Deep-pocketed investors have adopted a bearish approach towards Deere (NYSE:DE), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 20 extraordinary options activities for Deere. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 35% leaning bullish and 45% bearish. Among these notable options, 16 are puts, totaling $779,083, and 4 are calls, amounting to $204,500.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $380.0 and $460.0 for Deere, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $380.0 and $460.0 for Deere, spanning the last three months.

Volume & Open Interest Trends

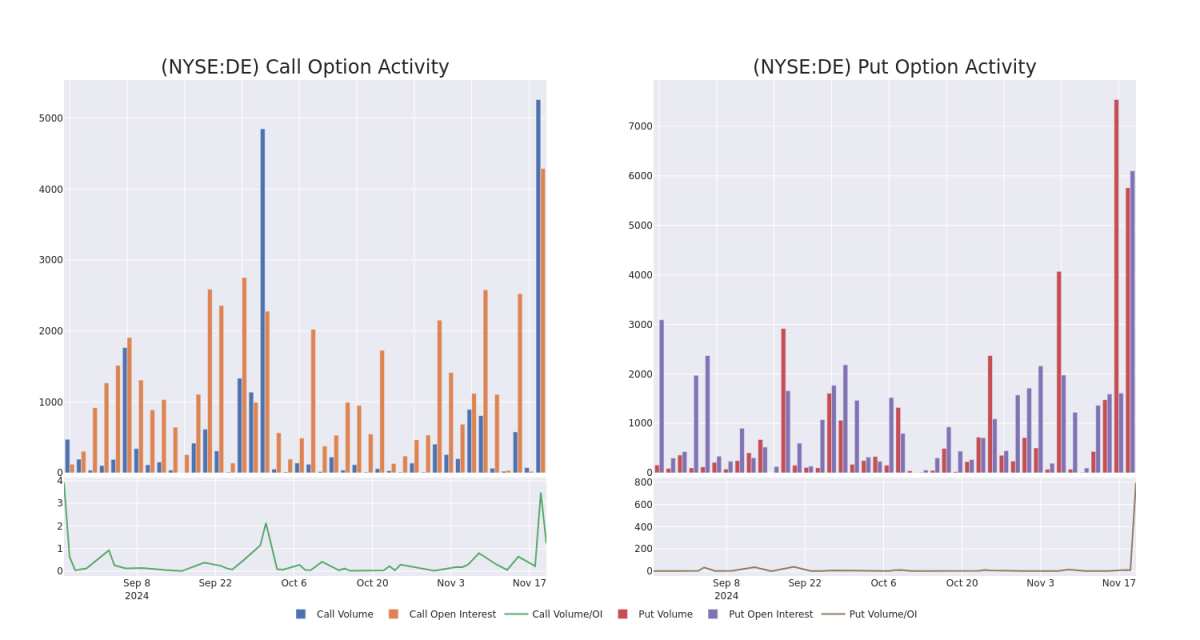

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Deere's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Deere's whale trades within a strike price range from $380.0 to $460.0 in the last 30 days.

Deere 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | CALL | TRADE | BULLISH | 12/20/24 | $16.8 | $14.9 | $16.8 | $420.00 | $100.8K | 1.5K | 176 |

| DE | PUT | SWEEP | BEARISH | 01/17/25 | $17.0 | $16.95 | $17.0 | $420.00 | $85.0K | 454 | 260 |

| DE | PUT | SWEEP | NEUTRAL | 01/17/25 | $16.65 | $13.55 | $14.79 | $420.00 | $81.1K | 454 | 310 |

| DE | PUT | SWEEP | BEARISH | 01/17/25 | $18.75 | $15.4 | $18.75 | $420.00 | $65.6K | 454 | 85 |

| DE | PUT | SWEEP | BEARISH | 01/17/25 | $16.35 | $14.45 | $16.35 | $430.00 | $52.3K | 112 | 163 |

About Deere

Deere is the world's leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry in their green and yellow livery. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

After a thorough review of the options trading surrounding Deere, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Deere

- With a trading volume of 1,145,107, the price of DE is up by 5.35%, reaching $426.62.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 0 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Deere with Benzinga Pro for real-time alerts.