稿和其他书面材料以及其高管、董事或雇员向第三方作出的口头陈述中作出书面或口头的前瞻性陈述。非历史事实的陈述,包括有关公司信念和期望的陈述,均为前瞻性陈述。本公告中的前瞻性陈述包括但不限于标题为 “业务展望” 的章节中的陈述,例如贷款便利额的预测,以及公司创始人、董事兼首席执行官的声明,例如公司的未来增长。前瞻性陈述涉及固有的风险和不确定性,基于当前对公司和行业的预期、假设、估计和预测。潜在的风险和不确定性包括但不限于与公司留住现有投资者和借款人并以有效和具有成本效益的方式吸引新的投资者和借款人的能力、公司通过市场便利的贷款增加投资量和贷款便利额的能力、公司信用评估模型和风险管理体系的有效性、与中国在线个人金融业相关的中国法律法规、中国的总体经济状况,以及公司达到维持其ADS在纳斯达克股票市场或其他证券交易所上市所需的标准的能力。本新闻稿中提供的所有信息均截至本新闻稿发布之日,除非法律要求,否则公司没有义务更新任何前瞻性陈述以反映随后发生的事件或情况或预期的变化。尽管公司认为这些前瞻性陈述中表达的预期是合理的,但它无法向您保证其预期将是正确的,并提醒投资者,实际业绩可能与预期业绩存在重大差异。有关公司面临的风险和不确定性的更多信息包含在公司向美国证券交易委员会提交的文件中,包括其20-F表年度报告。

投资者和媒体垂询,请联系:

Jiayin Group

佳音集团

Mr. Shawn Zhang

Email: ir@jiayinfintech.cn

张肖恩先生

电子邮件: ir@jiayinfintech.cn

| JIAYIN GROUP INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (Amounts in thousands, except for share and per share data) | ||||||||

|

As of December 31, |

As of September 30, |

|||||||

| 2023 | 2024 | |||||||

| RMB | RMB | US$ | ||||||

| ASSETS | ||||||||

| Cash and cash equivalents | 370,193 | 741,206 | 105,621 | |||||

| Restricted cash | 2,435 | — | — | |||||

| Accounts receivable and contract assets, net | 2,103,545 | 2,820,024 | 401,850 | |||||

| Financial assets receivables, net | 991,628 | 514,263 | 73,282 | |||||

| Prepaid expenses and other current assets, net | 1,922,056 | 807,660 | 115,091 | |||||

| Deferred tax assets, net | 61,174 | 86,783 | 12,366 | |||||

| Property and equipment, net | 40,332 | 44,708 | 6,371 | |||||

| Right-of-use assets, net | 49,659 | 54,057 | 7,703 | |||||

| Long-term investment | 101,481 | 175,702 | 25,037 | |||||

| Other non-current assets | 2,263 | 2,983 | 425 | |||||

| TOTAL ASSETS | 5,644,766 | 5,247,386 | 747,746 | |||||

| LIABILITIES AND EQUITY | ||||||||

| Deferred guarantee income | 886,862 | 380,717 | 54,252 | |||||

| Contingent guarantee liabilities | 933,947 | 351,370 | 50,070 | |||||

| Payroll and welfare payable | 94,856 | 111,369 | 15,870 | |||||

| Tax payables | 568,819 | 605,076 | 86,223 | |||||

| Accrued expenses and other current liabilities | 731,863 | 895,795 | 127,650 | |||||

| Lease liabilities | 47,958 | 54,244 | 7,730 | |||||

| TOTAL LIABILITIES | 3,264,305 | 2,398,571 | 341,795 | |||||

| TOTAL SHAREHOLDERS' EQUITY | 2,380,461 | 2,848,815 | 405,951 | |||||

| TOTAL LIABILITIES AND EQUITY | 5,644,766 | 5,247,386 | 747,746 | |||||

| 佳音集团有限公司 未经审计的简明合并资产负债表 (金额以千计,股票和每股数据除外) | ||||||||

| 截至 十二月 31, |

截至 九月三十日 |

|||||||

| 2023 | 2024 | |||||||

| 人民币 | 人民币 | 美元 | ||||||

| 资产 | ||||||||

| 现金和现金等价物 | 370,193 | 741,206 | 105,621 | |||||

| 受限制的现金 | 2,435 | — | — | |||||

| 应收账款和合同资产,净额 | 2,103,545 | 2,820,024 | 401,850 | |||||

| 金融资产应收账款,净额 | 991,628 | 514,263 | 73,282 | |||||

| 预付费用和其他流动资产,净额 | 1,922,056 | 807,660 | 115,091 | |||||

| 递延所得税资产,净额 | 61,174 | 86,783 | 12,366 | |||||

| 财产和设备,净额 | 40,332 | 44,708 | 6,371 | |||||

| 使用权资产,净额 | 49,659 | 54,057 | 7,703 | |||||

| 长期投资 | 101,481 | 175,702 | 25,037 | |||||

| 其他非流动资产 | 2,263 | 2,983 | 425 | |||||

| 总资产 | 5,644,766 | 5,247,386 | 747,746 | |||||

| 负债和权益 | ||||||||

| 递延担保收入 | 886,862 | 380,717 | 54,252 | |||||

| 或有担保负债 | 933,947 | 351,370 | 50,070 | |||||

| 应付工资和福利 | 94,856 | 111,369 | 15,870 | |||||

| 应付税款 | 568,819 | 605,076 | 86,223 | |||||

| 应计费用和其他流动负债 | 731,863 | 895,795 | 127,650 | |||||

| 租赁负债 | 47,958 | 54,244 | 7,730 | |||||

| 负债总额 | 3,264,305 | 2,398,571 | 341,795 | |||||

| 股东权益总额 | 2,380,461 | 2,848,815 | 405,951 | |||||

| 负债和权益总额 | 5,644,766 | 5,247,386 | 747,746 | |||||

| JIAYIN GROUP INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amounts in thousands, except for share and per share data) | ||||||||||||||||||

|

For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||||||||

| 2023 | 2024 | 2023 | 2024 | |||||||||||||||

| RMB | RMB | US$ | RMB | RMB | US$ | |||||||||||||

| Net revenue | 1,466,344 | 1,444,872 | 205,893 | 3,866,330 | 4,396,539 | 626,502 | ||||||||||||

| Operating costs and expenses: | ||||||||||||||||||

| Facilitation and servicing | (544,251 | ) | (419,056 | ) | (59,715 | ) | (1,174,305 | ) | (1,694,188 | ) | (241,420 | ) | ||||||

| Allowance for uncollectible receivables, contract assets, loans receivable and others |

(8,491 | ) | (11,638 | ) | (1,658 | ) | (29,011 | ) | (10,993 | ) | (1,566 | ) | ||||||

| Sales and marketing | (407,940 | ) | (550,289 | ) | (78,416 | ) | (1,209,461 | ) | (1,396,660 | ) | (199,022 | ) | ||||||

| General and administrative | (53,209 | ) | (56,099 | ) | (7,994 | ) | (149,673 | ) | (167,310 | ) | (23,841 | ) | ||||||

| Research and development | (70,532 | ) | (95,925 | ) | (13,669 | ) | (203,400 | ) | (272,014 | ) | (38,762 | ) | ||||||

| Total operating costs and expenses | (1,084,423 | ) | (1,133,007 | ) | (161,452 | ) | (2,765,850 | ) | (3,541,165 | ) | (504,611 | ) | ||||||

| Income from operation | 381,921 | 311,865 | 44,441 | 1,100,480 | 855,374 | 121,891 | ||||||||||||

| Interest income, net | 2,957 | 2,934 | 418 | 4,940 | 9,168 | 1,306 | ||||||||||||

| Other income, net | 2,567 | 8,742 | 1,246 | 13,579 | 74,966 | 10,683 | ||||||||||||

|

Income before income taxes and loss from investment in affiliates |

387,445 | 323,541 | 46,105 | 1,118,999 | 939,508 | 133,880 | ||||||||||||

| Income tax expense | (61,806 | ) | (53,927 | ) | (7,685 | ) | (185,055 | ) | (158,559 | ) | (22,594 | ) | ||||||

| Loss from investment in affiliates | (1,738 | ) | — | — | (4,002 | ) | — | — | ||||||||||

| Net income | 323,901 | 269,614 | 38,420 | 929,942 | 780,949 | 111,286 | ||||||||||||

| Less: net income (loss) attributable to non-controlling interest |

108 | 2 | — | 85 | (4 | ) | (1 | ) | ||||||||||

|

Net income attributable to Jiayin Group Inc. |

323,793 | 269,612 | 38,420 | 929,857 | 780,953 | 111,287 | ||||||||||||

|

Weighted average shares used in calculating net income per share: |

||||||||||||||||||

| - Basic and diluted | 214,740,208 | 212,672,997 | 212,672,997 | 214,168,317 | 212,380,527 | 212,380,527 | ||||||||||||

| Net income per share: | ||||||||||||||||||

| - Basic and diluted | 1.51 | 1.27 | 0.18 | 4.34 | 3.68 | 0.52 | ||||||||||||

| Net income per ADS: | ||||||||||||||||||

| - Basic and diluted | 6.04 | 5.08 | 0.72 | 17.36 | 14.72 | 2.08 | ||||||||||||

| Net income | 323,901 | 269,614 | 38,420 | 929,942 | 780,949 | 111,286 | ||||||||||||

|

Other comprehensive income (loss), net of tax of nil: |

||||||||||||||||||

| Foreign currency translation adjustments | 2,044 | (7,008 | ) | (999 | ) | 8,014 | (9,891 | ) | (1,409 | ) | ||||||||

| Comprehensive income | 325,945 | 262,606 | 37,421 | 937,956 | 771,058 | 109,877 | ||||||||||||

| Comprehensive income (loss) attributable to non-controlling interest |

147 | (69 | ) | (10 | ) | (4 | ) | (13 | ) | (2 | ) | |||||||

|

Total comprehensive income attributable to Jiayin Group Inc. |

325,798 | 262,675 | 37,431 | 937,960 | 771,071 | 109,879 | ||||||||||||

| 佳音集团有限公司 未经审计的综合收益简明合并报表 (金额以千计,股票和每股数据除外) | ||||||||||||||||||

| 在结束的三个月中 九月三十日 |

在截至的九个月中 九月三十日 |

|||||||||||||||||

| 2023 | 2024 | 2023 | 2024 | |||||||||||||||

| 人民币 | 人民币 | 美元 | 人民币 | 人民币 | 美元 | |||||||||||||

| 净收入 | 1,466,344 | 1,444,872 | 205,893 | 3,866,330 | 4,396,539 | 626,502 | ||||||||||||

| 运营成本和支出: | ||||||||||||||||||

| 便利和服务 | (544,251) | ) | (419,056) | ) | (59,715) | ) | (1,174,305) | ) | (1,694,188) | ) | (241,420) | ) | ||||||

| 无法收回的应收账款备抵金, 合同资产、应收贷款等 |

(8,491) | ) | (11,638) | ) | (1,658) | ) | (29,011) | ) | (10,993) | ) | (1,566) | ) | ||||||

| 销售和营销 | (407,940) | ) | (550,289) | ) | (78,416) | ) | (1,209,461 | ) | (1,396,660) | ) | (199,022 | ) | ||||||

| 一般和行政 | (53,209) | ) | (56,099) | ) | (7,994) | ) | (149,673) | ) | (167,310) | ) | (23,841) | ) | ||||||

| 研究和开发 | (70,532) | ) | (95,925) | ) | (13,669) | ) | (203,400) | ) | (272,014) | ) | (38,762) | ) | ||||||

| 运营成本和支出总额 | (1,084,423) | ) | (1,133,007) | ) | (161,452) | ) | (2,765,850 | ) | (3,541,165) | ) | (504,611) | ) | ||||||

| 运营收入 | 381,921 | 311,865 | 44,441 | 1,100,480 | 855,374 | 121,891 | ||||||||||||

| 净利息收入 | 2,957 | 2,934 | 418 | 4,940 | 9,168 | 1,306 | ||||||||||||

| 其他收入,净额 | 2,567 | 8,742 | 1,246 | 13,579 | 74,966 | 10,683 | ||||||||||||

| 所得税和亏损前的收入 来自对附属公司的投资 |

387,445 | 323,541 | 46,105 | 1,118,999 | 939,508 | 133,880 | ||||||||||||

| 所得税支出 | (61,806) | ) | (53,927) | ) | (7,685) | ) | (185,055) | ) | (158,559) | ) | (22,594) | ) | ||||||

| 关联公司投资的损失 | (1,738) | ) | — | — | (4,002) | ) | — | — | ||||||||||

| 净收入 | 323,901 | 269,614 | 38,420 | 929,942 | 780,949 | 111,286 | ||||||||||||

| 减去:净收益(亏损)归因于 非控股权益 |

108 | 2 | — | 85 | (4) | ) | (1) | ) | ||||||||||

| 归属于的净收益 佳音集团有限公司 |

323,793 | 269,612 | 38,420 | 929,857 | 780,953 | 111,287 | ||||||||||||

| 使用的加权平均份额 计算每股净收益: |

||||||||||||||||||

| -基本和稀释后 | 214,740,208 | 212,672,997 | 212,672,997 | 214,168,317 | 212,380,527 | 212,380,527 | ||||||||||||

| 每股净收益: | ||||||||||||||||||

| -基本和稀释后 | 1.51 | 1.27 | 0.18 | 4.34 | 3.68 | 0.52 | ||||||||||||

| 每份ADS的净收入: | ||||||||||||||||||

| -基本和稀释后 | 6.04 | 5.08 | 0.72 | 17.36 | 14.72 | 2.08 | ||||||||||||

| 净收入 | 323,901 | 269,614 | 38,420 | 929,942 | 780,949 | 111,286 | ||||||||||||

| 其他综合收益(亏损), 扣除零税: |

||||||||||||||||||

| 外币折算调整 | 2,044 | (7,008) | ) | (999) | ) | 8,014 | (9,891) | ) | (1,409) | ) | ||||||||

| 综合收益 | 325,945 | 262,606 | 37,421 | 937,956 | 771,058 | 109,877 | ||||||||||||

| 综合收益(亏损) 归因于非控股权益 |

147 | (69) | ) | (10) | ) | (4) | ) | (13) | ) | (2) | ) | |||||||

| 综合收入总额 归属于佳音集团有限公司 |

325,798 | 262,675 | 37,431 | 937,960 | 771,071 | 109,879 | ||||||||||||

A chart accompanying this announcement is available at

本公告附带的图表可在以下网址获取

Mr. Yan Dinggui, the Company's Founder, Director and Chief Executive Officer, commented: "As we close out the third quarter of 2024, I'm proud to report continued strong performance, with a significant year-over-year increase in both loan facilitation volume and related revenue. Our loan facilitation volume reached RMB26.7 billion in the third quarter, a 10.3% increase compared with the same period last year. Loan facilitation service revenue grew 18.1% to RMB1,105.7 million. This growth reflects our strategic focus on innovation, risk management, and market diversification. We've successfully leveraged technology to enhance operational efficiency and borrower experience, while maintaining a sharp eye on risk resilience. We are confident that our adaptable business model and commitment to sustainable growth will enable us to capture new opportunities and deliver long-term value to our shareholders."

Mr. Yan Dinggui, the Company's Founder, Director and Chief Executive Officer, commented: "As we close out the third quarter of 2024, I'm proud to report continued strong performance, with a significant year-over-year increase in both loan facilitation volume and related revenue. Our loan facilitation volume reached RMB26.7 billion in the third quarter, a 10.3% increase compared with the same period last year. Loan facilitation service revenue grew 18.1% to RMB1,105.7 million. This growth reflects our strategic focus on innovation, risk management, and market diversification. We've successfully leveraged technology to enhance operational efficiency and borrower experience, while maintaining a sharp eye on risk resilience. We are confident that our adaptable business model and commitment to sustainable growth will enable us to capture new opportunities and deliver long-term value to our shareholders."