Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Orbbec Inc. (SHSE:688322) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Orbbec's Net Debt?

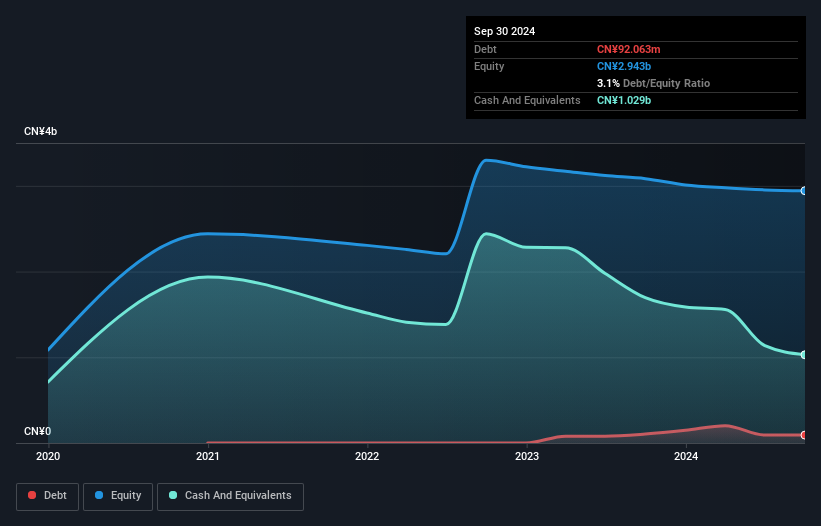

You can click the graphic below for the historical numbers, but it shows that Orbbec had CN¥92.1m of debt in September 2024, down from CN¥104.4m, one year before. However, it does have CN¥1.03b in cash offsetting this, leading to net cash of CN¥937.0m.

A Look At Orbbec's Liabilities

According to the last reported balance sheet, Orbbec had liabilities of CN¥245.5m due within 12 months, and liabilities of CN¥52.8m due beyond 12 months. Offsetting this, it had CN¥1.03b in cash and CN¥106.6m in receivables that were due within 12 months. So it can boast CN¥837.4m more liquid assets than total liabilities.

According to the last reported balance sheet, Orbbec had liabilities of CN¥245.5m due within 12 months, and liabilities of CN¥52.8m due beyond 12 months. Offsetting this, it had CN¥1.03b in cash and CN¥106.6m in receivables that were due within 12 months. So it can boast CN¥837.4m more liquid assets than total liabilities.

This short term liquidity is a sign that Orbbec could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Orbbec boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Orbbec's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Orbbec reported revenue of CN¥451m, which is a gain of 24%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Orbbec?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Orbbec lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through CN¥251m of cash and made a loss of CN¥144m. But the saving grace is the CN¥937.0m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. With very solid revenue growth in the last year, Orbbec may be on a path to profitability. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for Orbbec that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.