① What are Bubble Mart's third quarter results? ② How does the agency evaluate Bubble Mart's trip to sea?

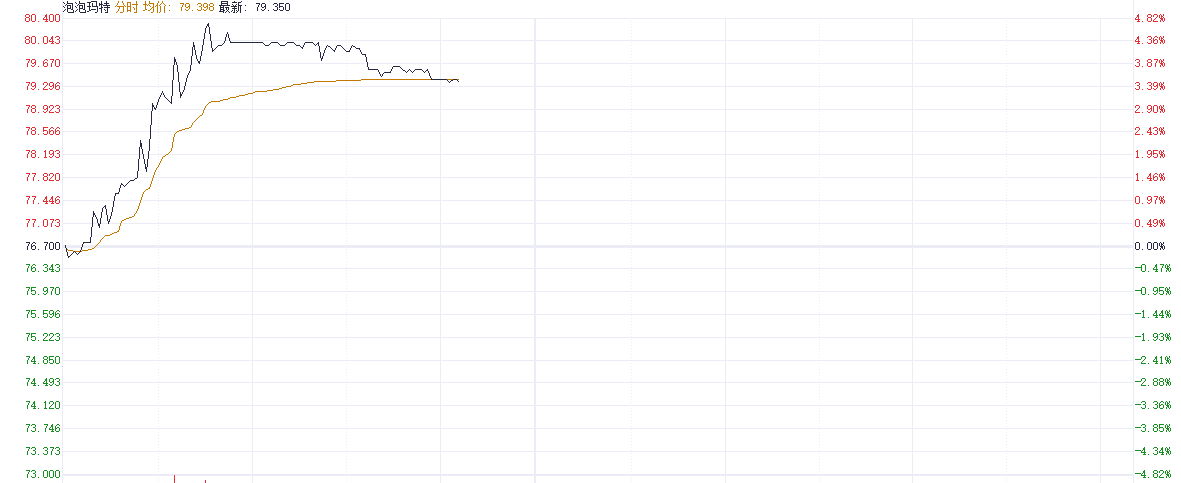

Finance Association, November 21 (Editor Hu Jiarong) Today's Bubble Mart (09992.HK) rose nearly 5% intraday and hit a new high since March 3, 2021. As of press release, it rose 3.52% to HK$79.45.

Note: Bubble Mart's trend

Judging from the chart above, Bubble Mart's stock price has continued to strengthen since the third quarter results were announced on October 22, with a cumulative increase of more than 25%.

Judging from the chart above, Bubble Mart's stock price has continued to strengthen since the third quarter results were announced on October 22, with a cumulative increase of more than 25%.

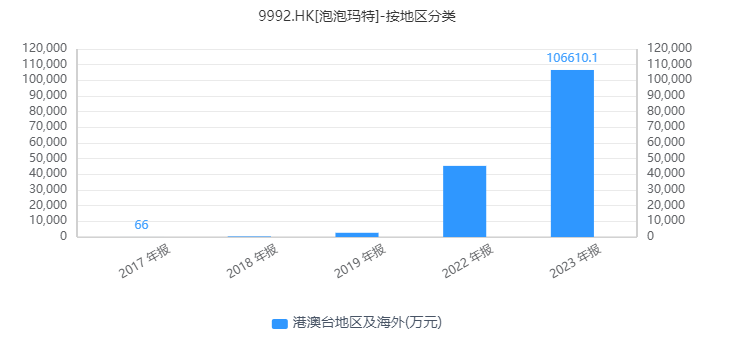

Specifically, Bubble Mart's third-quarter performance data shows that the company's overall revenue increased 120% to 125% year-on-year in 2023. Among them, revenue within China increased 55% to 60% year over year, and revenue from Hong Kong, Macao, Taiwan and overseas increased 440% to 445% year over year. Judging from the growth rate, Bubble Mart has surpassed market expectations for several consecutive quarters, and the four-fold increase in overseas markets in the third quarter has dazzled many eyes.

According to Bubble Mart's financial report for the first half of the year, the company's annual revenue growth is not expected to be less than 60%, overseas annual growth will not be less than 200%, and total sales will exceed 10 billion yuan, double the forecast at the beginning of the year.

Boosted by this performance, Bubble Mart's stock price hit a new high since March 3, 2021.

Agencies say going overseas to create a second growth curve

As Everbright Securities pointed out, domestic channels are growing steadily, and going overseas has created a second growth curve. In 2019-2023, the company's revenue increased from 1.683 billion yuan to 6.301 billion yuan, and the share of overseas revenue increased from 2% to 17%.

In overseas markets, online, offline, and wholesale channels accounted for 15%, 60%, and 25% of revenue respectively in 2023. The revenue from online channels Shopee, Amazon, and the official website is relatively balanced, and there is still room for improvement in channel construction. Retail stores contributed 91% of offline channel revenue in 2023, and offline store openings accelerated. In 2023, there were a total of 80 overseas stores (including joint ventures and franchises). From January to July 2024, the company added about 28 new stores globally, rapidly expanding the Thai and US markets, adding 4 to 5 new offline stores; the overseas market has high pricing and high revenue, and profitability is superior to mainland China.

Open Source Securities is optimistic about Bubble Mart's continued growth in the domestic market and the development of overseas channels. Tianfeng Securities also pointed out that as the second half of the year enters the traditional peak sales season and is driven by important sales points such as Tmall Super Day in August, Golden Week on October 11, November Double Eleven, and Christmas in December, the company's performance in the second half of the year is expected to show greater flexibility.

Anxin International predicts that Bubble Mart's gross margin level for the whole year will increase by about 3 percentage points year over year, while adjusted net profit for the second half of the year may be higher than in the first half due to overseas holiday factors.

从上图来看,泡泡玛特自10月22日公布三季度业绩后,股价持续走强,其累计涨幅超25%。

从上图来看,泡泡玛特自10月22日公布三季度业绩后,股价持续走强,其累计涨幅超25%。