Financial giants have made a conspicuous bearish move on NVIDIA. Our analysis of options history for NVIDIA (NASDAQ:NVDA) revealed 509 unusual trades.

Delving into the details, we found 39% of traders were bullish, while 42% showed bearish tendencies. Out of all the trades we spotted, 87 were puts, with a value of $5,771,224, and 422 were calls, valued at $42,566,316.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $0.5 to $280.0 for NVIDIA over the last 3 months.

Analyzing Volume & Open Interest

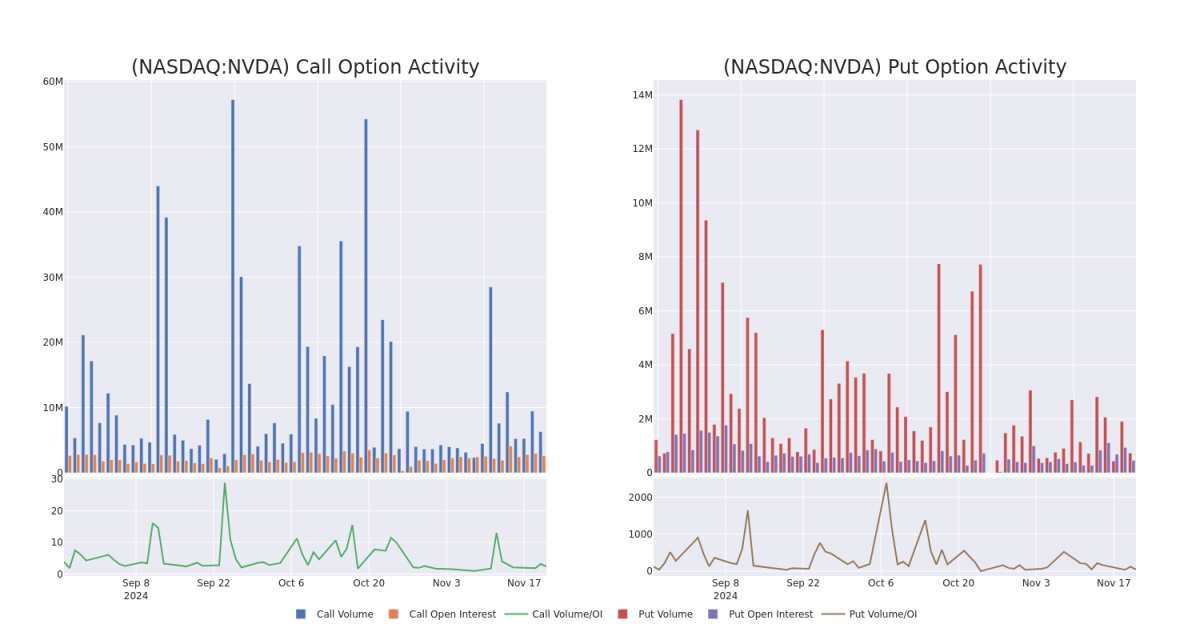

In terms of liquidity and interest, the mean open interest for NVIDIA options trades today is 29645.59 with a total volume of 6,724,021.00.

In terms of liquidity and interest, the mean open interest for NVIDIA options trades today is 29645.59 with a total volume of 6,724,021.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for NVIDIA's big money trades within a strike price range of $0.5 to $280.0 over the last 30 days.

NVIDIA Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | CALL | SWEEP | NEUTRAL | 01/16/26 | $33.95 | $33.75 | $33.84 | $150.00 | $795.2K | 26.7K | 543 |

| NVDA | CALL | SWEEP | BULLISH | 11/29/24 | $2.9 | $2.87 | $2.9 | $150.00 | $219.9K | 57.1K | 24.2K |

| NVDA | CALL | SWEEP | NEUTRAL | 01/16/26 | $7.85 | $7.6 | $7.73 | $280.00 | $181.7K | 18.2K | 539 |

| NVDA | CALL | SWEEP | BULLISH | 11/29/24 | $3.25 | $3.2 | $3.25 | $150.00 | $158.2K | 57.1K | 27.9K |

| NVDA | CALL | SWEEP | BEARISH | 11/29/24 | $2.83 | $2.8 | $2.81 | $150.00 | $132.6K | 57.1K | 21.3K |

About NVIDIA

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

In light of the recent options history for NVIDIA, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is NVIDIA Standing Right Now?

- Currently trading with a volume of 48,977,431, the NVDA's price is up by 4.01%, now at $151.74.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 90 days.

What The Experts Say On NVIDIA

5 market experts have recently issued ratings for this stock, with a consensus target price of $177.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for NVIDIA, targeting a price of $175. * An analyst from JP Morgan persists with their Overweight rating on NVIDIA, maintaining a target price of $170. * An analyst from Truist Securities persists with their Buy rating on NVIDIA, maintaining a target price of $167. * Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for NVIDIA, targeting a price of $190. * Maintaining their stance, an analyst from Melius Research continues to hold a Buy rating for NVIDIA, targeting a price of $185.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.