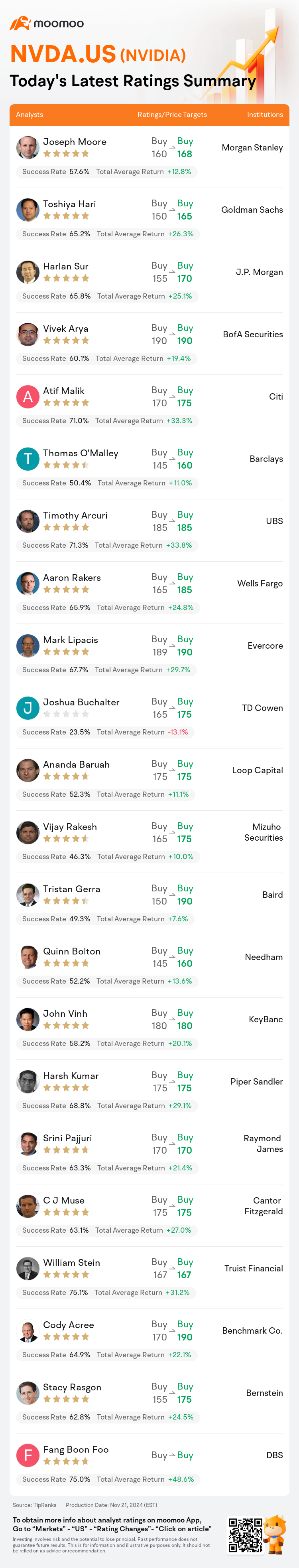

On Nov 21, major Wall Street analysts update their ratings for $NVIDIA (NVDA.US)$, with price targets ranging from $160 to $190.

Morgan Stanley analyst Joseph Moore maintains with a buy rating, and adjusts the target price from $160 to $168.

Goldman Sachs analyst Toshiya Hari maintains with a buy rating, and adjusts the target price from $150 to $165.

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and adjusts the target price from $155 to $170.

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and adjusts the target price from $155 to $170.

BofA Securities analyst Vivek Arya maintains with a buy rating, and maintains the target price at $190.

Citi analyst Atif Malik maintains with a buy rating, and adjusts the target price from $170 to $175.

Furthermore, according to the comprehensive report, the opinions of $NVIDIA (NVDA.US)$'s main analysts recently are as follows:

Nvidia surpassed Q3 Street expectations primarily due to robust data center compute performance, which compensated for an unexpected sequential decrease in data center networking. Despite Q4 revenue projections only meeting Street forecasts and anticipated near-term gross margin challenges linked to Blackwell lasting up to the April quarter, growing demand for artificial intelligence infrastructure among all customer groups, alongside improvements in supply and anticipated gross margin normalization in the second half of 2025, are expected to spearhead substantial sequential earnings growth and favorable revisions in the coming year.

The company's October quarter results were above consensus estimates and, starting from a higher revenue base, it forecasted a 7% increase for the January quarter, aligning with consensus but somewhat below market expectations. Analysts note that the company maintains a significant advantage over competitors with its comprehensive suite of silicon, hardware, and software platforms. The earnings report was seen as robust, bolstered by ongoing demand for artificial intelligence solutions.

Following Nvidia's recent quarterly report, expectations for the next two quarters have improved due to modest guidance and positive gross margin commentary. The company is now focusing on ramping up Blackwell, demonstrating successful management of its transition.

The complexity of system implementation in Nvidia is noted, but it does not severely affect demand due to issues like overheating. Additionally, the demand for Blackwell remains extremely strong. Analysts see no signs of a demand slowdown, as Nvidia anticipates that the global data center modernization for AI development will continue to expand over the next five years. Furthermore, the advent of generative AI is expected to introduce a new layer of demand.

The firm considers that any significant decline in the shares should be seized as an opportunity to buy, driven by the company's optimistic outlook on Blackwell demand.

Here are the latest investment ratings and price targets for $NVIDIA (NVDA.US)$ from 22 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

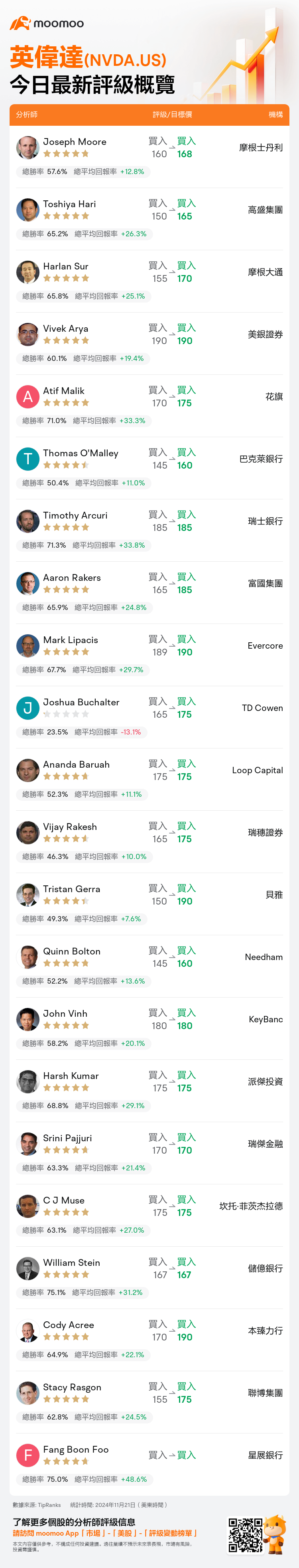

美東時間11月21日,多家華爾街大行更新了$英偉達 (NVDA.US)$的評級,目標價介於160美元至190美元。

摩根士丹利分析師Joseph Moore維持買入評級,並將目標價從160美元上調至168美元。

高盛集團分析師Toshiya Hari維持買入評級,並將目標價從150美元上調至165美元。

摩根大通分析師Harlan Sur維持買入評級,並將目標價從155美元上調至170美元。

摩根大通分析師Harlan Sur維持買入評級,並將目標價從155美元上調至170美元。

美銀證券分析師Vivek Arya維持買入評級,維持目標價190美元。

花旗分析師Atif Malik維持買入評級,並將目標價從170美元上調至175美元。

此外,綜合報道,$英偉達 (NVDA.US)$近期主要分析師觀點如下:

英偉達超出了第三季度的華爾街預期,主要是由於數據中心計算性能強勁,彌補了數據中心網絡意外出現的連續下降。儘管第四季度的營業收入預測僅符合華爾街的預期,並預計與Blackwell相關的近期毛利率挑戰將持續到四月季度,但所有客戶群體對人工智能基礎設施的需求增長,加上供應的改善和預計到2025年下半年毛利率的正常化,預計將推動可觀的連續盈利增長和未來一年的良好修正。

該公司的十月季度業績超過了市場共識估計,從較高的營業收入基數出發,預測一月季度將增長7%,符合共識但略低於市場預期。分析師指出,該公司憑藉其全面的硅、硬件和軟件平台保持了對競爭對手的顯著優勢。業績被視爲強勁,受到對人工智能解決方案持續需求的支持。

在英偉達最近的季度報告之後,由於溫和的指引和積極的毛利率評論,未來兩個季度的預期有所改善。該公司現在專注於提升Blackwell,展示了成功管理其過渡的能力。

英偉達的系統實施複雜性已被提到,但由於過熱等問題並沒有嚴重影響需求。此外,Blackwell的需求仍然非常強勁。分析師沒有看到需求放緩的跡象,英偉達預計全球數據中心對人工智能開發的現代化需求將在未來五年繼續擴大。此外,生成性人工智能的出現預計將帶來新的需求層次。

該公司認爲,任何顯著的股價下跌應被視爲買入的機會,推動因素是公司對Blackwell需求的樂觀展望。

以下爲今日22位分析師對$英偉達 (NVDA.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

摩根大通分析師Harlan Sur維持買入評級,並將目標價從155美元上調至170美元。

摩根大通分析師Harlan Sur維持買入評級,並將目標價從155美元上調至170美元。

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and adjusts the target price from $155 to $170.

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and adjusts the target price from $155 to $170.