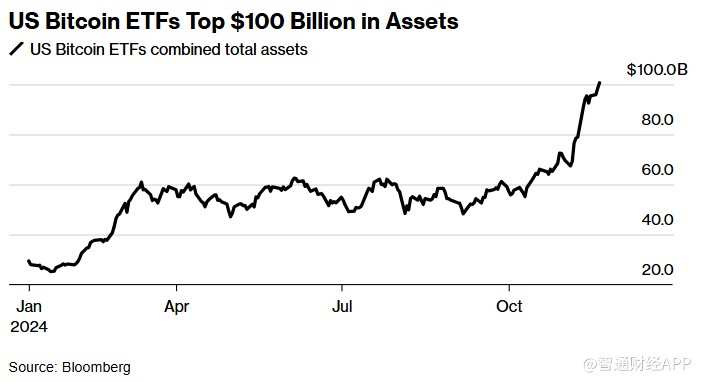

As Bitcoin continues its record rise, the total assets of US exchange-traded funds (ETFs) directly invested in Bitcoin surpassed $100 billion.

The Zhitong Finance App learned that as Bitcoin continues its record rise, the total assets of US exchange-traded funds (ETFs) that directly invest in Bitcoin have exceeded 100 billion dollars. Twelve Bitcoin ETFs issued by institutions such as BlackRock and Fidelity Investments went public in January and reached this milestone just 10 months later, becoming one of the most successful fund classes in history.

The net inflow of these funds reached $0.773 billion on Wednesday as Bitcoin hit a record high, according to data compiled by Bloomberg. Bitcoin continued to move towards the $0.1 million mark on Thursday.

US Bitcoin ETF assets surpass 100 billion dollars

US Bitcoin ETF assets surpass 100 billion dollars

Bitcoin's rise was fueled by optimism about US President-elect Donald Trump's plans to boost the development of the US crypto industry. Trump's transition team has begun discussions on whether to establish a position dedicated to digital asset policy in the White House. The cryptocurrency industry is fighting for this position — which will be the first of its kind in the US — to directly connect with Trump. Trump is now one of the biggest supporters in the crypto industry.

Caroline Bowler, CEO of BTC Markets Pty, said: “This price increase was fueled by a number of news related to the incoming Trump administration's support for cryptocurrency development.”

On Thursday, Bitcoin rose 3.6% to a record high of $9,7892. Since the US election day on November 5, the net inflow of Bitcoin ETFs reached 5.8 billion dollars. Bitcoin rose 129% in 2024, outperforming stocks, gold, and other assets.

美国比特币ETF资产规模突破1000亿美元

美国比特币ETF资产规模突破1000亿美元