Early this morning, Nvidia announced its financial report for the third fiscal quarter of FY2025. Revenue and profit both exceeded Wall Street expectations; however, with AI demand continuing to be booming, its performance guidance for the current quarter failed to impress investors (note: Nvidia's fiscal year is out of sync with the natural year; the end of January 2024 to the end of January 2025 is fiscal year 2025).

Revenue and profit exceeded expectations

Nvidia's earnings results are excellent data for Wall Street to understand the latest developments in the AI industry. Nvidia shares have risen 196% this year due to the explosive growth of AI.

In the third fiscal quarter, Nvidia's revenue was 35.1 billion US dollars, up 94% year over year; adjusted earnings per share were 0.81 US dollars, up 103% year over year. In contrast, the average expectation of Wall Street analysts is that revenue will reach $33.2 billion and earnings per share will reach $0.74.

In the third fiscal quarter, Nvidia's revenue was 35.1 billion US dollars, up 94% year over year; adjusted earnings per share were 0.81 US dollars, up 103% year over year. In contrast, the average expectation of Wall Street analysts is that revenue will reach $33.2 billion and earnings per share will reach $0.74.

The outlook for Q4 is lackluster

Investors are not only concerned about whether Nvidia's revenue and profit for the third fiscal quarter exceeded expectations, but also on its performance outlook for the fourth fiscal quarter. Analysts on average expect Nvidia's fourth fiscal quarter revenue to reach 37 billion dollars.

Meanwhile, Nvidia expects its revenue for the fourth fiscal quarter of fiscal year 2025 to reach 37.5 billion US dollars, fluctuating 2% up and down. Although this performance guide is largely in line with analysts' expectations, it falls short of analysts' highest expectations.

As in the previous quarter, Nvidia shares fell more than 2% in after-hours trading after the earnings report was released. In the second fiscal quarter, Nvidia's revenue and profit both exceeded expectations and gave a strong performance outlook, but the stock price fell 6%.

Analysts' Views

1. Explosive financial reports

Alonso Munoz, chief investment officer at investment consulting firm Hamilton Capital Partners, said, “Nvidia has once again released an explosive quarterly earnings report.”

Nvidia's stock price movement was to be expected as investors tried to sell at a profit during peak times. To continue to hold Nvidia shares, investors must hold their teeth tight and believe in the company's continued growth trajectory. This time, Nvidia proved it once again. “We are optimistic about this fact,” Munoz said.

2. It is not easy to maintain high growth

The revenue forecast of $37.5 billion means that Nvidia's revenue increase for the fourth fiscal quarter will drop to about 69.5% from 94% in the third fiscal quarter.

Ryan Detrick, chief market strategist at Carson Group (Carson Group), said: “Investors are used to Nvidia's amazing performance (significantly exceeding expectations), but it's getting harder and harder to do so. Today's earnings report is still a very solid report, but I have to admit that when the standards are so high, things get even more difficult.”

Gross margin of more than 3.70% is not low

Nvidia's gross margin for the third fiscal quarter was 74.6%, down from 75.1% in the previous quarter. Nvidia anticipates a further decline in gross margin this quarter, which could scare investors. However, Derren Nathan, head of stock research at investment service company Hargreaves Lansdown, believes that gross margin of over 70% is already very high.

Nathan said, “A lot of companies work hard for a gross margin of more than 70%. For Nvidia, this threshold doesn't seem dangerous anytime soon.”

Nathan pointed out that overall, Nvidia shares have brought huge returns to shareholders over the years, and we haven't seen any major loopholes in investing in Nvidia yet.

4. Is there a problem with the product pricing strategy?

Nvidia's profit margins continued to decline slightly in the third fiscal quarter. For this reason, some analysts are skeptical about Nvidia's pricing strategy for more complex products.

Lukas Keh, an analyst at investment research firm Third Bridge, said, “If the transition to more complex GPUs had a negative impact on Nvidia's profit margins, this shows that Nvidia's pricing of Blackwell systems was not as aggressive as AMD at the beginning.”

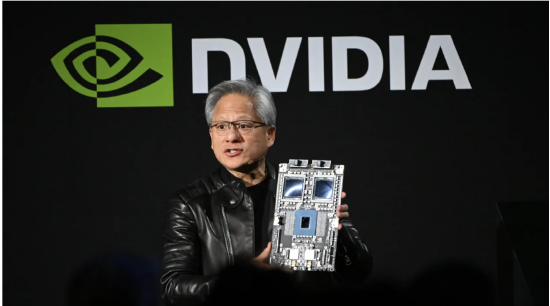

5. Blackwell continues to be in short supply

Nvidia said during the earnings call that it is making every effort to produce Blackwell and is working to expand production capacity next year, but supply will still be in short supply.

Ben Bajarin, CEO and chief analyst at research firm Creative Strategies, said, “Compared to previous chips, Blackwell uses more advanced packaging technology, which adds a challenge.” Bajarin anticipates that Nvidia will be in short supply throughout 2025.

6. Supply bottlenecks affect Nvidia's revenue

Nvidia's mistakes have also exacerbated the problem. Blackwell's design flaws forced Nvidia to make so-called “mask change” adjustments. However, Nvidia CEO Wong In-hoon acknowledged that the adjustment reduced Blackwell's yield.

Analysts said this adjustment appears to have delayed Blackwell's production schedule and cost it.

Michael Schulman, chief investment officer at financial services firm Running Point Capital, said: “This bottleneck may worsen rather than improve, which may affect Nvidia's revenue expectations.”

There is no doubt that demand for Nvidia chips will remain extremely strong in the foreseeable future, said Hendi Susanto, portfolio manager at Gabelli Funds. He said, “The key is supply. How much Nvidia can produce when it reaches the bottom.”

Nvidia stock price trend

This year, Nvidia shares continued to soar, rising nearly 200%. Earlier this week, Nvidia once again surpassed Apple in market capitalization and topped the global list. Nvidia closed on Wednesday with a market capitalization of $3.579 trillion.

Of the 23 analysts who track Nvidia shares, 22 gave a “buy” rating and 1 gave a “hold” rating. The average target share price given by these analysts is 170 dollars, which means that Nvidia's stock price still has room to rise by about 17%.

第三财季,英伟达营收为351亿美元,同比增长94%;经调每股收益0.81美元,同比增长103%。相比之下,华尔街分析师的平均预期是:营收将达到332亿美元,每股收益将达到0.74美元。

第三财季,英伟达营收为351亿美元,同比增长94%;经调每股收益0.81美元,同比增长103%。相比之下,华尔街分析师的平均预期是:营收将达到332亿美元,每股收益将达到0.74美元。