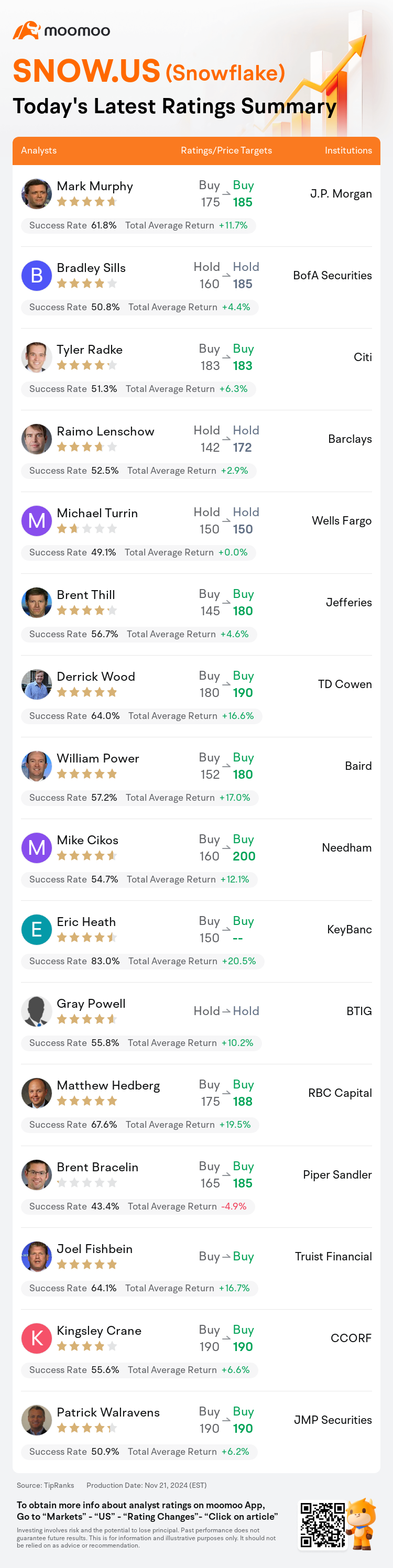

On Nov 21, major Wall Street analysts update their ratings for $Snowflake (SNOW.US)$, with price targets ranging from $150 to $200.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $175 to $185.

BofA Securities analyst Bradley Sills maintains with a hold rating, and adjusts the target price from $160 to $185.

Citi analyst Tyler Radke maintains with a buy rating, and maintains the target price at $183.

Citi analyst Tyler Radke maintains with a buy rating, and maintains the target price at $183.

Barclays analyst Raimo Lenschow maintains with a hold rating, and adjusts the target price from $142 to $172.

Wells Fargo analyst Michael Turrin maintains with a hold rating, and maintains the target price at $150.

Furthermore, according to the comprehensive report, the opinions of $Snowflake (SNOW.US)$'s main analysts recently are as follows:

Current analysis suggests that headwinds affecting product revenue and consumption at Snowflake appear to be diminishing. This observation is based on the fact that the company's Q3 product revenue of $900M notably surpassed the estimated $852M. Analysts continue to maintain a cautious stance, waiting for clearer signs of consistent stabilization.

Post their Q3 report, Snowflake's bookings are intensifying, accompanied by an uplift in their fiscal 2025 revenue outlook. It's believed that Snowflake continues to benefit from significant secular tailwinds.

Snowflake's potential to maintain its current growth levels appears viable given its robust remaining performance obligation bookings and stabilizing net recurring revenue trends. Analysts suggest that, contrary to market expectations of ongoing deceleration, a re-evaluation of investor assumptions might lead to an appreciation in share value.

The firm reported that Snowflake delivered robust third quarter results. They expressed increasing confidence in the company's prospect to grow by mid-20s percent or more in fiscal 2026, and the potential for an enhanced AI/competitive narrative moving into next year. This optimism supports a favorable mid- to long-term outlook for the company.

Following Snowflake's substantial 5% Q3 product revenue beat and guidance indicating an $18M increase for Q4, analysts remain optimistic about the company's potential. Key debates on the stock regarding its role in AI and as an 'iceberg' suggest a positive shift in narrative, reinforced by strong management commentary. Snowflake's current positioning as a leading data cloud entity is expected to benefit from rising public cloud trends. With ongoing product innovations, particularly in AI since the addition of a notable new team member, and its role in enabling AI/Gen AI workloads through a user-friendly platform, Snowflake continues to capture a significant portion of the $300B+ total addressable market.

Here are the latest investment ratings and price targets for $Snowflake (SNOW.US)$ from 16 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

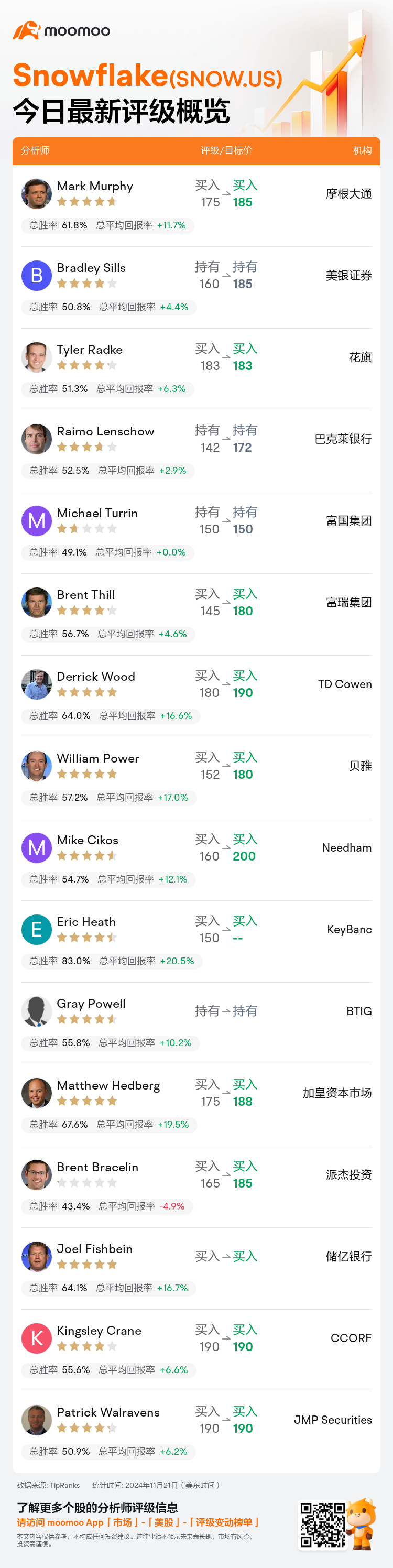

美东时间11月21日,多家华尔街大行更新了$Snowflake (SNOW.US)$的评级,目标价介于150美元至200美元。

摩根大通分析师Mark Murphy维持买入评级,并将目标价从175美元上调至185美元。

美银证券分析师Bradley Sills维持持有评级,并将目标价从160美元上调至185美元。

花旗分析师Tyler Radke维持买入评级,维持目标价183美元。

花旗分析师Tyler Radke维持买入评级,维持目标价183美元。

巴克莱银行分析师Raimo Lenschow维持持有评级,并将目标价从142美元上调至172美元。

富国集团分析师Michael Turrin维持持有评级,维持目标价150美元。

此外,综合报道,$Snowflake (SNOW.US)$近期主要分析师观点如下:

当前分析表明,影响snowflake产品营业收入和消费的阻力似乎正在减弱。这一观察是基于公司第三季度产品营业收入为90000万,显著超过了预估的85200万。分析师们继续保持谨慎态度,等待更清晰的一致稳定迹象。

在发布第三季度报告后,snowflake的订单正在增加,伴随着对其2025财年的营业收入前景的提升。人们认为,snowflake继续受益于显著的长期顺风。

考虑到其强劲的剩余履约义务订单和稳定的净经常性收入趋势,snowflake维持当前增长水平的潜力似乎是可行的。分析师建议,与市场持续放缓的预期相反,重新评估投资者假设可能会导致股价的升值。

该公司报告称,snowflake在第三季度交出了强劲的业绩。他们对该公司在2026财年实现中20%或更高增长的前景表示越来越多的信心,以及在明年增强的人工智能/竞争叙事的潜力。这一乐观情绪支持了公司中长期的良好前景。

在snowflake第三季度产品营业收入超出预期5%且指引显示第四季度增加1800万后,分析师们对该公司的潜力保持乐观。围绕其在人工智能中的角色和作为“冰山”的关键辩论,暗示叙事的积极转变,并得到了强劲管理层评论的支持。snowflake目前作为领先的数据云实体的定位预计将受益于日益增长的公共云趋势。随着产品创新的持续进行,特别是在新关键团队成员加入后在人工智能领域的创新,以及其在通过用户友好的平台支持人工智能/生成人工智能工作负载方面的作用,snowflake持续捕获3000亿+总可寻址市场的显著部分。

以下为今日16位分析师对$Snowflake (SNOW.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

花旗分析师Tyler Radke维持买入评级,维持目标价183美元。

花旗分析师Tyler Radke维持买入评级,维持目标价183美元。

Citi analyst Tyler Radke maintains with a buy rating, and maintains the target price at $183.

Citi analyst Tyler Radke maintains with a buy rating, and maintains the target price at $183.