Morgan Stanley expects that emerging market bonds are likely to benefit from increased inflows of funds next year, as the dollar is expected to weaken and the performance of emerging economies is expected to surpass that of the United States.

Andrew Sheets, Global Credit Research Director at Morgan Stanley, stated that trading South Korean government bonds has become significantly more convenient for foreign investors, which will bring considerable benefits to South Korea in this trend. Morgan Stanley is also bullish on Hungarian Forint and Indian Rupee bonds, and expects Mexican bonds to stand out in the Latin American market.

Morgan Stanley predicts that the US dollar and US bond yields will decline next year, and if Trump imposes tariff measures, they will only be gradually implemented. Sheets believes that this will benefit local currency bonds in emerging markets.

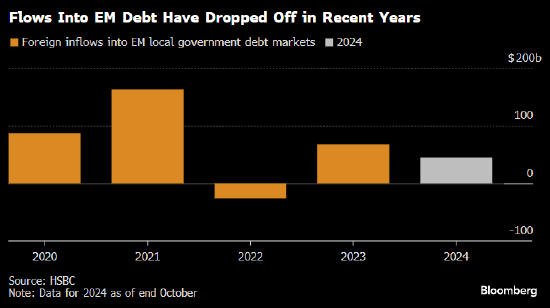

The continuous appreciation of the US dollar and the high interest rates in the United States are widely seen as the main reasons for the recent softness in inflows of funds into emerging markets.

The continuous appreciation of the US dollar and the high interest rates in the United States are widely seen as the main reasons for the recent softness in inflows of funds into emerging markets.

Although some expect the strong dollar trend to continue, especially considering President-elect Trump's tariff plan, some investors are starting to bet on the possibility of a weaker dollar. The scope and speed of Trump's policies may not be sufficient to sustain a strong dollar, and continued Fed rate cuts may also create pressure on the dollar.

Sheets believes that the credit bond market in emerging economies has a strong foundation. For example, South Korean government bonds will join the FTSE Russell World Government Bond Index next year, which may attract billions of dollars in inflows.

美元持续升值以及美国的高利率被广泛视为近年来新兴市场资金流入疲软的主因。

美元持续升值以及美国的高利率被广泛视为近年来新兴市场资金流入疲软的主因。